Addressing High Stock Market Valuations: Insights From BofA

Table of Contents

BofA's Assessment of Current Market Conditions

BofA generally maintains a cautiously optimistic stance on the current market, acknowledging the elevated valuations but also pointing to potential for continued, albeit moderated, growth. Their assessment isn't solely based on gut feeling; it's grounded in rigorous analysis of key market indicators.

-

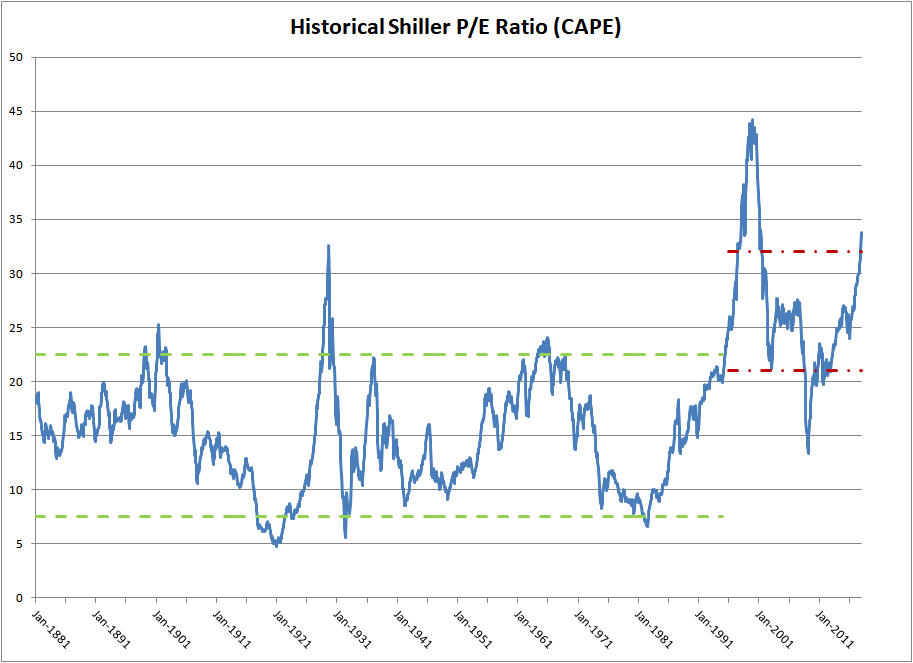

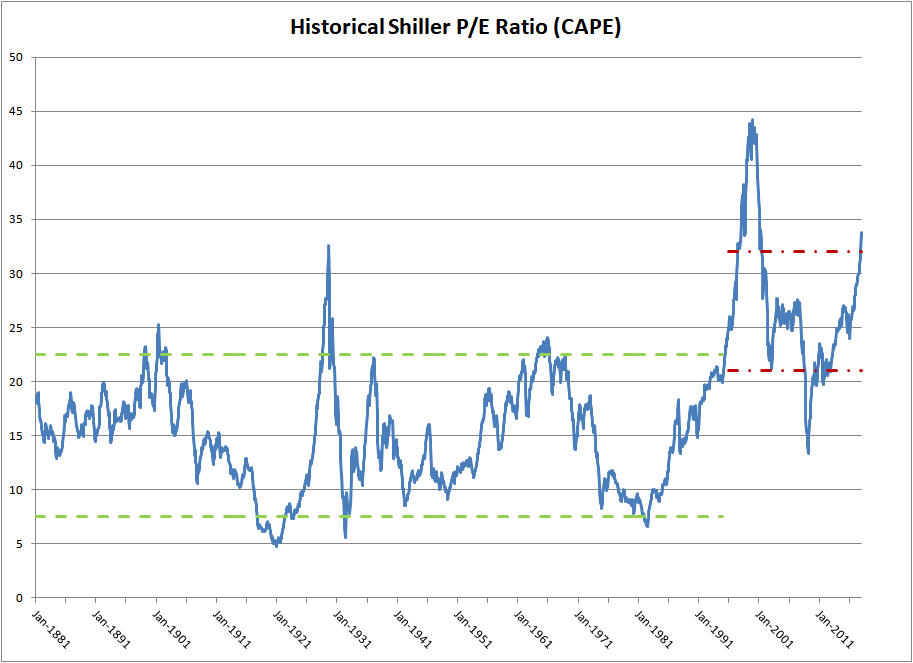

Specific Metrics: BofA utilizes a range of metrics to assess valuations, including the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (CAPE or Shiller PE), and various sector-specific valuation multiples. They carefully analyze these metrics to gauge whether current prices reflect underlying company fundamentals and future earnings potential. High P/E ratios, for example, might suggest overvaluation, while a comparison to historical averages using the Shiller PE provides valuable context.

-

Future Market Forecast: BofA's forecasts often incorporate various economic scenarios, acknowledging the inherent uncertainty in predicting market movements. While precise predictions are elusive, their outlook usually considers factors like potential interest rate hikes, inflation trends, and global economic growth. These forecasts provide a framework for investors to adjust their strategies.

-

Key Influencing Factors: BofA's assessment is heavily influenced by macroeconomic factors. Current interest rate levels play a crucial role, as higher rates can impact corporate borrowing costs and investor appetite for equities. Inflation is another critical factor; persistent high inflation can erode corporate profits and diminish investor confidence, potentially leading to lower stock prices. Finally, the overall pace of economic growth significantly impacts corporate earnings and investor sentiment, influencing stock valuations.

Identifying Potential Risks Associated with High Valuations

While opportunities exist, BofA acknowledges significant risks associated with these high stock market valuations. Understanding these risks is paramount for responsible investment decisions.

-

Risk of Market Correction: High valuations often precede market corrections or downturns. A sudden drop in investor confidence or an unexpected economic shock could trigger a sell-off, leading to significant losses for investors. BofA's analysis likely incorporates the probability of such corrections.

-

Impact of Rising Interest Rates: Rising interest rates increase the cost of borrowing for companies and can make bonds a more attractive investment compared to stocks. This can lead to a decrease in stock prices as investors shift their allocations. BofA's analysis considers the sensitivity of different sectors to interest rate changes.

-

Vulnerability to Economic Shocks: Unexpected economic events, such as geopolitical instability, supply chain disruptions, or a resurgence of a pandemic, can significantly impact stock market performance. High valuations magnify the potential impact of such shocks.

-

Sector-Specific Risks: BofA's analysis often highlights sector-specific risks. Certain sectors might be more vulnerable to interest rate hikes or economic downturns than others. Understanding these sector-specific vulnerabilities is crucial for portfolio diversification.

Opportunities Within the Current Market Environment (Despite High Valuations)

Despite the elevated valuations, BofA likely identifies potential investment opportunities for discerning investors. A key strategy is focusing on long-term growth rather than short-term gains.

-

Recommended Sectors/Asset Classes: BofA might recommend sectors less sensitive to interest rate hikes or those with strong growth potential, even in a challenging economic environment. Specific sectors may vary depending on their current valuations and future prospects. This might include companies with strong fundamentals and a history of consistent earnings growth.

-

Risk Mitigation Strategies: Diversification across different asset classes and sectors is crucial to mitigate risk. Value investing, focusing on companies trading below their intrinsic value, can also be an effective strategy.

-

Importance of Long-Term Strategies: BofA stresses the importance of long-term investing, especially during periods of high valuations. A long-term perspective allows investors to weather short-term market fluctuations and benefit from the long-term growth potential of their investments.

BofA's Recommendations for Investors

Navigating high stock market valuations requires a cautious and strategic approach. BofA likely advises investors to:

-

Adjust Portfolio Allocation: Investors should adjust their portfolio allocation based on their risk tolerance and investment horizon. A more conservative approach might be advisable in a highly valued market.

-

Due Diligence and Research: Thorough due diligence and research are essential before making any investment decisions. Understanding the fundamentals of individual companies and the broader economic outlook is crucial.

-

Seek Professional Advice: Consulting with a qualified financial advisor is strongly recommended. A financial advisor can help investors develop a personalized investment strategy that aligns with their individual financial goals and risk tolerance.

Conclusion

This article summarized BofA's perspective on addressing high stock market valuations, highlighting both the potential risks and opportunities present in the current market. BofA's analysis offers valuable insights for investors seeking to navigate this complex landscape. Understanding and managing the risks associated with high stock market valuations is crucial for successful investing. Stay informed about BofA's ongoing analysis and consult with a financial advisor to develop a personalized investment strategy that addresses your specific needs and risk tolerance in the face of these high stock market valuations.

Featured Posts

-

Us Pushes For Peace As Russia Unleashes Devastating Aerial Attacks On Ukraine

Apr 22, 2025

Us Pushes For Peace As Russia Unleashes Devastating Aerial Attacks On Ukraine

Apr 22, 2025 -

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 22, 2025

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 22, 2025 -

T Mobile Hit With 16 Million Fine Over Three Years Of Data Breaches

Apr 22, 2025

T Mobile Hit With 16 Million Fine Over Three Years Of Data Breaches

Apr 22, 2025 -

Los Angeles Wildfires The Rise Of Disaster Betting

Apr 22, 2025

Los Angeles Wildfires The Rise Of Disaster Betting

Apr 22, 2025 -

Trade War Impact Live Updates On Dow Futures And Dollar Movement

Apr 22, 2025

Trade War Impact Live Updates On Dow Futures And Dollar Movement

Apr 22, 2025