Understanding High Stock Market Valuations: BofA's Take For Investors

Table of Contents

BofA's Current Assessment of Stock Market Valuations

BofA's recent reports indicate a cautious stance on current stock market valuations. While acknowledging the strong performance, they highlight concerns about whether these elevated prices are fully justified by underlying fundamentals. Their analysis often incorporates a variety of valuation metrics to provide a comprehensive picture.

-

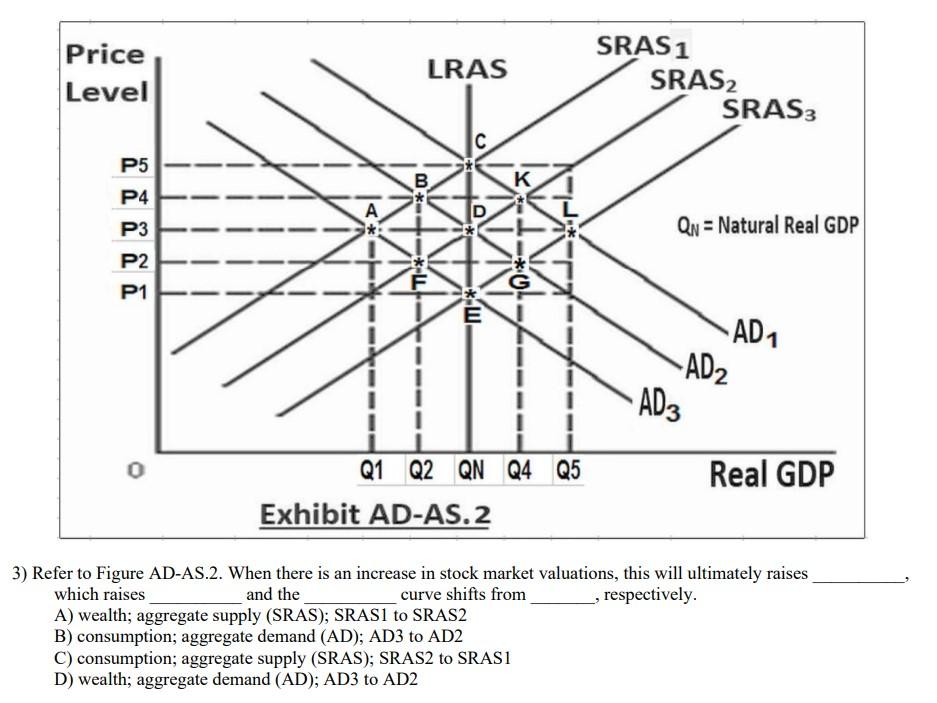

Summary of BofA's valuation metrics: BofA regularly uses metrics like the Price-to-Earnings ratio (P/E), the Shiller P/E (CAPE ratio), and other forward-looking measures to assess market valuation. These ratios are compared against historical averages and industry benchmarks to gauge whether the market is trading at a premium or discount.

-

Comparison to historical valuations: BofA's analysis often shows that current P/E ratios and other valuation metrics are significantly higher than their long-term historical averages. This suggests that the market is trading at a premium, presenting a higher risk of potential corrections.

-

Specific sectors: BofA's reports may identify specific sectors that appear overvalued (e.g., technology during periods of rapid growth) or undervalued (e.g., cyclical sectors during economic downturns). This sector-specific analysis helps investors fine-tune their portfolio allocations.

-

Key factors driving BofA's assessment: Interest rates, economic growth projections, inflation expectations, and geopolitical events significantly influence BofA's valuation assessments. Low interest rates, for instance, can inflate asset prices, contributing to higher valuations.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors have contributed to the current high stock market valuations. Understanding these factors is crucial for comprehending the market's trajectory and potential risks.

-

Low interest rates: Historically low interest rates have significantly impacted discounted cash flow valuations. Lower discount rates increase the present value of future earnings, leading to higher stock prices. This makes investing in bonds less attractive, pushing more capital into the stock market.

-

Strong corporate earnings (or expectations thereof): Robust corporate earnings, or expectations of future strong earnings growth, often support higher stock valuations. Positive economic forecasts and successful corporate strategies fuel investor optimism.

-

Impact of quantitative easing and monetary policy: Central banks' quantitative easing (QE) programs and other stimulative monetary policies have injected significant liquidity into the market, pushing up asset prices, including stocks.

-

Technological advancements and growth in specific sectors: Breakthroughs in technology and the growth of specific sectors like technology and renewable energy have attracted significant investment, contributing to higher valuations within these sectors and the broader market.

-

Investor sentiment and risk appetite: Positive investor sentiment and a high risk appetite often lead to increased demand for stocks, pushing prices higher. This sentiment can be influenced by various factors, including economic data, political events, and media coverage.

BofA's Recommendations for Investors

Navigating a market with high valuations requires a strategic approach. BofA typically recommends a multi-faceted strategy tailored to individual risk tolerance.

-

Diversification strategies: BofA likely advises diversification across various sectors and asset classes to mitigate risk. This might involve allocating funds to bonds, real estate, or alternative investments alongside stocks.

-

Importance of risk management: In a high-valuation market, risk management is paramount. BofA might suggest setting stop-loss orders, diversifying holdings, and carefully considering position sizing.

-

Potential investment opportunities: BofA's research might highlight specific undervalued sectors or companies that offer attractive risk-adjusted returns, even in a high-valuation market.

-

Adjusting portfolio allocation: BofA may recommend adjusting portfolio allocation based on individual risk tolerance. Conservative investors might reduce their equity exposure, while more aggressive investors might maintain higher allocations but with a focus on risk management.

-

Long-term vs. short-term strategies: BofA likely emphasizes the importance of a long-term investment horizon, particularly in a market with elevated valuations. Short-term trading can amplify risks in such an environment.

Risks Associated with High Stock Market Valuations

Investing in a market with high valuations carries inherent risks. Understanding these risks is essential for making sound investment decisions.

-

Increased vulnerability to market corrections or crashes: High valuations make the market more susceptible to sharp corrections or crashes. A negative economic shock or shift in investor sentiment could trigger significant price declines.

-

Potential for lower future returns: Stocks purchased at high valuations generally offer lower potential future returns compared to those bought at historically lower valuations. This is because future growth has to justify the already high price.

-

Impact of rising interest rates: Rising interest rates can negatively impact stock valuations. Higher rates increase the discount rate used in valuation models, reducing the present value of future earnings.

-

Geopolitical risks: Geopolitical events and uncertainty can trigger market volatility and negatively affect stock prices, especially in a market already considered overvalued.

-

Inflationary pressures: High inflation erodes purchasing power and can impact corporate profitability, potentially leading to lower stock prices.

Conclusion

BofA's analysis of high stock market valuations paints a picture of a market operating at elevated levels. While strong corporate earnings and low interest rates have driven growth, the elevated valuations compared to historical averages present potential risks. Key takeaways include the need for diversification, robust risk management, and a careful consideration of both long-term and short-term investment strategies. Understanding these factors is crucial for informed decision-making.

Call to Action: Don't let high stock market valuations leave you feeling uncertain. Conduct thorough research, consult with a financial advisor, and develop a well-informed investment strategy based on your risk tolerance and financial goals, considering BofA's insights on high stock market valuations. Explore BofA's research reports and other reputable market analyses to gain a deeper understanding of the current market landscape and effectively manage your investments in this environment of high stock market valuations.

Featured Posts

-

Trump Administration Challenges Europes Proposed Ai Rulebook

Apr 26, 2025

Trump Administration Challenges Europes Proposed Ai Rulebook

Apr 26, 2025 -

Golds Record High Understanding The Trade War Impact On Bullion

Apr 26, 2025

Golds Record High Understanding The Trade War Impact On Bullion

Apr 26, 2025 -

La Palisades Fire Victims A Full List Of Celebrities Affected

Apr 26, 2025

La Palisades Fire Victims A Full List Of Celebrities Affected

Apr 26, 2025 -

Florida A Cnn Anchor Shares His Go To Vacation Destination

Apr 26, 2025

Florida A Cnn Anchor Shares His Go To Vacation Destination

Apr 26, 2025 -

Covid 19 Pandemic Lab Owner Pleads Guilty To Fraudulent Testing

Apr 26, 2025

Covid 19 Pandemic Lab Owner Pleads Guilty To Fraudulent Testing

Apr 26, 2025

Latest Posts

-

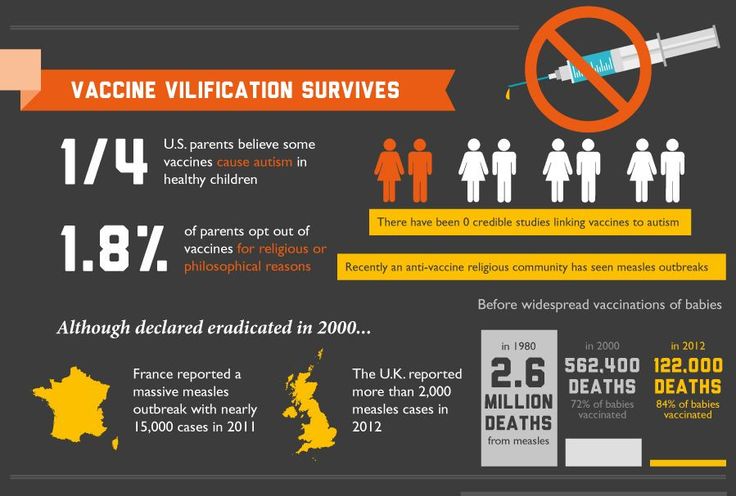

Government Appoints Vaccine Skeptic To Head Autism Vaccine Study Public Reaction

Apr 27, 2025

Government Appoints Vaccine Skeptic To Head Autism Vaccine Study Public Reaction

Apr 27, 2025 -

Immunization And Autism Research A Vaccine Skeptic Takes The Helm

Apr 27, 2025

Immunization And Autism Research A Vaccine Skeptic Takes The Helm

Apr 27, 2025 -

Federal Study On Vaccines And Autism Headed By Vaccine Skeptic Concerns Raised

Apr 27, 2025

Federal Study On Vaccines And Autism Headed By Vaccine Skeptic Concerns Raised

Apr 27, 2025 -

Public Outrage Anti Vaxxer Appointed To Head Autism Study

Apr 27, 2025

Public Outrage Anti Vaxxer Appointed To Head Autism Study

Apr 27, 2025 -

Federal Agency Appoints Anti Vaccine Advocate To Lead Autism Research

Apr 27, 2025

Federal Agency Appoints Anti Vaccine Advocate To Lead Autism Research

Apr 27, 2025