Private Credit Hiring: 5 Do's And Don'ts To Get Hired

Table of Contents

5 Do's for Private Credit Hiring Success

Do #1: Tailor Your Resume and Cover Letter to the Specific Private Credit Firm

Generic applications rarely cut it in the competitive landscape of private credit hiring. Each firm has a unique investment strategy and focus, whether it's leveraged finance, distressed debt, mezzanine financing, or direct lending. Your resume and cover letter must reflect this understanding.

- Focus on relevant keywords: Incorporate terms like "leveraged finance," "distressed debt," "private equity," "credit analysis," "financial modeling," "valuation," and "credit risk assessment" throughout your materials. Use a keyword research tool to identify terms frequently used in job descriptions for your target roles.

- Highlight relevant experiences: Showcase experiences demonstrating your proficiency in financial modeling, valuation, and credit risk assessment. Quantify your accomplishments whenever possible. For example, instead of "Improved portfolio performance," write "Increased portfolio returns by 15% through strategic credit analysis and risk mitigation."

- Research the firm's investment strategy: Thoroughly investigate the firm's website, recent investments, and news articles to understand their specific focus and tailor your resume to highlight relevant skills and experience. This demonstrates initiative and genuine interest.

- Use action verbs and a concise writing style: Use strong action verbs to describe your accomplishments and maintain a concise and impactful writing style, making it easy for recruiters to quickly assess your qualifications.

Do #2: Network Strategically Within the Private Credit Industry

Networking is paramount in private credit hiring. It’s not just about handing out resumes; it's about building genuine relationships.

- Attend industry conferences and events: These events offer invaluable networking opportunities to connect with professionals and learn about the latest trends in the private credit market.

- Connect with professionals on LinkedIn: Engage in relevant discussions, share insightful articles, and personalize your connection requests.

- Conduct informational interviews: Reach out to professionals in private credit for informational interviews. These conversations provide valuable insights into the industry and can lead to potential job opportunities.

- Leverage alumni networks and professional organizations: Tap into your alumni network and join professional organizations like the CFA Institute or the Turnaround Management Association to expand your network.

- Build relationships with recruiters specializing in private credit placements: Recruiters possess valuable knowledge of the industry and can provide guidance and connect you with potential employers.

Do #3: Master the Art of the Private Credit Interview

Private credit interviews are rigorous, testing both your technical skills and soft skills.

- Prepare for technical questions: Expect detailed questions on financial modeling, valuation, credit analysis, and understanding of different private credit strategies (e.g., direct lending, mezzanine financing).

- Practice your behavioral interview responses: Prepare examples demonstrating your teamwork, problem-solving, and communication skills. Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Demonstrate your understanding of market trends: Stay updated on market trends, economic factors, and regulatory changes impacting private credit. Show your ability to analyze market dynamics and their implications.

- Research the interviewers and the firm: Show you've done your homework by researching the interviewers' backgrounds and the firm's recent activities. This demonstrates your genuine interest and preparedness.

- Ask insightful questions: Prepare thoughtful questions that demonstrate your understanding of the firm and the role. This shows your engagement and initiative.

Do #4: Showcase Your Understanding of Private Credit Investments

Demonstrating a strong understanding of private credit investments is critical.

- Demonstrate knowledge of different strategies: Show familiarity with various private credit strategies such as direct lending, mezzanine financing, distressed debt, and special situations.

- Highlight your understanding of credit risk assessment: Explain your approach to credit risk assessment, including due diligence processes, financial statement analysis, and covenant monitoring.

- Show familiarity with relevant regulations: Demonstrate awareness of relevant regulations and compliance issues, such as those related to lending, leverage, and reporting.

- Stay up-to-date on market trends: Stay abreast of the latest market trends, investment opportunities, and challenges facing the private credit industry.

- Be prepared to discuss your investment philosophy: Articulate your investment philosophy, including your risk tolerance and approach to investment decisions.

Do #5: Follow Up Professionally After Each Interview

Following up effectively shows your continued interest and professionalism.

- Send a thank-you note: Send a personalized thank-you note to each interviewer within 24 hours, reiterating your interest and highlighting key discussion points.

- Follow up politely: After a reasonable timeframe (e.g., a week), follow up politely to inquire about the status of your application.

- Maintain professional communication: Maintain professional and courteous communication throughout the hiring process, regardless of the outcome.

- Show genuine enthusiasm and persistence: Your enthusiasm and persistence will leave a positive impression.

5 Don'ts to Avoid During Your Private Credit Job Search

Don't #1: Submit a Generic Resume and Cover Letter

Avoid using a generic resume and cover letter. Tailoring your application to each firm is essential to demonstrating your genuine interest and understanding of their specific needs.

Don't #2: Neglect Networking Opportunities

Don't underestimate the power of networking. Failing to engage with industry professionals significantly limits your access to potential opportunities and valuable insights.

Don't #3: Underprepare for the Technical and Behavioral Aspects of the Interview

Being unprepared for both technical and behavioral questions will significantly hurt your chances. Thorough preparation is crucial for success.

Don't #4: Demonstrate a Lack of Understanding of Private Credit

A lack of understanding of private credit investments, strategies, and market dynamics will severely hinder your candidacy. Demonstrate your expertise to stand out.

Don't #5: Fail to Follow Up After Interviews

Failing to follow up demonstrates a lack of interest and professionalism. A simple thank-you note and a polite follow-up can make a significant difference.

Conclusion

Securing a position in private credit requires a strategic and targeted approach. By following these five do's and don'ts, you can significantly enhance your chances of success. Remember to tailor your application materials, network effectively, master the interview process, showcase your knowledge of private credit investments, and follow up professionally. Start putting these tips into action today and boost your chances of landing your dream job in private credit hiring!

Featured Posts

-

How Is A New Pope Chosen A Comprehensive Guide To Papal Conclaves

Apr 22, 2025

How Is A New Pope Chosen A Comprehensive Guide To Papal Conclaves

Apr 22, 2025 -

Dissecting The Economic Impact Of Trumps Presidency

Apr 22, 2025

Dissecting The Economic Impact Of Trumps Presidency

Apr 22, 2025 -

Blue Origins Rocket Launch Canceled Due To Technical Issue

Apr 22, 2025

Blue Origins Rocket Launch Canceled Due To Technical Issue

Apr 22, 2025 -

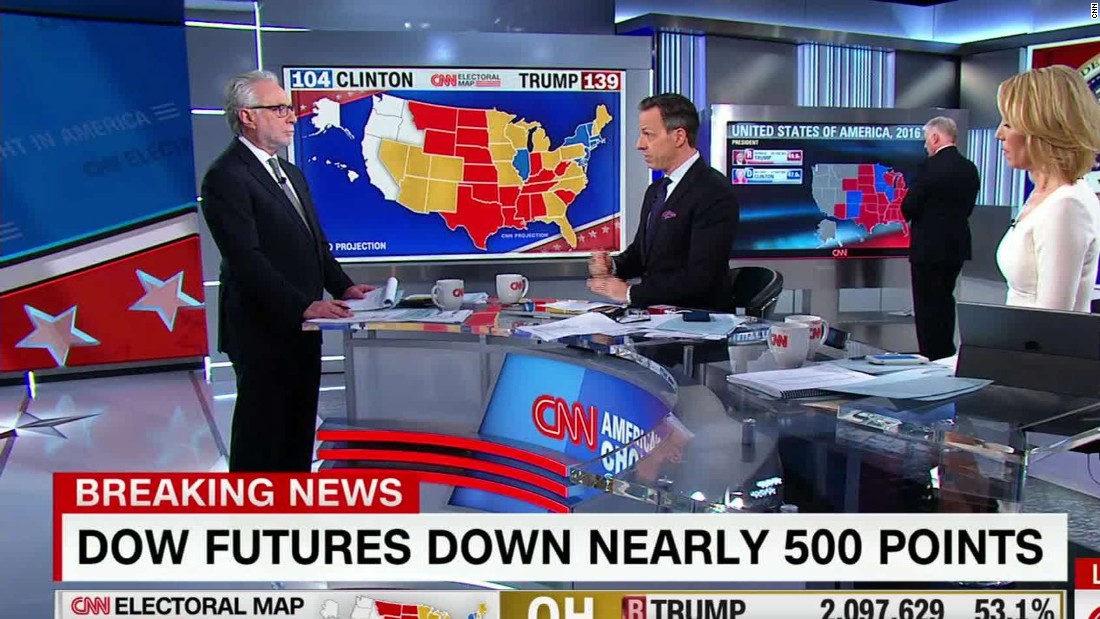

Trade War Impact Live Updates On Dow Futures And Dollar Movement

Apr 22, 2025

Trade War Impact Live Updates On Dow Futures And Dollar Movement

Apr 22, 2025 -

Covid 19 Pandemic Lab Owners Guilty Plea For Fake Test Results

Apr 22, 2025

Covid 19 Pandemic Lab Owners Guilty Plea For Fake Test Results

Apr 22, 2025