The Threat To US Financial Primacy: Examining Trump's Trade Policies And Their Consequences

Table of Contents

Trade Wars and Retaliatory Tariffs

The Trump administration's "America First" approach manifested significantly in its aggressive imposition of tariffs on various imported goods. This strategy ignited a series of trade wars, particularly with China, significantly impacting global trade flows and relations.

Impact on Global Trade

The imposition of tariffs led to a considerable decrease in global trade volume. Specific sectors, like agriculture and manufacturing, were disproportionately affected.

- Quantifiable Data: Studies show a decline in bilateral trade between the US and China following the implementation of tariffs. For example, [cite a reputable source with data on trade volume decreases]. This decrease directly translates to increased costs for consumers and disruptions in global supply chains.

- Examples of Tariffs: The 25% tariff imposed on steel and aluminum imports, and the tariffs on various Chinese goods, triggered retaliatory measures from affected countries, further exacerbating the situation.

Damage to International Relations

The trade wars initiated under the Trump administration severely damaged relationships with key trading partners. This erosion of trust has significant implications for future international cooperation on economic issues.

- Strained Diplomatic Relations: The disputes led to tense diplomatic negotiations and increased protectionist sentiment globally, hindering collaborative efforts on issues such as climate change and global health crises.

- Erosion of Multilateral Agreements: The withdrawal from the Trans-Pacific Partnership (TPP) and the challenges posed to the World Trade Organization (WTO) weakened the global framework for regulating international trade and resolving disputes, further undermining US global influence.

"America First" Approach and its Economic Ramifications

The "America First" approach, while prioritizing domestic interests, had significant ramifications for the US economy and its global standing.

Impact on Foreign Investment

The protectionist policies and unpredictable trade actions under the Trump administration created uncertainty in the global market, negatively impacting foreign direct investment (FDI) in the US.

- Statistical Data: [Cite a source showing changes in FDI flows to the US before and after the implementation of Trump's trade policies]. The data likely reveals a slowdown or even decline in FDI, indicating a loss of investor confidence.

- Investor Confidence: The erratic nature of the trade policies made it difficult for foreign investors to predict future regulations and market conditions, discouraging long-term investments in the US.

Weakening of International Institutions

The Trump administration's actions towards international trade agreements and institutions signaled a retreat from global engagement and cooperation, weakening US influence on the world stage.

- Role of International Institutions: Organizations like the WTO and TPP play a crucial role in establishing fair trade practices, resolving disputes, and fostering global economic stability. US withdrawal or undermining of these institutions weakens their effectiveness and undermines the global trading system.

- Consequences of Reduced Engagement: The diminished US participation in these institutions has emboldened other nations to pursue their own protectionist agendas, potentially leading to a more fragmented and less efficient global economy.

The Dollar's Status as Reserve Currency

The US dollar's dominance as the world's reserve currency is intrinsically linked to the stability and perceived reliability of the US economy. Trump's trade policies presented a significant threat to this status.

Challenges to the Dollar's Hegemony

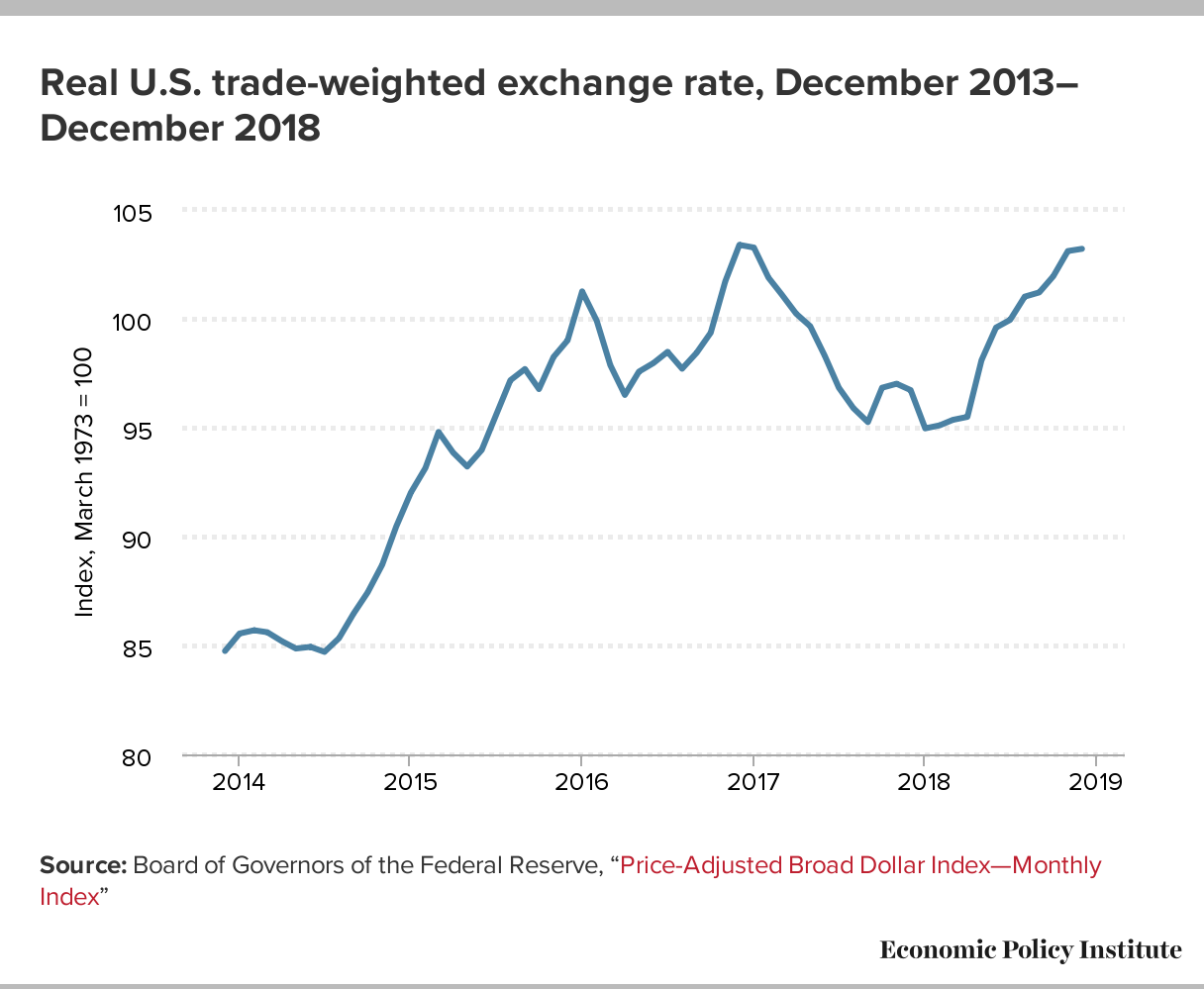

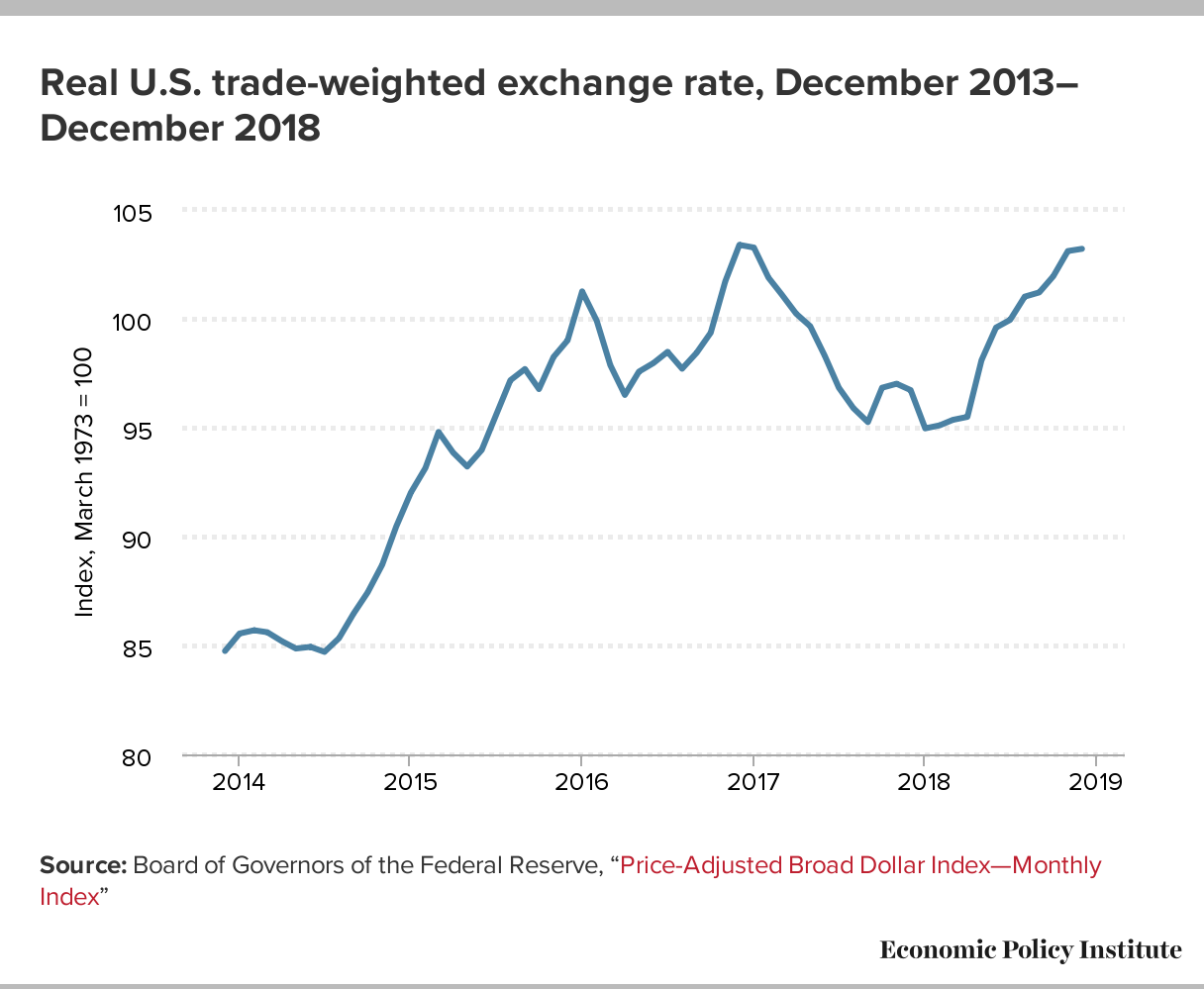

The trade wars and resulting economic uncertainty raised concerns about the stability of the US economy, potentially prompting a shift away from the dollar as the preferred reserve currency.

- Alternative Currencies: The rise of other global currencies, such as the Euro and the Chinese Yuan, poses a challenge to the dollar's hegemony, especially in the context of growing trade imbalances and economic uncertainty.

- Impact of Trade Wars: The unpredictability and instability caused by the trade wars negatively impacted the perception of the US economy’s reliability, reducing investor confidence in the dollar's long-term stability.

Long-Term Implications for US Financial Power

A decline in the dollar's dominance would have far-reaching implications for the US financial system and its global influence.

- Potential Consequences: A reduced demand for the dollar could lead to higher interest rates, reduced investment in the US, and a diminished role for US financial institutions in global markets.

- Challenges to US Financial Center Status: The erosion of the dollar's reserve currency status would directly challenge the US's position as the global financial center, impacting its economic and political power.

Conclusion

Trump's trade policies, driven by an "America First" approach, significantly impacted global trade relations and potentially jeopardized US financial primacy. The resulting trade wars damaged international relationships, decreased investor confidence, and challenged the dollar's hegemony as the world's reserve currency. Understanding the threats to US financial primacy requires a critical examination of past trade policies. Further research into the lasting effects of protectionism is crucial for securing a robust and globally influential US financial system. A more nuanced and collaborative approach to international trade is essential to safeguard US financial primacy and ensure long-term economic prosperity.

Featured Posts

-

A Pan Nordic Defense Strategy Integrating Swedish Armor And Finnish Infantry

Apr 22, 2025

A Pan Nordic Defense Strategy Integrating Swedish Armor And Finnish Infantry

Apr 22, 2025 -

The Distributional Effects Of Trumps Economic Plans

Apr 22, 2025

The Distributional Effects Of Trumps Economic Plans

Apr 22, 2025 -

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 22, 2025

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 22, 2025 -

2025 Razer Blade 16 Review Balancing Portability Performance And Price

Apr 22, 2025

2025 Razer Blade 16 Review Balancing Portability Performance And Price

Apr 22, 2025 -

Chinas Impact On Bmw And Porsche Sales Market Headwinds And Strategic Responses

Apr 22, 2025

Chinas Impact On Bmw And Porsche Sales Market Headwinds And Strategic Responses

Apr 22, 2025