Gold's Record High: Understanding The Trade War Impact On Bullion

Table of Contents

Safe-Haven Asset in Times of Uncertainty

Trade wars inject significant uncertainty into the global economy, making investors seek safer alternatives to riskier assets. This flight to safety is a key driver of the increased demand for gold.

Trade Wars and Market Volatility

- Increased uncertainty leads to capital flight from equities and other riskier assets. Investors, fearing losses in volatile stock markets, pull their money out of equities and seek refuge in assets perceived as more stable. The Gold Trade War narrative underscores this shift.

- Gold's historical performance as a safe-haven asset during times of economic and geopolitical instability is well-documented. Throughout history, gold has served as a reliable store of value during periods of crisis, shielding investors from market downturns. This inherent stability makes it an attractive option amidst trade war uncertainty.

- The inverse relationship between the US dollar and gold prices is crucial. A weakening US dollar often boosts gold's appeal, as investors seek alternatives to a depreciating currency. Trade wars can contribute to dollar weakness, further fueling gold's price increase. Understanding this Gold Trade War correlation is vital for investors.

Inflationary Pressures and Gold's Hedge

Trade wars can trigger inflationary pressures, making gold an attractive hedge against rising prices.

- Tariffs and trade restrictions disrupt supply chains and increase prices of goods. This leads to higher consumer prices and reduces purchasing power, making inflation a significant concern.

- Gold historically performs well during inflationary periods. As the value of fiat currencies erodes due to inflation, gold's inherent value remains relatively stable, acting as a safeguard for investors. The Gold Trade War connection is particularly evident here.

- Central bank monetary policies play a significant role in influencing both inflation and gold prices. Actions taken by central banks to combat inflation or stimulate economic growth can have a direct impact on the gold market, further complicating the Gold Trade War equation.

Geopolitical Risks and Gold Investment

Rising geopolitical tensions, often exacerbated by trade disputes, heighten investor anxiety and increase demand for safe-haven assets like gold.

Escalating Tensions and Gold Demand

- Specific examples of trade disputes impacting gold prices include the US-China trade war. These prolonged conflicts create significant uncertainty, boosting gold's appeal as a safe haven. The Gold Trade War dynamic is clearly observable in these instances.

- Investors view gold as a hedge against geopolitical risks. The inherent stability and scarcity of gold make it an attractive asset during times of international turmoil, mitigating the impact of trade war-related disruptions.

- Central banks accumulate gold reserves as a strategic asset. This demonstrates confidence in gold's long-term value and reinforces its role as a safe haven, particularly amidst the complexities of the Gold Trade War.

Currency Devaluation and Gold's Value

Trade wars can significantly impact currency exchange rates, affecting gold's value in different markets.

- A weakening currency can increase the demand for gold. Investors in countries experiencing currency devaluation may turn to gold as a store of value, driving up demand and prices. The interplay between currency fluctuations and the Gold Trade War is a critical factor here.

- Different currency exchange rates impact gold prices in various markets. Gold's price is typically quoted in US dollars, but changes in other currencies affect the local price of gold.

- Countries whose currencies have been affected by trade wars often see increased activity in their gold markets. This highlights the direct link between trade tensions, currency fluctuations, and gold investment.

Investment Strategies in the Face of Trade War Uncertainty

Diversification is key to mitigating risk associated with trade wars and fluctuating gold prices.

Diversification with Gold Bullion

- Different ways to invest in gold include physical gold, gold ETFs (exchange-traded funds), and gold mining stocks. Each option carries varying levels of risk and reward. Understanding these options is critical to navigating the Gold Trade War landscape.

- Holding physical gold offers the advantage of tangible asset ownership. This can be reassuring during times of economic uncertainty.

- Each investment strategy has its own set of risks and rewards. Investors should carefully consider their risk tolerance and investment goals before making any decisions.

Long-Term Outlook for Gold and Trade Wars

The long-term impact of trade wars on gold prices remains uncertain.

- Potential scenarios and their effects on the gold market require careful analysis. Factors such as the resolution (or escalation) of trade disputes and global economic growth will play a significant role.

- Cautious predictions about future gold prices are necessary given the current dynamics. The Gold Trade War relationship is complex and unpredictable.

- Staying informed about global economic and geopolitical events is crucial for making informed investment decisions. Monitoring news and economic indicators is vital for navigating the Gold Trade War and its effect on gold prices.

Conclusion

The record-high gold prices are a direct reflection of the uncertainty and volatility created by ongoing trade wars. The safe-haven nature of gold, combined with inflationary pressures and geopolitical risks, has driven significant demand for gold bullion. Investors should consider diversifying their portfolios with gold as a hedge against these uncertainties. By understanding the complex relationship between Gold Trade War dynamics and precious metal prices, investors can make informed decisions and navigate the complexities of the current market climate. Stay informed about global events impacting gold prices, and consider incorporating gold into your investment strategy to mitigate risk and effectively manage your exposure to the Gold Trade War.

Featured Posts

-

The Karen Read Case A Detailed Timeline Of Court Proceedings

Apr 26, 2025

The Karen Read Case A Detailed Timeline Of Court Proceedings

Apr 26, 2025 -

Construction Resumes On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025

Construction Resumes On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025 -

American Battleground A David Vs Goliath Showdown With The Worlds Richest Man

Apr 26, 2025

American Battleground A David Vs Goliath Showdown With The Worlds Richest Man

Apr 26, 2025 -

Subystem Issue Forces Blue Origin To Cancel Rocket Launch Attempt

Apr 26, 2025

Subystem Issue Forces Blue Origin To Cancel Rocket Launch Attempt

Apr 26, 2025 -

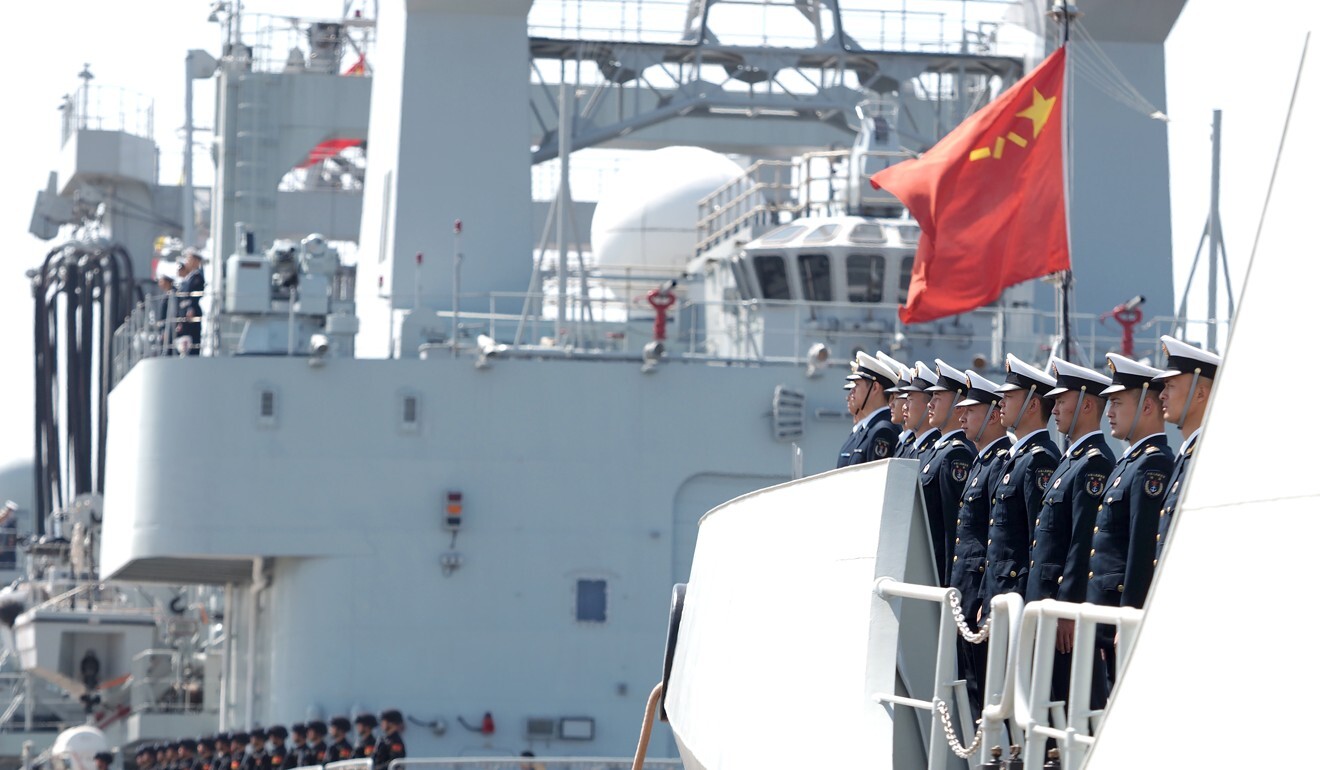

The Military Base At The Heart Of Us China Rivalry

Apr 26, 2025

The Military Base At The Heart Of Us China Rivalry

Apr 26, 2025