X's Financial Restructuring: Analyzing Musk's Debt Sale Data

Table of Contents

The Scale of Musk's Debt Acquisition and Subsequent Restructuring

Musk's acquisition of X was largely funded through debt, placing a significant burden on the platform's financial stability. The initial leveraged buyout involved a complex mix of debt instruments, including substantial leveraged loans and high-yield bonds. This high-risk strategy, while enabling the acquisition, created a precarious financial situation requiring a significant restructuring effort.

- Total debt acquired: Estimates place the total debt at approximately $13 billion (Source: [Insert reliable source, e.g., reputable financial news outlet]). This figure includes the principal amounts plus accrued interest.

- Types of debt: A considerable portion was high-yield bonds, also known as "junk bonds," reflecting the inherent risk associated with the leveraged buyout. Leveraged loans, typically provided by a syndicate of banks, also constituted a substantial part of the debt.

- Interest rates and costs: The interest rates on these debts were likely high, reflecting the risk profile. This translates to significant annual interest payments, putting pressure on X's operating cash flow and profitability. Accurate interest rates require accessing private financial documents, but publicly available information gives estimates.

The keywords X debt, Musk acquisition debt, Leveraged buyout debt, High-yield bond, and Debt financing accurately describe this phase.

Analyzing the Debt Sale Data: Key Indicators and Trends

To alleviate the debt burden, Musk initiated a series of debt sales. Analyzing this data reveals crucial insights into the restructuring's success. Key aspects to examine include:

- Amounts sold: The precise amounts sold aren't publicly available in their entirety, but reports indicate a significant reduction in the overall debt load. Accessing private financial information is crucial for accurate analysis.

- Buyers: The identities of the buyers provide insights into the market's perception of X's risk profile. Were these institutional investors, hedge funds, or other parties?

- Pricing: The prices at which the debt was sold reflect the market's assessment of X's creditworthiness. Discounts from face value would point to a lower credit rating and increased risk.

- Impact on Debt-to-Equity Ratio: The debt sales aim to reduce X's leverage, improving its debt-to-equity ratio. A lower ratio suggests improved financial health and reduced bankruptcy risk.

- Credit rating changes: Credit rating agencies closely monitor X's financial situation. The debt sales might have impacted X's credit rating, either positively (through improved leverage) or negatively (due to lingering debt). (Insert chart or graph illustrating debt reduction or credit rating changes, if available).

Keywords Debt sale analysis, X debt reduction, Credit rating impact, and Financial performance analysis are integral to this section.

The Role of Equity Investments and Other Funding Sources

While debt reduction is central, it's important to consider additional funding sources impacting X's financial restructuring.

- Equity investments: Did Musk or other investors inject further equity to support the restructuring? This would reduce reliance on debt and strengthen the balance sheet.

- Advertising revenue: X's advertising revenue plays a crucial role in its financial stability. Increases in ad revenue directly improve its ability to service debt and fund operations.

- Subscription services: The launch of paid subscription services, like X Blue, diversifies revenue streams and reduces reliance on advertising. Growth in subscribers is critical for long-term financial stability.

Keywords relevant to this section include Equity financing, X revenue, Subscription model, and Funding sources.

Implications for X's Long-Term Financial Stability

The success of X's financial restructuring depends on its long-term financial stability. While debt reduction is positive, the high debt levels remaining still pose risks.

- Future growth: The level of debt impacts X's ability to invest in future growth initiatives, such as product development and expansion.

- Investment opportunities: High debt levels can restrict access to new investment opportunities, potentially hindering X's competitive position.

- Financial risk: Despite the restructuring, the substantial debt remaining exposes X to significant financial risk, particularly if operating performance deteriorates. This risk can include potential defaults or refinancing difficulties.

Keywords used here include Financial stability, X future, Financial risk, and Long-term outlook.

Conclusion: Understanding the Future of X's Finances After the Debt Restructuring

Analyzing Musk's debt sale data provides crucial insights into X's financial restructuring. While debt reduction is a positive step, significant challenges remain. The long-term impact will depend on factors like X's operational performance, revenue growth, and the broader economic climate. The level of debt, even after the sales, represents a considerable financial risk.

To stay informed about X's financial performance and further developments regarding X's financial restructuring and Musk's debt management strategies, continue to follow financial news and updates. Subscribe to our newsletter [link to newsletter signup] to receive future updates. We encourage comments and sharing of this analysis. Let's continue the conversation about the complexities of X's financial future.

Featured Posts

-

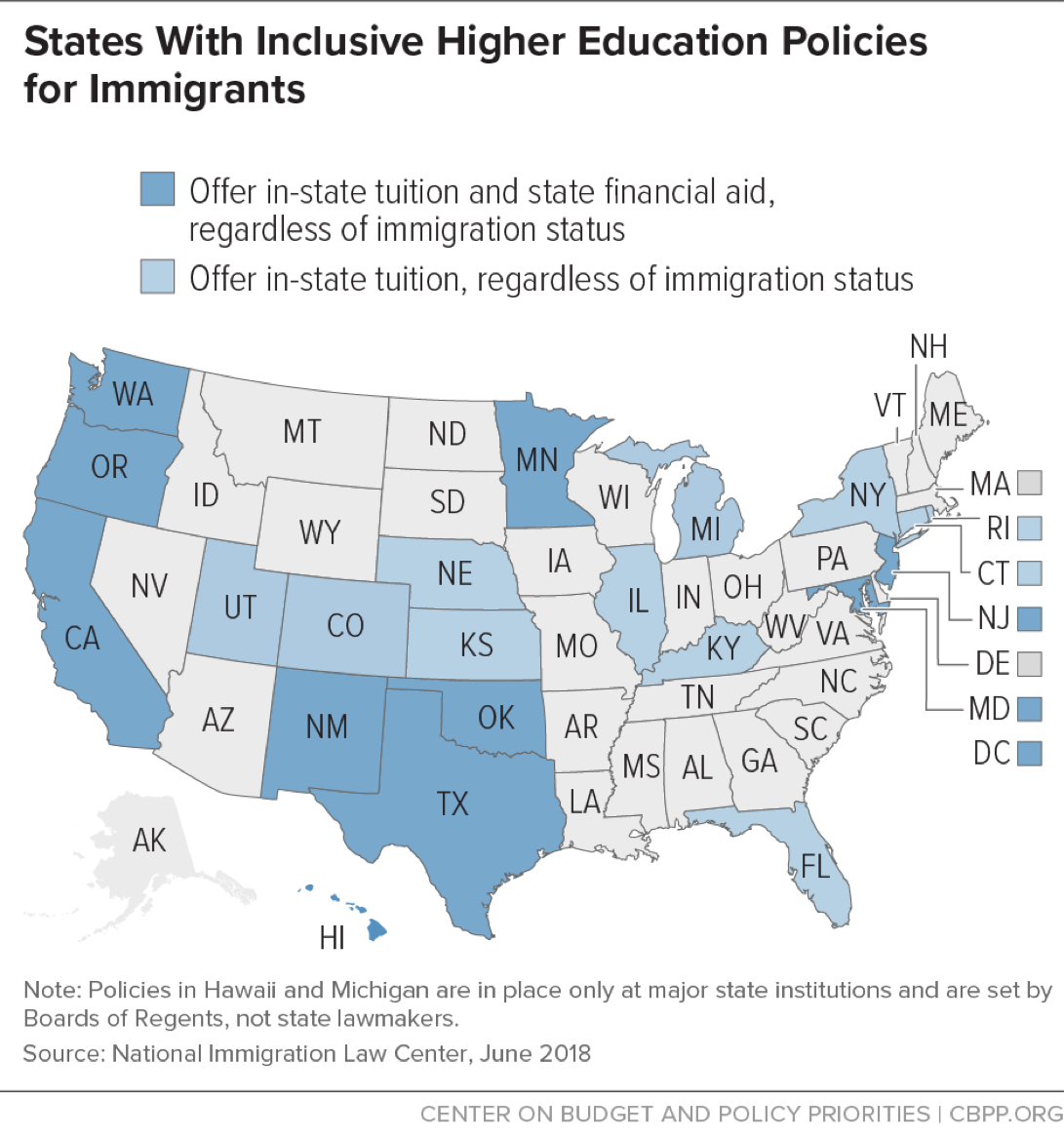

Trump Administrations Higher Education Policies A Wider Reach

Apr 28, 2025

Trump Administrations Higher Education Policies A Wider Reach

Apr 28, 2025 -

Chinoiserie And Feminism A New Interpretation At The Mets Monstrous Beauty Exhibit

Apr 28, 2025

Chinoiserie And Feminism A New Interpretation At The Mets Monstrous Beauty Exhibit

Apr 28, 2025 -

U S Dollars Performance A Troubling First 100 Days Under The Current Presidency

Apr 28, 2025

U S Dollars Performance A Troubling First 100 Days Under The Current Presidency

Apr 28, 2025 -

Martinsville Speedway Hamlins End To The Dry Spell

Apr 28, 2025

Martinsville Speedway Hamlins End To The Dry Spell

Apr 28, 2025 -

Blue Jays Vs Yankees Spring Training Live Stream Time And Channel Info March 7 2025

Apr 28, 2025

Blue Jays Vs Yankees Spring Training Live Stream Time And Channel Info March 7 2025

Apr 28, 2025