The Distributional Effects Of Trump's Economic Plans

Table of Contents

Tax Cuts and Their Impact

The cornerstone of Trump's economic strategy was the 2017 Tax Cuts and Jobs Act (TCJA). This legislation significantly reduced both corporate and individual income tax rates.

The 2017 Tax Cuts and Jobs Act

- Reduced the top individual income tax rate from 39.6% to 37%: This substantial reduction primarily benefited high-income earners.

- Lowered the corporate tax rate from 35% to 21%: This dramatic cut was intended to boost corporate investment and job creation, a key tenet of the "trickle-down" economic theory.

- Disproportionate Benefit to High-Income Earners and Corporations: Analysis reveals that the tax cuts disproportionately benefited high-income individuals and corporations. Studies from the Tax Policy Center, for instance, showed that the top 1% of earners received a significantly larger share of the tax cuts than other income brackets. [Insert citation to Tax Policy Center study here]. The reduced corporate tax rate also led to increased corporate profits, but the extent to which this translated into higher wages or increased investment remains a subject of debate.

- The "Trickle-Down" Effect and its Efficacy: The effectiveness of the "trickle-down" theory, which posits that tax cuts for corporations and the wealthy will stimulate economic growth and benefit everyone, remains a hotly contested issue. While corporate profits increased, wage growth remained relatively stagnant for many workers, raising questions about the actual impact on lower and middle-income households.

Impact on Different Income Brackets

The TCJA's impact varied significantly across income brackets.

- Data Showing Percentage Change in After-Tax Income: [Insert data showing percentage changes in after-tax income for low, middle, and high-income households. Cite reputable sources such as the Congressional Budget Office or the Brookings Institution]. This data will clearly illustrate the uneven distribution of the tax cuts' benefits.

- Increased National Debt: The tax cuts contributed to a significant increase in the national debt. [Insert statistics on the increase in national debt following the TCJA]. This raises concerns about the long-term sustainability of the nation's fiscal position.

- Impact on Investment and Job Creation: While proponents argued that the tax cuts would stimulate investment and job creation, the empirical evidence supporting this claim is mixed. [Cite studies examining the impact on investment and job creation, noting both positive and negative findings].

Trade Policies and Their Distributional Consequences

Trump's administration implemented significant changes to US trade policy, initiating trade wars and renegotiating existing trade agreements.

The Impact of Tariffs

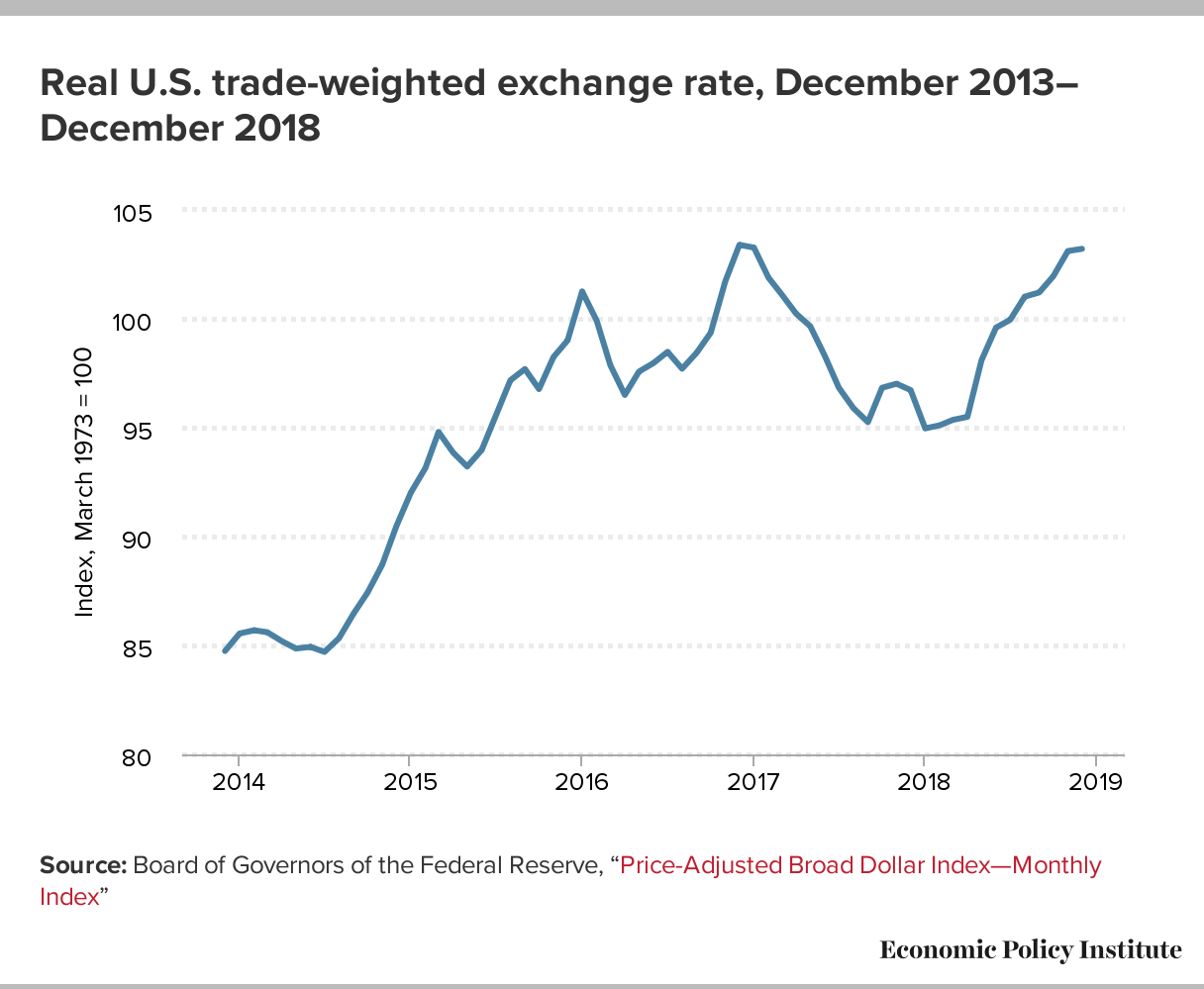

Trump's imposition of tariffs, particularly on goods from China, had profound distributional consequences.

- Increased Costs for Consumers: Tariffs increased the cost of imported goods, leading to higher prices for consumers and contributing to inflation.

- Impact on Specific Industries: Certain industries, such as agriculture and manufacturing, were significantly affected by the trade wars. Some sectors experienced job losses due to reduced exports or increased competition from domestic producers, while others benefited from protectionist measures. [Provide specific examples and data].

- Job Losses and Gains: The net effect of the trade wars on employment is complex and debated. While some sectors experienced job losses, others may have gained due to increased domestic production. [Cite studies analyzing the impact on employment].

- Impact on Global Supply Chains: The trade wars disrupted global supply chains, leading to increased uncertainty and costs for businesses.

Negotiated Trade Deals

The renegotiation of NAFTA, resulting in the USMCA (United States-Mexico-Canada Agreement), also had distributional implications.

- Impact on Different Sectors: The USMCA affected different sectors differently. Some sectors, such as the automotive industry, experienced significant changes in trade rules and regulations. [Discuss specific examples and their impact].

- Potential Benefits and Drawbacks: The agreement aimed to benefit various sectors, but its actual impact remains a subject of ongoing evaluation. [Discuss potential benefits and drawbacks for workers and businesses in different sectors].

Deregulation and its Effects

The Trump administration pursued a significant deregulation agenda, impacting various sectors of the economy.

Environmental Regulations

The rollback of environmental regulations had substantial distributional consequences.

- Impacts on Public Health and Environmental Justice: Weakening environmental protections disproportionately affected low-income communities and communities of color who often bear the brunt of environmental pollution. [Provide examples and data supporting this claim].

- Long-Term Economic Consequences: The long-term economic consequences of reduced environmental regulations, including the costs associated with climate change, are significant and far-reaching. [Discuss the potential economic costs of climate change and their distributional impacts].

Financial Regulations

Changes to financial regulations also had potential distributional effects.

- Risk of Increased Financial Instability: Easing financial regulations could increase the risk of future financial crises, potentially impacting various income groups and the overall economy.

- Impact on Access to Credit: Changes to financial regulations could affect access to credit for different groups, potentially exacerbating income inequality. [Discuss potential effects on access to credit for low-income households and small businesses].

Conclusion

The distributional effects of Trump's economic plans were complex and far-reaching. While the tax cuts benefited high-income earners disproportionately, the impact of trade policies and deregulation varied across different sectors and communities. Some groups experienced significant gains, while others faced job losses, increased costs, or environmental risks. The long-term consequences of these policies continue to be debated, highlighting the need for further research and analysis. The increase in the national debt also raises concerns about future economic stability. The impact was not uniform, with significant disparities in the benefits received by different segments of the population.

Call to Action: Further research into the distributional effects of Trump's economic policies is crucial for informing future economic decisions. Continue exploring the impact of these policies on various segments of the population to foster a more equitable and sustainable economic future. Use the search term "Trump's economic policies distributional effects" to find more information and contribute to this important discussion.

Featured Posts

-

The Threat To Us Financial Primacy Examining Trumps Trade Policies And Their Consequences

Apr 22, 2025

The Threat To Us Financial Primacy Examining Trumps Trade Policies And Their Consequences

Apr 22, 2025 -

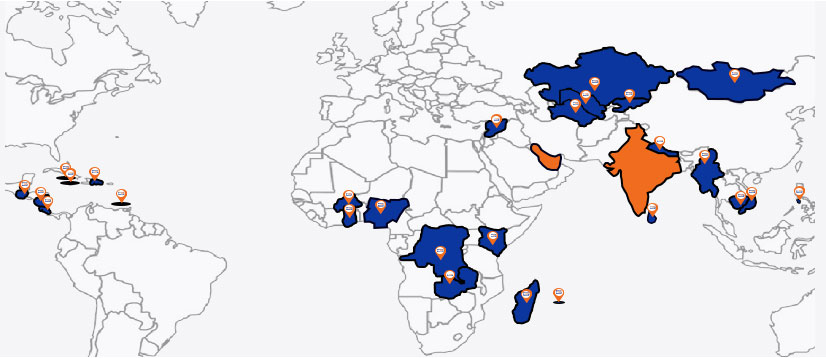

Mapping The Countrys Emerging Business Hotspots

Apr 22, 2025

Mapping The Countrys Emerging Business Hotspots

Apr 22, 2025 -

Evaluating The Social And Economic Impacts Of Trumps Policies

Apr 22, 2025

Evaluating The Social And Economic Impacts Of Trumps Policies

Apr 22, 2025 -

Massive Office365 Executive Account Hack Results In Millions In Losses

Apr 22, 2025

Massive Office365 Executive Account Hack Results In Millions In Losses

Apr 22, 2025 -

The Deteriorating Us China Relationship A Path To Cold War

Apr 22, 2025

The Deteriorating Us China Relationship A Path To Cold War

Apr 22, 2025