Trump Calls For Ban On Congressional Stock Trading In New Time Interview

Table of Contents

Donald Trump's recent comments in a New Time interview have once again thrust the issue of congressional stock trading into the national spotlight. His forceful call for a complete ban on members of Congress and their immediate family members trading stocks has sparked intense debate, highlighting deep-seated concerns about ethics, transparency, and the potential for insider trading within the government. This article delves into Trump's proposal, the ongoing controversy surrounding congressional stock trading, and the potential implications of a ban.

Trump's Call for a Ban: The New Time Interview Highlights

In his New Time interview, Donald Trump reiterated his long-held belief that members of Congress should not be allowed to trade stocks. He characterized the current system as rife with conflicts of interest, arguing that lawmakers are using their privileged access to information to gain an unfair advantage in the stock market. While specific quotes from the interview require verification, reports suggest Trump stated the practice erodes public trust and undermines the integrity of the legislative process.

- Reasons cited by Trump: Trump reportedly cited the inherent conflict of interest between legislative duties and personal financial gain as the primary reason for advocating a ban. He argued that the appearance of impropriety alone is damaging enough, regardless of whether actual insider trading occurs.

- Proposed enforcement mechanisms: Details on Trump's proposed enforcement mechanisms remain scarce, but he indicated a need for strict regulations and robust oversight to prevent any circumvention of a potential ban. This might involve independent audits, enhanced disclosure requirements, and potentially criminal penalties for violations.

- Comparison to previous statements: This call for a ban is consistent with Trump's previous public pronouncements on the issue, indicating a sustained focus on this aspect of political reform.

The Current Debate Surrounding Congressional Stock Trading

The debate surrounding congressional stock trading is multifaceted and deeply entrenched. Concerns about insider trading are central, as lawmakers often have access to non-public information that could influence their investment decisions. This potential for unfair advantage raises serious ethical questions and undermines public confidence in the integrity of the government.

- Examples of recent controversies: Several recent instances of congressional stock trades have fueled public outrage and calls for stricter regulations. These controversies often involve lawmakers making seemingly well-timed trades based on upcoming legislation or sensitive briefings.

- Arguments for and against a ban: Proponents of a ban argue that it's the only effective way to eliminate the potential for abuse and restore public trust. Opponents, however, contend that a ban could infringe on lawmakers' personal financial freedom and discourage qualified individuals from seeking public office. They often propose increased transparency and stricter disclosure rules as a more suitable alternative.

- Existing regulations and their effectiveness: Current regulations require disclosure of stock trades by members of Congress, but these rules are often criticized for their lack of enforcement and loopholes that allow for circumvention. The effectiveness of these existing regulations in preventing conflicts of interest is widely debated.

Public Opinion and the Demand for Reform

Public opinion polls consistently demonstrate widespread dissatisfaction with the current system of congressional stock trading. A significant portion of the public believes that lawmakers should be prohibited from engaging in such activities to prevent conflicts of interest and enhance public trust.

- Public perception of the ethics of lawmakers trading stocks: The public overwhelmingly views the practice of congressional stock trading as unethical, regardless of whether specific instances of illegal insider trading are proven.

- The level of support for a ban among different demographics: While support for a ban is generally high across various demographic groups, the intensity of that support may vary depending on political affiliation and other factors.

- The impact of this issue on public trust in government: The ongoing debate surrounding congressional stock trading significantly erodes public trust in government institutions. Many believe that this issue represents a systemic flaw that needs urgent attention.

Potential Implications of a Ban on Congressional Stock Trading

Implementing a ban on congressional stock trading would have far-reaching consequences, both positive and negative. While it could improve public trust and reduce the perception of corruption, it could also create unintended challenges.

- Impact on the financial markets: A ban might affect the stock market's overall dynamics, although the precise impact is difficult to predict.

- Effects on campaign finance: It's possible that a ban might alter the landscape of campaign finance, as lawmakers could rely less on financial support from individuals and groups with interests in specific legislation.

- Challenges in implementing and enforcing the ban: Crafting and enforcing such a ban would present significant practical challenges, requiring careful consideration of various legal and constitutional aspects.

Conclusion

Donald Trump's renewed call for a ban on congressional stock trading, highlighted in his recent New Time interview, underscores a deep and persistent concern regarding ethics in government. The current debate surrounding this issue highlights the tension between lawmakers' personal financial interests and their public responsibilities. While a ban might enhance public trust and address concerns about insider trading, its implementation presents significant challenges. Public opinion strongly supports reform, suggesting a growing demand for stricter regulations and increased transparency. What are your thoughts on Trump's call for a ban on congressional stock trading? Share your opinion in the comments below and let's continue the conversation about this crucial aspect of political reform. For further reading, you can explore resources on Congressional Stock Trading and its reform [insert links to relevant articles and resources here].

Featured Posts

-

Activision Blizzard Acquisition Ftc Launches Appeal

Apr 26, 2025

Activision Blizzard Acquisition Ftc Launches Appeal

Apr 26, 2025 -

Selling Sunset Star Accuses Landlords Of Price Gouging Amidst La Fires

Apr 26, 2025

Selling Sunset Star Accuses Landlords Of Price Gouging Amidst La Fires

Apr 26, 2025 -

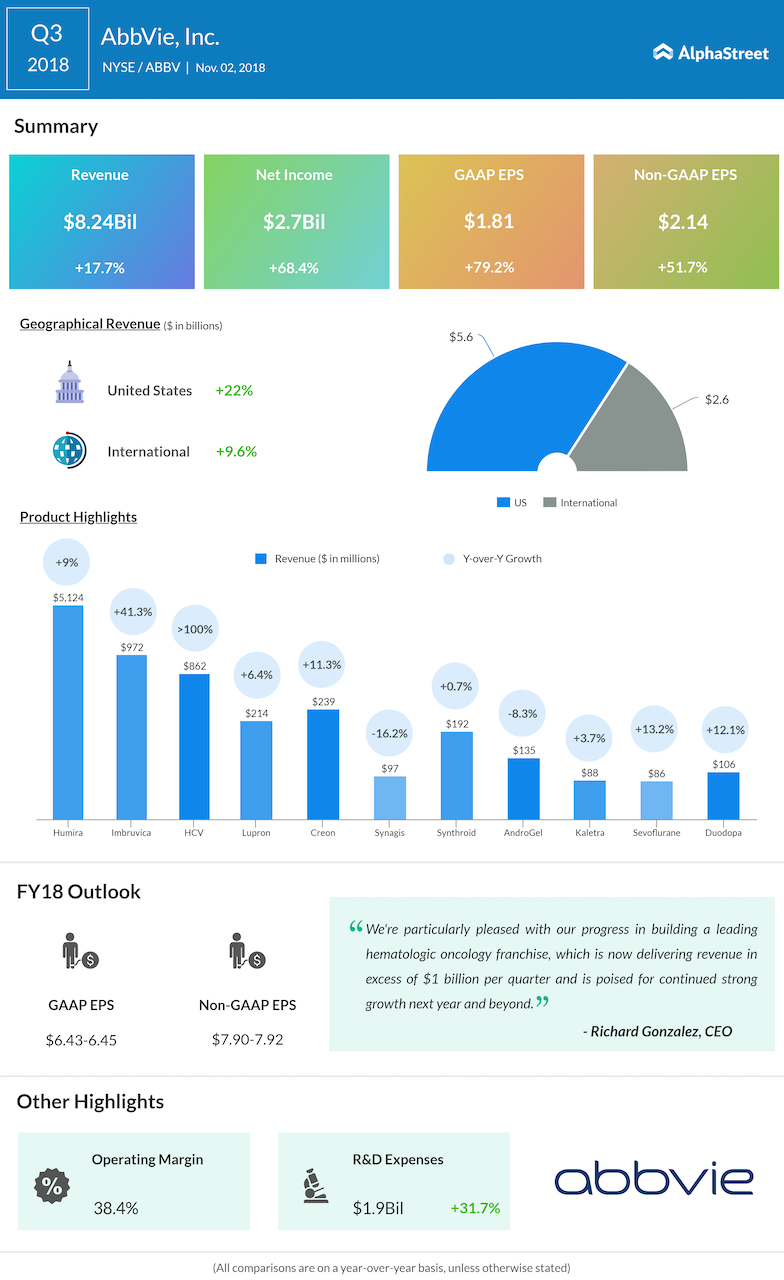

Abb Vies Q Quarter Earnings Higher Profits Driven By New Drug Performance

Apr 26, 2025

Abb Vies Q Quarter Earnings Higher Profits Driven By New Drug Performance

Apr 26, 2025 -

7 Hot New Orlando Restaurants To Try In 2025 Beyond Disney

Apr 26, 2025

7 Hot New Orlando Restaurants To Try In 2025 Beyond Disney

Apr 26, 2025 -

Covid 19 Pandemic Lab Owner Pleads Guilty To Fraudulent Testing

Apr 26, 2025

Covid 19 Pandemic Lab Owner Pleads Guilty To Fraudulent Testing

Apr 26, 2025