How Tariffs Threaten China's Export-Led Growth Model

Table of Contents

Reduced Global Demand for Chinese Goods

The imposition of tariffs directly reduces the global demand for Chinese goods. Higher prices resulting from tariffs make Chinese products less competitive in international markets, leading to a decline in exports and impacting China's economic growth.

Impact on Specific Sectors

Tariffs have disproportionately impacted specific Chinese export sectors.

- Electronics: Tariffs on Chinese-manufactured electronics have led to a noticeable decline in exports to key markets like the US and Europe. Companies have struggled to maintain profit margins, resulting in reduced production and investment.

- Textiles: The textile industry, a cornerstone of China's export economy, has also faced significant headwinds. Increased tariffs have made Chinese textiles less competitive, forcing some manufacturers to reduce production or seek alternative markets.

- Machinery: Tariffs on machinery exports have hampered China's ability to compete with other manufacturing hubs. This has prompted some companies to explore alternative strategies, such as focusing on higher-value-added products or relocating production.

These tariffs, coupled with the overall global trade slowdown, have significantly reduced demand for Chinese exports, impacting employment and overall economic output. Countermeasures taken by Chinese businesses have included seeking new markets, streamlining production, and investing in automation to reduce costs.

Shifting Global Supply Chains

Tariffs are fundamentally reshaping global supply chains. Companies are actively diversifying their sourcing and manufacturing operations to mitigate the risks associated with relying heavily on Chinese production.

- Nearshoring and Reshoring: Many businesses are shifting production closer to their target markets (nearshoring) or back to their home countries (reshoring) to avoid tariff costs and reduce supply chain disruptions.

- Vietnam, Mexico, and other Southeast Asian countries have become attractive alternatives for manufacturers seeking to reduce their reliance on China.

- This shift is impacting Chinese employment, particularly in labor-intensive industries, and requires a significant adjustment for China’s economy.

The resulting loss of foreign investment and manufacturing activity threatens to further undermine China’s export-led growth model.

Increased Production Costs and Reduced Competitiveness

Tariffs don't just impact the final price of goods; they also increase production costs for Chinese manufacturers.

Impact of Tariffs on Raw Materials and Intermediate Goods

Many Chinese manufacturers rely on imported raw materials and intermediate goods. Tariffs on these inputs directly increase production costs, squeezing profit margins and reducing competitiveness.

- Rising Input Costs: The cost of essential raw materials, such as steel and rare earth minerals, has increased significantly due to tariffs, impacting various industries.

- Reduced Profit Margins: Manufacturers are facing reduced profit margins as they struggle to absorb the increased input costs while maintaining competitive pricing in the global market.

- Higher Prices for Chinese Goods: The increased production costs are ultimately passed on to consumers, making Chinese goods less price-competitive in international markets.

This price increase further reduces demand for Chinese products, creating a vicious cycle that negatively impacts economic growth.

Retaliatory Tariffs and Trade Disputes

China has implemented retaliatory tariffs on goods from other countries, further escalating trade tensions and disrupting global trade flows.

- Impact on Bilateral Trade Relations: These retaliatory measures have strained bilateral trade relations, creating uncertainty and impacting investment decisions.

- Escalation of Trade Tensions: The tit-for-tat tariff increases have led to a significant escalation of trade tensions, creating instability in the global economy.

- The resulting trade war undermines the predictability and stability essential for healthy global trade.

Implications for China's Economic Growth and Stability

The combined impact of reduced demand, increased costs, and trade disputes poses a serious threat to China's economic growth and stability.

Impact on GDP Growth

The decline in exports and reduced investment are likely to significantly impact China's GDP growth.

- Projected GDP Growth Rates: Economic forecasts predict a slowdown in GDP growth if the current trade tensions persist.

- Potential for Job Losses: Reduced exports and factory closures may lead to significant job losses, potentially causing social unrest.

- Social and Political Implications: The economic consequences of the tariff war could trigger significant social and political repercussions for China.

Maintaining economic stability in the face of these challenges requires a strategic response from the Chinese government.

Need for Economic Diversification

To mitigate the risks associated with its export-led growth model, China needs to aggressively diversify its economy.

- Fostering Domestic Consumption: Stimulating domestic consumption will reduce reliance on exports and create a more resilient economic structure.

- Investing in Innovation and Technology: Investing in research and development, innovation, and high-tech industries will enable China to compete in higher-value-added sectors.

- Development of the Services Sector: Promoting the growth of the service sector will create new employment opportunities and reduce dependence on manufacturing exports.

This multifaceted approach is crucial for long-term economic growth and stability.

Conclusion

The imposition of tariffs poses a significant threat to China's export-led growth model. Reduced global demand, increased production costs, and escalating trade tensions are creating considerable challenges for the Chinese economy. To maintain its economic momentum, China must actively pursue economic diversification, fostering domestic consumption and investing in innovation. Failure to adapt could result in a substantial slowdown in economic growth and significant social and political consequences. The future of China's economy hinges on its ability to navigate these challenges and effectively respond to the evolving global trade landscape. Understanding the impact of tariffs on China's export-led growth is crucial for businesses and policymakers alike. This requires ongoing monitoring of global trade developments and a proactive approach to mitigating future risks. Developing strategies to mitigate the effects of future tariffs on China's export-led growth is vital for its continued economic success.

Featured Posts

-

Razer Blade 16 2025 Ultra Thin Laptop Performance And Price Analysis

Apr 22, 2025

Razer Blade 16 2025 Ultra Thin Laptop Performance And Price Analysis

Apr 22, 2025 -

Private Credit Hiring 5 Dos And Don Ts To Get Hired

Apr 22, 2025

Private Credit Hiring 5 Dos And Don Ts To Get Hired

Apr 22, 2025 -

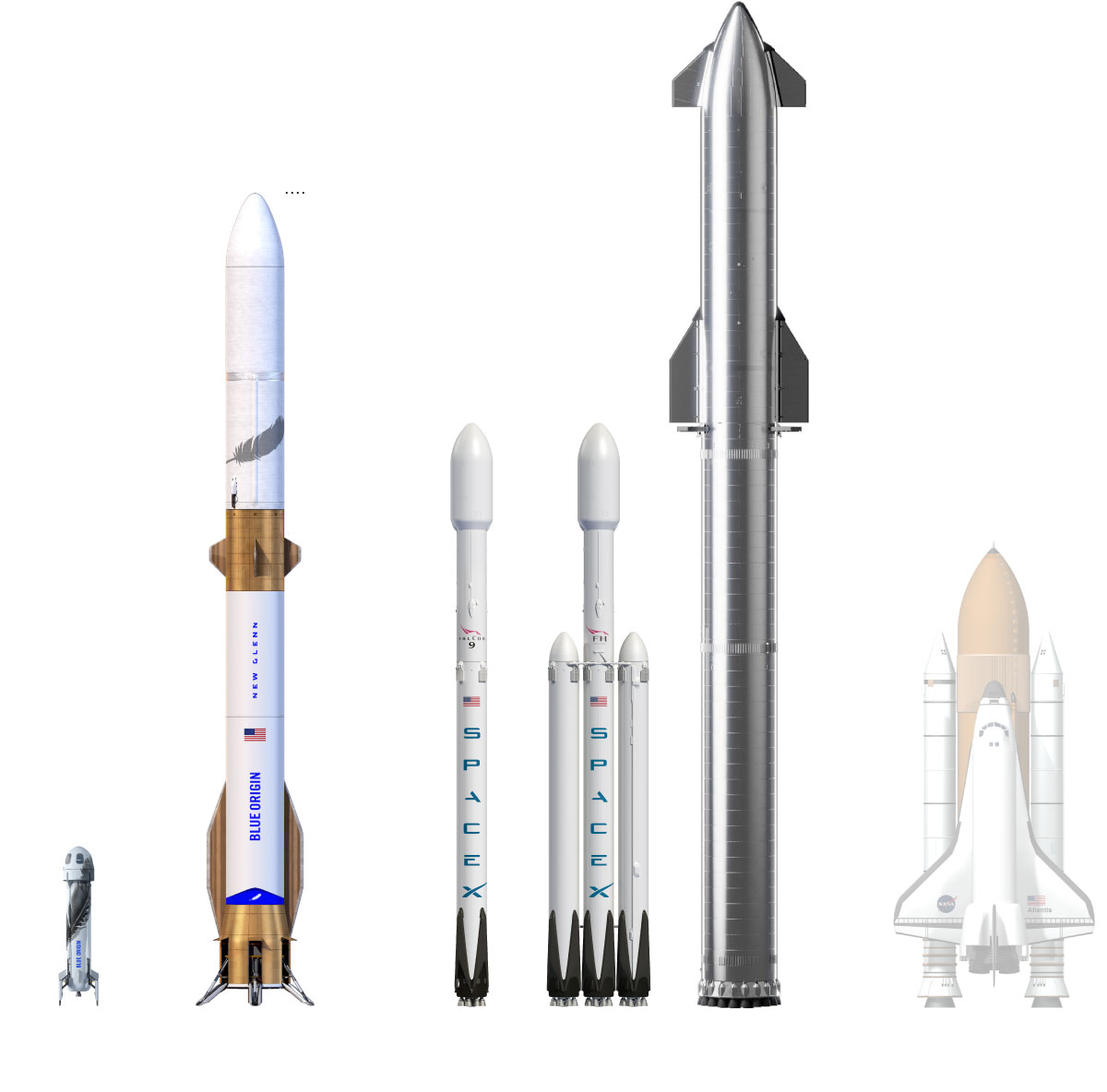

Blue Origin Rocket Launch Delayed Subsystem Malfunction Reported

Apr 22, 2025

Blue Origin Rocket Launch Delayed Subsystem Malfunction Reported

Apr 22, 2025 -

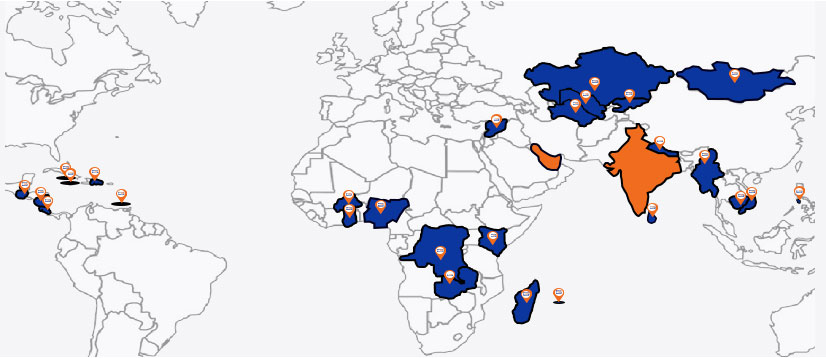

Mapping The Countrys Emerging Business Hotspots

Apr 22, 2025

Mapping The Countrys Emerging Business Hotspots

Apr 22, 2025 -

Cracking The Private Credit Code 5 Dos And Don Ts For Job Seekers

Apr 22, 2025

Cracking The Private Credit Code 5 Dos And Don Ts For Job Seekers

Apr 22, 2025