Cracking The Private Credit Code: 5 Do's And Don'ts For Job Seekers

Table of Contents

5 Do's for Navigating Private Credit Checks

Do 1: Obtain Your Credit Report and Dispute Errors

Before even thinking about applying for jobs, obtain your credit report. Inaccuracies on your credit report can significantly lower your credit score and hurt your chances in the job application process. It's essential to identify and dispute any errors.

- Get your free credit report: You're entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually at AnnualCreditReport.com. This is your first step towards credit score improvement.

- Dispute errors promptly: If you find any inaccuracies (incorrect account information, late payments that weren't your fault, accounts that aren't yours), dispute them immediately with the respective credit bureau. Provide documentation supporting your claims.

- Impact of inaccuracies: Even small errors can negatively affect your credit score, impacting your ability to secure employment. Addressing these issues proactively is crucial for credit report accuracy and credit score improvement.

Do 2: Understand Your Credit Score and Take Steps to Improve It

Understanding your credit score—specifically, your FICO score and VantageScore—is vital. Different lenders and employers may use different scoring models, so a general understanding of credit scoring is important.

- Credit scoring models: Familiarize yourself with the different credit scoring models and their components (payment history, amounts owed, length of credit history, new credit, credit mix).

- Improve your credit score: Focus on improving your creditworthiness. Key strategies include paying down high-interest debt, paying all bills on time, and maintaining a healthy credit utilization ratio (keeping your credit card balances low). Many resources are available online to guide you through credit score improvement.

- Debt management: If you have significant debt, consider debt management strategies like creating a budget, negotiating with creditors, or seeking help from a credit counselor.

Do 3: Prepare for Potential Questions About Your Credit

Employers may ask about your credit history during the job interview process. Prepare thoughtful and honest answers.

- Anticipate questions: Anticipate potential questions like, "Can you explain any negative marks on your credit report?" or "What steps are you taking to improve your credit score?"

- Frame negative aspects positively: If you have experienced financial challenges, present them as learning experiences and demonstrate your commitment to financial responsibility. Focus on your positive actions and plans for the future.

- Show responsibility and commitment: Highlight any steps you've taken to improve your credit, such as paying down debt, creating a budget, or seeking professional financial guidance.

Do 4: Know Your Rights Regarding Credit Checks

The Fair Credit Reporting Act (FCRA) protects consumers' rights regarding credit checks. Understanding these protections is crucial.

- Employer's right to perform checks: Employers generally have the right to perform credit checks, but they must follow specific procedures, such as obtaining your consent.

- Your right to access your report: You have the right to request and receive a copy of your credit report used in the employment decision-making process.

- Discrimination laws: Be aware of anti-discrimination laws that protect you from adverse employment actions based solely on your credit history.

Do 5: Monitor Your Credit Regularly

Proactive credit monitoring is vital to protect yourself from identity theft and other potential problems that could negatively affect your credit score.

- Utilize credit monitoring tools: Many free and paid services offer credit monitoring and alerts, notifying you of changes to your credit report.

- Detect and address fraud: Regularly checking your credit reports allows you to quickly detect and address any signs of fraud or identity theft, minimizing the potential damage.

- Maintain accuracy: By monitoring your credit report frequently, you can ensure its accuracy and address any discrepancies or errors in a timely manner.

5 Don'ts for Navigating Private Credit Checks

Don't 1: Ignore Your Credit Report

Ignoring your credit report is a significant mistake. A poor credit report can lead to missed job opportunities.

- Missed opportunities: A neglected credit report can result in lost job opportunities due to unfavorable credit scores and potential red flags for employers.

- Negative impact on job offers: Employers may view a neglected credit report as a sign of irresponsibility, potentially leading to rejection.

Don't 2: Provide False Information

Never misrepresent your credit history. This can have serious consequences.

- Legal consequences: Providing false information on your credit report is a serious offense with potential legal ramifications.

- Loss of trust: Employers will lose trust in you if you are dishonest about your credit history.

Don't 3: Panic About a Less-Than-Perfect Score

A less-than-perfect credit score doesn't have to derail your job search.

- Focus on improvement: Showcase your proactive steps to improve your creditworthiness. Employers appreciate responsibility and commitment to improvement.

- Highlight other positive attributes: Emphasize your skills, experience, and other positive attributes to demonstrate your value as a candidate.

Don't 4: Assume Your Credit History Won't Be Checked

Credit checks are becoming increasingly common in the hiring process; preparation is key.

- Preparation is key: Don't assume your credit history won't be checked; proactively address any potential concerns beforehand.

- Understand the hiring process: Familiarize yourself with the employer's pre-employment screening procedures.

Don't 5: Neglect to Update Your Contact Information

Ensuring your contact information is up-to-date is crucial for receiving important credit reports and notifications.

- Importance for receiving reports: Accurate contact details ensure you receive important updates regarding your credit report. Missed notifications could be detrimental.

Conclusion: Mastering the Private Credit Code for Job Success

Navigating private credit checks during your job search requires proactive preparation and a strategic approach. By following the 5 Do's and avoiding the 5 Don'ts outlined above, you can confidently tackle this aspect of the job application process. Start cracking the private credit code today! Take control of your credit report and boost your job prospects. Don't let a poor credit report hinder your career – take action now!

Featured Posts

-

Just Contact Us Investigating Tik Toks Tariff Circumvention Tactics

Apr 22, 2025

Just Contact Us Investigating Tik Toks Tariff Circumvention Tactics

Apr 22, 2025 -

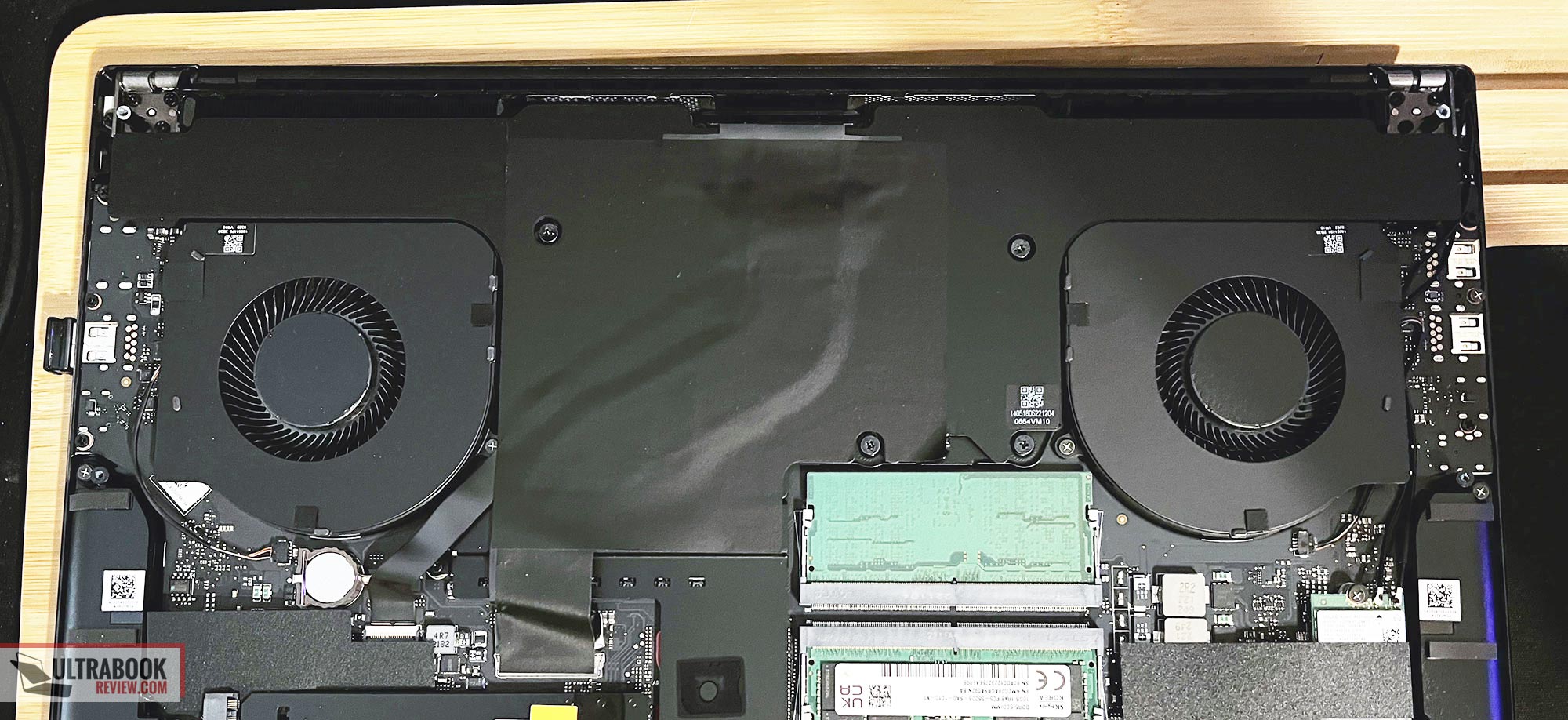

In Depth Review Razer Blade 16 2025 Ultra Portable Powerhouse

Apr 22, 2025

In Depth Review Razer Blade 16 2025 Ultra Portable Powerhouse

Apr 22, 2025 -

How Trumps Trade Policies Affected Americas Global Financial Position

Apr 22, 2025

How Trumps Trade Policies Affected Americas Global Financial Position

Apr 22, 2025 -

Increased Student Fear At Fsu Following Security Breach Despite Prompt Police Response

Apr 22, 2025

Increased Student Fear At Fsu Following Security Breach Despite Prompt Police Response

Apr 22, 2025 -

T Mobile Data Breaches 16 Million Penalty For Security Lapses

Apr 22, 2025

T Mobile Data Breaches 16 Million Penalty For Security Lapses

Apr 22, 2025