Activision Blizzard Acquisition: FTC Launches Appeal

Table of Contents

H2: The FTC's Argument Against the Merger

The FTC's core argument rests on the assertion that the Microsoft-Activision Blizzard merger would create an illegal monopoly, stifling competition and ultimately harming consumers. Their primary focus revolves around the potential for Microsoft to leverage its control over Activision Blizzard's vast portfolio, particularly the immensely popular Call of Duty franchise, to gain an unfair competitive advantage.

- Anticompetitive Practices: The FTC argues that Microsoft could use Call of Duty to bolster its Xbox Game Pass subscription service, potentially making the game exclusive or offering significantly inferior versions on competing platforms like PlayStation. This would limit consumer choice and drive players towards the Xbox ecosystem.

- Stifling Innovation: By consolidating such significant market power, the FTC contends that the merger would discourage innovation among smaller game developers and publishers, who would face an insurmountable competitor in a now-monopolized market. This lack of competition would lead to reduced quality, higher prices, and less variety for gamers.

- Market Dominance: The FTC points to Microsoft’s substantial market share in the gaming console market, coupled with Activision Blizzard's dominance in several key gaming genres, as evidence of the anticompetitive nature of the merger. The combined entity would control a disproportionate amount of market power, potentially undermining fair competition.

H2: The Judge's Ruling and the FTC's Response

A federal judge initially ruled in favor of Microsoft, dismissing the FTC's lawsuit and allowing the acquisition to proceed. The judge’s decision largely centered on a lack of compelling evidence to support the FTC's claims of significant anticompetitive effects. However, the FTC strongly disagrees with this assessment, arguing the judge's interpretation of antitrust law was flawed and that the potential harms to competition were significantly underestimated.

- Appeal Process: The FTC's appeal will involve a thorough review of the judge's decision by a higher court. This process could take several months, if not longer, involving extensive legal briefs, potentially oral arguments, and a final ruling that could significantly impact the future of the gaming industry.

- Legal Precedents: The FTC is relying on several established legal precedents in antitrust law to bolster its case, emphasizing previous instances where mergers of similarly sized companies were deemed anticompetitive. They are attempting to demonstrate that the judge's decision deviated from established legal principles.

- Strategic Implications: The FTC’s appeal represents a significant strategic move, highlighting its commitment to upholding competitive practices within the tech sector. The outcome will likely shape future regulatory scrutiny of large-scale mergers in the digital marketplace.

H2: Implications for the Gaming Industry and Beyond

The outcome of the FTC's appeal has far-reaching implications for the gaming industry and the broader tech sector. This case sets a precedent that could impact future mergers and acquisitions, particularly in the increasingly consolidated digital entertainment landscape.

- Market Consolidation: A successful appeal could signal a heightened level of regulatory scrutiny over future mergers and acquisitions in the gaming industry, potentially slowing down the trend toward market consolidation.

- Smaller Developers: The impact on smaller game developers and publishers is significant. If the merger proceeds unchecked, it could stifle opportunities and create an uneven playing field.

- Regulatory Oversight: This case underscores the critical role of regulatory bodies like the FTC in monitoring mergers and acquisitions within the tech sector and ensuring fair competition.

- Future of Antitrust: The outcome will shape the interpretation and application of antitrust laws in the digital age, influencing how regulators approach future mergers in the tech industry.

H3: The Role of Call of Duty in the Dispute

The Call of Duty franchise stands as the central point of contention in this acquisition. Its immense popularity and profitability make it a crucial asset in the FTC's argument.

- Strategic Importance: Call of Duty's massive player base and consistent revenue generation make it a key driver of Activision Blizzard's overall success.

- Exclusivity Concerns: The FTC fears Microsoft could leverage Call of Duty to make it exclusive to Xbox Game Pass, potentially damaging competitors like Sony's PlayStation.

- Impact on PlayStation: This exclusivity could significantly harm PlayStation’s competitiveness, alienating millions of loyal Call of Duty players and potentially impacting sales.

- Key Argument: The FTC’s argument hinges on the potential harm caused by the loss of Call of Duty on other platforms, highlighting the game's pivotal role in shaping the competitive landscape.

3. Conclusion

The FTC's appeal against the Microsoft-Activision Blizzard acquisition represents a significant challenge to the initial court ruling and highlights the ongoing debate regarding antitrust issues in the rapidly evolving tech sector. The core arguments revolve around the potential for anticompetitive practices, particularly concerning the Call of Duty franchise and its impact on the overall gaming market. The outcome of this appeal will have profound implications for the future of the gaming industry, shaping regulatory oversight of future mergers and acquisitions, and potentially influencing antitrust law for years to come. Stay informed about the developments in this ongoing legal battle concerning the Activision Blizzard acquisition. Follow future updates on the FTC’s appeal to understand the impact on the gaming industry and the evolution of antitrust law in the tech sector. Further research into the Activision Blizzard acquisition will reveal the intricate complexities of this high-stakes deal.

Featured Posts

-

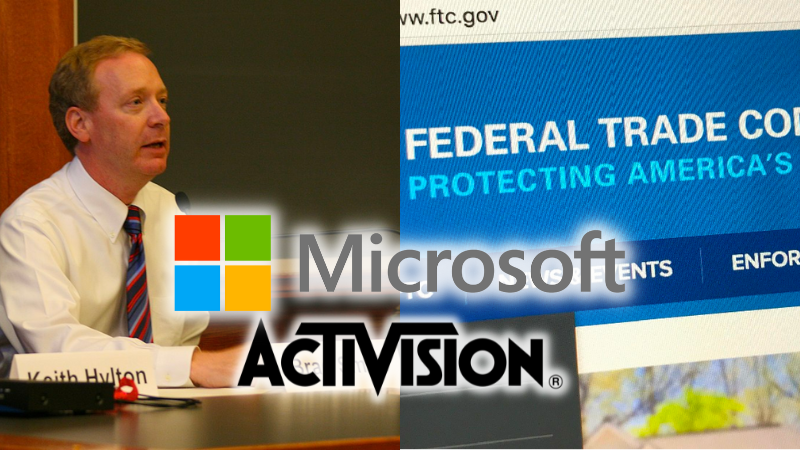

Nintendos Action Shuts Down Ryujinx Switch Emulator Development

Apr 26, 2025

Nintendos Action Shuts Down Ryujinx Switch Emulator Development

Apr 26, 2025 -

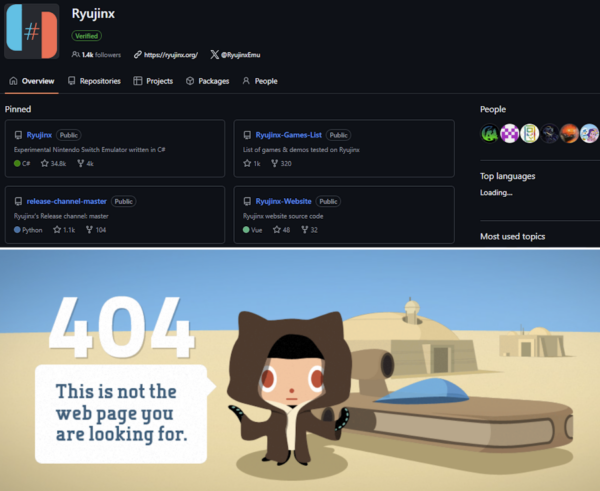

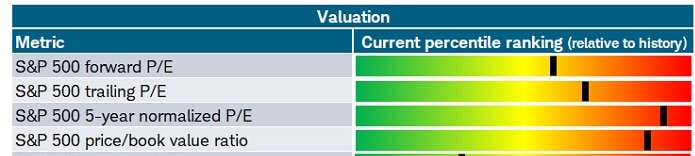

Are High Stock Market Valuations A Concern Bof A Says No Heres Why

Apr 26, 2025

Are High Stock Market Valuations A Concern Bof A Says No Heres Why

Apr 26, 2025 -

January 6th Hearings Witness Cassidy Hutchinson Announces Memoir

Apr 26, 2025

January 6th Hearings Witness Cassidy Hutchinson Announces Memoir

Apr 26, 2025 -

Trump Administration Challenges Europes Proposed Ai Rulebook

Apr 26, 2025

Trump Administration Challenges Europes Proposed Ai Rulebook

Apr 26, 2025 -

The Strategic Importance Of A Military Base In The Us China Competition

Apr 26, 2025

The Strategic Importance Of A Military Base In The Us China Competition

Apr 26, 2025