U.S. Dollar's Performance: A Troubling First 100 Days Under The Current Presidency

Table of Contents

Inflationary Pressures and the Weakening Dollar

The weakening US dollar is significantly linked to rising inflationary pressures. The current administration's economic policy has been challenged by a confluence of factors contributing to this downward trend in dollar performance.

Rising Interest Rates and Their Impact

The Federal Reserve's response to soaring inflation has involved aggressive interest rate hikes. This crucial aspect of the current economic policy has direct consequences for the US dollar.

- Relationship between interest rates, inflation, and the dollar: Higher interest rates are intended to curb inflation by making borrowing more expensive, thereby reducing consumer spending and investment. A stronger dollar typically results from higher interest rates as it attracts foreign investment seeking higher returns.

- Specific interest rate hikes and data: For example, the Fed raised the federal funds rate by 0.75 percentage points in June 2023, the largest increase since 1994. The Consumer Price Index (CPI) in the same month showed inflation still stubbornly high, at 3%.

- Consequences of aggressive interest rate hikes: While aiming to control inflation, these aggressive measures could potentially trigger a recession by slowing economic growth too sharply. This economic slowdown could further weaken the dollar's performance.

Supply Chain Disruptions and Their Contribution

Supply chain disruptions, exacerbated by the pandemic and geopolitical events, have fueled inflation, putting additional pressure on the US dollar.

- Examples of supply chain disruptions: The ongoing chip shortage, port congestion, and disruptions in global transportation networks have increased the cost of goods, contributing to inflation. Specific industries like automobiles and electronics have been particularly affected.

- Long-term effects on the dollar's value: The persistent vulnerability of global supply chains indicates the possibility of continued inflationary pressures, which could exert sustained downward pressure on the US dollar's value.

Geopolitical Uncertainty and the Dollar's Role as a Safe Haven

Geopolitical instability significantly impacts investor confidence and the dollar's status as a safe-haven asset. The dollar performance is frequently impacted by the shifting sands of global politics.

The Impact of International Conflicts

Global conflicts and tensions reduce investor confidence in the dollar.

- Geopolitical events influencing the dollar: The ongoing war in Ukraine, tensions with China, and other regional conflicts create uncertainty, leading to capital flight from riskier assets, including the US dollar (though initially, it can see a temporary surge as a safe haven).

- Capital flight and safe-haven demand: While the dollar is often viewed as a safe haven during times of global uncertainty, prolonged instability can erode its appeal, leading to a weakening of the dollar's value. The weakening dollar performance can be observed through decreased demand for US Treasury bonds.

Trade Wars and Protectionist Policies

Trade disputes and protectionist policies negatively affect the US economy and the dollar's value.

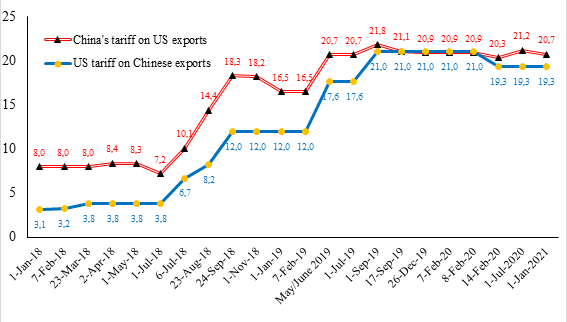

- Examples of trade disputes and their impact: Trade wars and tariffs implemented by the current administration can disrupt global trade flows, increase prices for consumers, and negatively impact investor sentiment.

- Consequences of protectionist policies: Protectionist measures often lead to retaliatory tariffs from other countries, harming US exports and potentially slowing economic growth, leading to further downward pressure on dollar performance.

Government Spending and the National Debt

Government spending and the national debt are crucial factors influencing the US dollar’s value. The economic policy surrounding these factors impacts both inflation and market confidence.

Fiscal Policy and its Influence

Government spending and the national debt have a direct relationship with inflation and the dollar's value.

- Relationship between government debt, inflation, and the dollar: High government debt can lead to increased inflation if financed through borrowing, putting downward pressure on the dollar's value.

- Relevant statistics on national debt: The US national debt continues to grow, raising concerns about the country’s long-term fiscal sustainability and its impact on the value of the dollar.

Market Confidence and the Dollar's Future

Government actions significantly impact market confidence in the US dollar.

- Investor sentiment towards the US economy and the dollar: Negative investor sentiment, fueled by concerns about the national debt, inflation, and geopolitical uncertainty, can lead to a decline in the dollar's value.

- Potential for future growth and stability: The long-term outlook for the US dollar depends on the government's ability to address these challenges and restore confidence in the US economy.

Conclusion: Assessing the U.S. Dollar's Performance and Looking Ahead

The first 100 days under the current presidency have witnessed a troubling decline in the US dollar's performance, driven by a combination of inflationary pressures, geopolitical uncertainty, and concerns about government spending and the national debt. The weakening dollar performance poses significant risks to the US economy, including reduced purchasing power and potential instability in global financial markets. The outlook for the US dollar remains uncertain, depending heavily on the government's ability to effectively manage inflation, navigate geopolitical challenges, and implement sustainable fiscal policies. Stay informed about developments affecting US dollar performance and the broader US dollar outlook by regularly reviewing economic news and analysis to make sound financial decisions in this uncertain climate. Understanding the factors influencing US dollar strength is crucial for navigating the complexities of the global economy.

Featured Posts

-

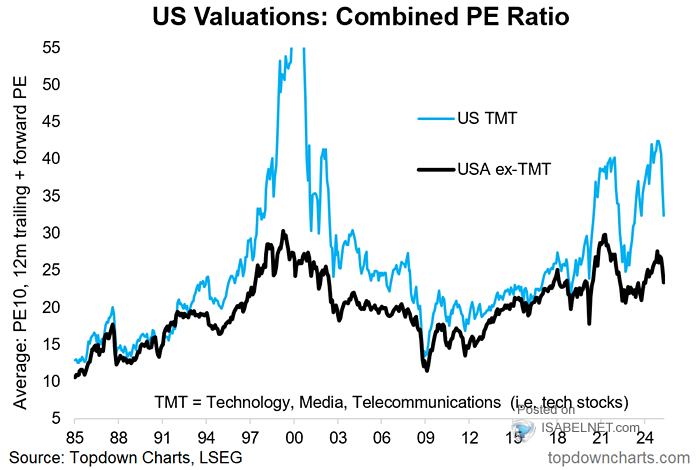

Bof A On Stock Market Valuations Why Investors Can Remain Calm

Apr 28, 2025

Bof A On Stock Market Valuations Why Investors Can Remain Calm

Apr 28, 2025 -

New Developments In Us China Trade Tariff Exemptions

Apr 28, 2025

New Developments In Us China Trade Tariff Exemptions

Apr 28, 2025 -

Orioles Announcers Curse Lifted 160 Game Hit Streak Snapped

Apr 28, 2025

Orioles Announcers Curse Lifted 160 Game Hit Streak Snapped

Apr 28, 2025 -

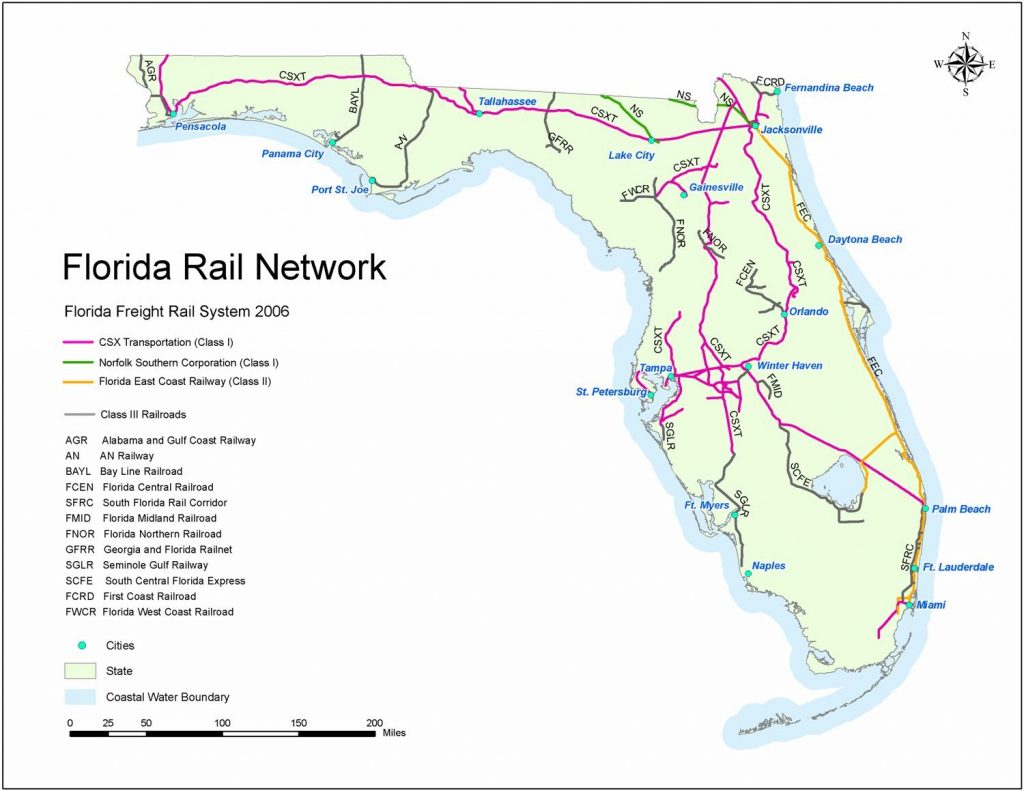

Exploring The Florida Keys From Railroad To Overwater Highway

Apr 28, 2025

Exploring The Florida Keys From Railroad To Overwater Highway

Apr 28, 2025 -

First Meeting Since Oval Office Confrontation Trump And Zelensky Attend Popes Funeral

Apr 28, 2025

First Meeting Since Oval Office Confrontation Trump And Zelensky Attend Popes Funeral

Apr 28, 2025