TikTok's "Just Contact Us" Workaround: Avoiding Trump-Era Tariffs

Table of Contents

The Trump administration's tariffs on Chinese goods significantly impacted businesses importing products, including those using the popular social media platform TikTok. Many sellers faced increased costs and logistical hurdles. This article explores a seemingly simple, yet effective strategy some businesses used: the "Just Contact Us" workaround. We'll delve into how this method helped circumvent some tariff complexities and offer insights into its efficacy and potential risks.

H2: Understanding the Impact of Trump-Era Tariffs on TikTok Businesses

H3: Increased Costs and Reduced Profit Margins:

The Trump-era tariffs directly increased the cost of goods sold (COGS) for businesses importing products from China through various channels, including TikTok. These increased costs significantly impacted profit margins. For example, a 25% tariff on a product costing $10 before tariffs now costs $12.50, directly impacting profitability. This squeezed margins, especially for businesses with tight profit margins to begin with. Specific tariff rates varied widely depending on the product category, impacting everything from fashion items and electronics sold on TikTok to smaller accessories.

- Example: A 25% tariff on certain electronics could easily wipe out a small business's profit margin, forcing them to either increase prices (risking sales) or accept lower profits.

H3: Logistical Challenges and Supply Chain Disruptions:

Tariffs introduced significant logistical challenges and supply chain disruptions. Importing goods became far more complex, requiring extensive documentation, increased processing times, and more stringent customs inspections. These delays caused significant disruptions in order fulfillment, leading to dissatisfied customers and potential loss of sales.

- Increased Paperwork: Businesses faced a mountain of new paperwork, including tariff codes, certificates of origin, and other compliance documents.

- Port Congestion: Tariffs contributed to port congestion, further delaying shipments and increasing costs.

- Order Fulfillment Delays: Delays in receiving goods impacted businesses' ability to fulfill orders promptly, damaging customer relationships and brand reputation.

H3: The Rise of Alternative Sourcing and Supply Chains:

The tariffs spurred many businesses to explore alternative sourcing and supply chains. This involved shifting to countries not subject to tariffs, relocating manufacturing operations, or finding alternative suppliers in other regions.

- Reshoring and Nearshoring: Some companies chose to bring manufacturing closer to home (reshoring) or to neighboring countries (nearshoring) to reduce reliance on Chinese-sourced goods.

- Diversification of Suppliers: Many companies diversified their supply chains to mitigate risk and reduce reliance on a single source.

- Long-Term Implications: These shifts had long-term implications, affecting business strategies, costs, and relationships with suppliers.

H2: How the "Just Contact Us" Workaround Functioned

H3: Direct Communication with Sellers/Manufacturers:

The "Just Contact Us" workaround involved businesses bypassing standard import channels and directly contacting sellers or manufacturers in China. This allowed for direct negotiations, potentially leading to lower prices or adjusted invoicing that might not reflect the full tariff costs. Pre-existing relationships and trust between businesses and suppliers were crucial for the success of this approach.

- Negotiating Lower Prices: Direct communication allowed businesses to negotiate lower prices to offset the impact of tariffs.

- Adjusted Invoicing: Some businesses might have engaged in adjusted invoicing to understate the true value of goods. This is a risky tactic with potential legal consequences.

H3: Minimizing Formal Documentation and Import Processes:

Direct contact potentially minimized the need for formal import documentation and streamlined the process. However, this approach carried significant risk. It bypassed established customs procedures and increased the likelihood of non-compliance with import regulations.

- Reduced Paperwork: Direct dealings reduced paperwork but lacked the necessary documentation for legitimate tariff compliance.

- Risk of Non-Compliance: This approach exposed businesses to legal repercussions if discovered by customs officials.

H3: Utilizing Discreet Shipping Methods and Labeling:

Some businesses may have used discreet shipping methods or under-reporting/mislabeling of goods to avoid higher tariffs. This practice is illegal and carries severe penalties. Ethical and legal compliance is paramount in any business operation. This approach is strongly discouraged.

- Under-reporting Value: Incorrectly declaring the value of goods is a serious offense that can lead to substantial fines.

- Mislabeling Goods: Shipping goods under false descriptions to evade tariffs is illegal and unethical.

H2: Assessing the Effectiveness and Risks of the "Just Contact Us" Workaround

H3: Cost Savings and Efficiency Gains:

The "Just Contact Us" approach potentially offered cost savings and efficiency gains compared to traditional import routes. Direct negotiations and reduced paperwork could translate to lower overall costs and faster delivery times. However, quantifying these benefits accurately is difficult due to the inherent risks and lack of transparency.

- Potential Cost Reduction: Negotiated lower prices directly with suppliers could result in significant cost savings.

- Faster Processing: Streamlined processes could result in faster delivery times.

H3: Legal and Ethical Considerations:

The legal and ethical ramifications of this workaround cannot be overstated. Circumventing tariff regulations is illegal and can result in severe penalties, including hefty fines and legal action. Ethical business practices are critical, and transparency in dealings is crucial for long-term success.

- Penalties and Fines: Customs violations can result in substantial penalties and fines.

- Legal Repercussions: Businesses engaging in illegal practices face significant legal risks.

H3: Long-Term Sustainability and Scalability:

The "Just Contact Us" workaround is not a sustainable or scalable long-term solution. Changes in trade policy and increased customs scrutiny make this approach highly risky and unreliable. Businesses should instead focus on ethical and sustainable strategies for managing import costs.

3. Conclusion:

The "Just Contact Us" workaround offered a seemingly simple solution to TikTok businesses facing Trump-era tariffs. While potentially effective in the short term, it involved significant legal and ethical risks. While this temporary measure might have offered relief, long-term success depends on legal and transparent operations. Prioritize legal compliance when importing goods via TikTok or any other platform. Understanding international trade regulations is vital for navigating future challenges. Avoid future TikTok tariff pitfalls by focusing on legitimate, transparent, and sustainable supply chain management strategies.

Featured Posts

-

Vehicle Subsystem Issue Forces Blue Origin Launch Cancellation

Apr 22, 2025

Vehicle Subsystem Issue Forces Blue Origin Launch Cancellation

Apr 22, 2025 -

Ftc Appeals Activision Blizzard Deal Ruling Microsoft Merger Uncertain

Apr 22, 2025

Ftc Appeals Activision Blizzard Deal Ruling Microsoft Merger Uncertain

Apr 22, 2025 -

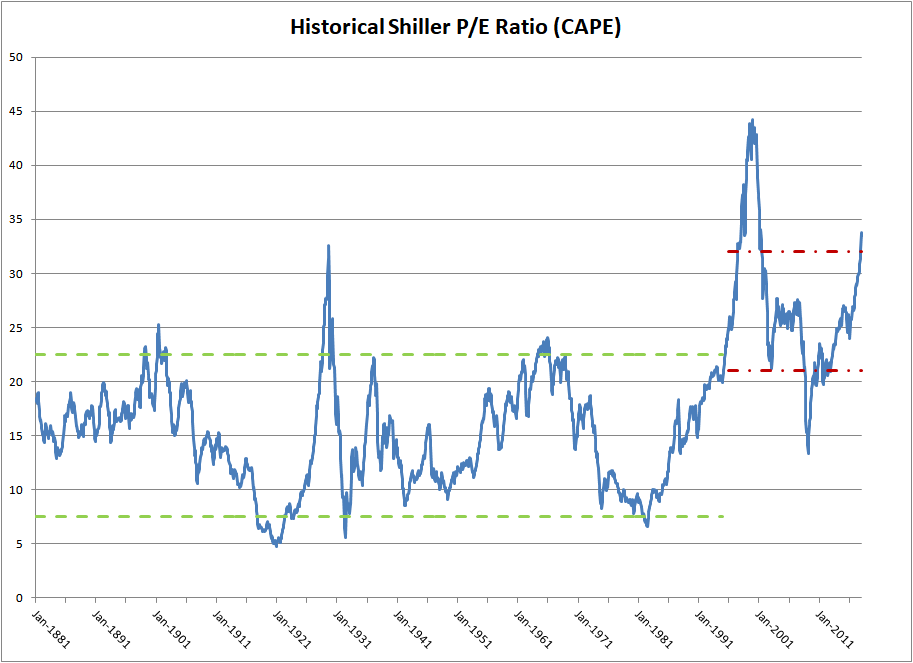

Addressing High Stock Market Valuations Insights From Bof A

Apr 22, 2025

Addressing High Stock Market Valuations Insights From Bof A

Apr 22, 2025 -

Russias Easter Truce Ends Renewed Fighting In Ukraine

Apr 22, 2025

Russias Easter Truce Ends Renewed Fighting In Ukraine

Apr 22, 2025 -

Open Ai Under Ftc Scrutiny Chat Gpts Future In Question

Apr 22, 2025

Open Ai Under Ftc Scrutiny Chat Gpts Future In Question

Apr 22, 2025