Stock Market Valuation Concerns? BofA Offers Reassurance For Investors

Table of Contents

BofA's Positive Outlook on Stock Market Valuations

BofA maintains a relatively positive outlook on current stock market valuations, despite acknowledging the legitimate concerns of some investors. Their assessment rests on several key pillars, primarily focusing on robust earnings growth and a considered outlook on interest rate hikes. They are not dismissing the high P/E ratios entirely, but rather contextualizing them within a broader picture of economic fundamentals.

-

Strong Earnings Growth Projections: BofA points to projected strong earnings growth across various sectors as a key justification for current valuations. They predict continued corporate profitability, driven by factors such as technological advancements and sustained consumer spending in key areas.

-

Favorable Interest Rate Forecasts: While acknowledging the potential impact of interest rate increases, BofA's economists predict a more measured and controlled approach by central banks, mitigating the risk of a sharp economic downturn that could significantly impact valuations. They believe the rate hikes will be manageable and conducive to a sustained economic expansion.

-

Positive Sectoral Outlook: BofA highlights specific sectors poised for strong growth, including technology, healthcare, and select segments of the consumer discretionary sector. Their analysis points to innovation, demographic trends, and pent-up demand as driving forces. They suggest that these growth sectors could offset any potential weakness in other areas of the market.

-

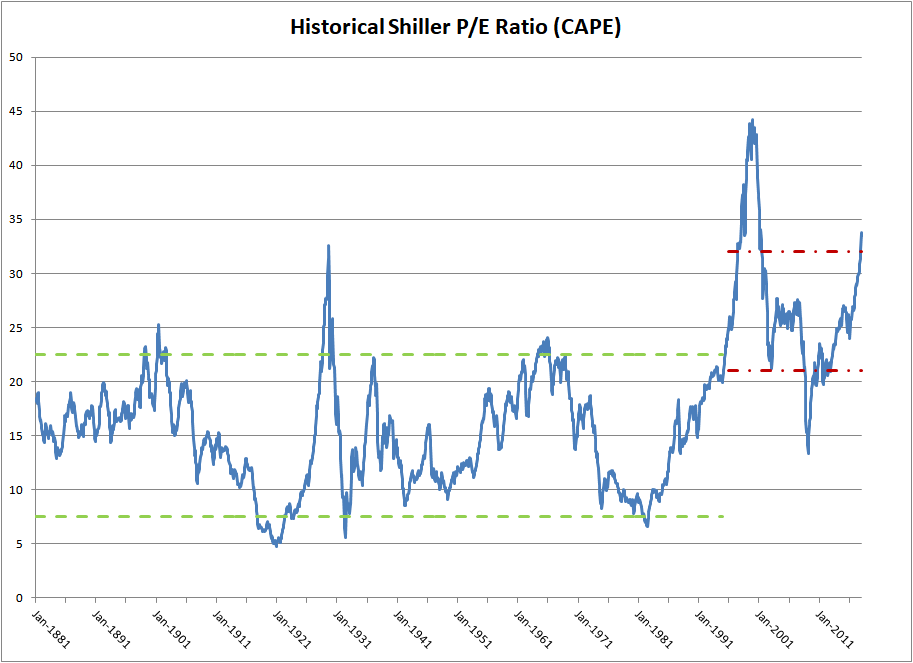

Forward-Looking Metrics: Instead of solely relying on trailing P/E ratios, BofA emphasizes the importance of forward-looking metrics like forward P/E ratios and discounted cash flow analysis, arguing these provide a more accurate picture of future earnings potential and therefore, a more balanced valuation assessment.

Addressing Key Valuation Concerns Raised by Critics

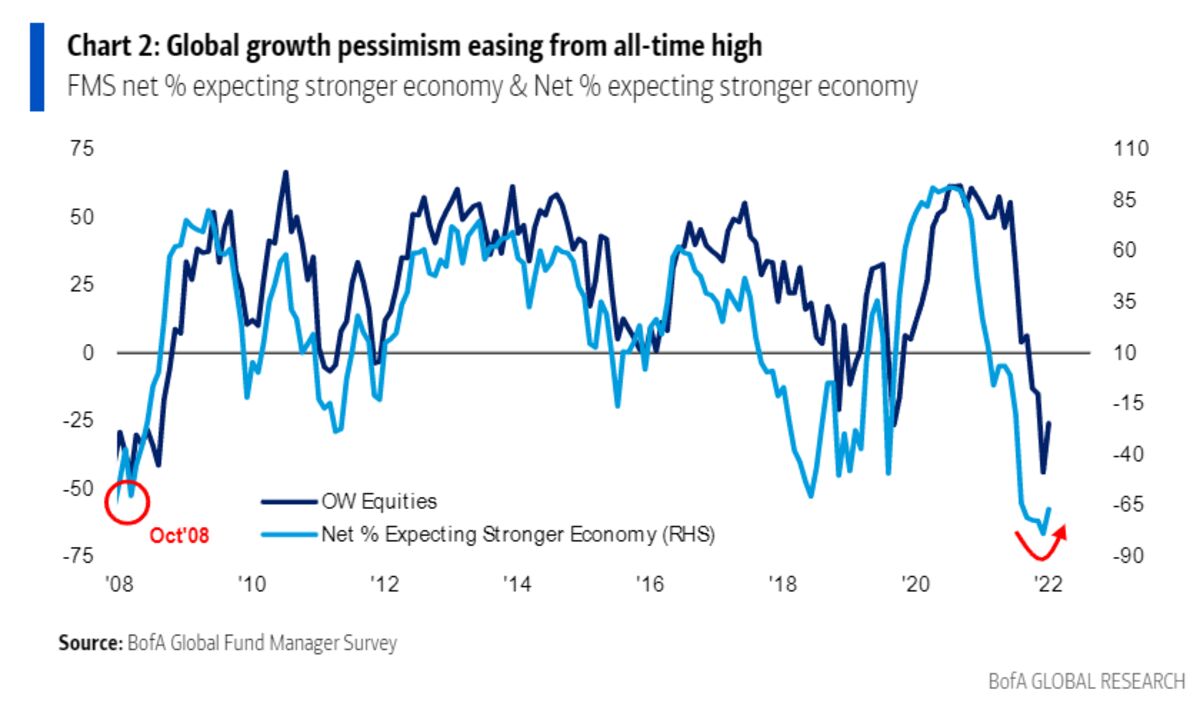

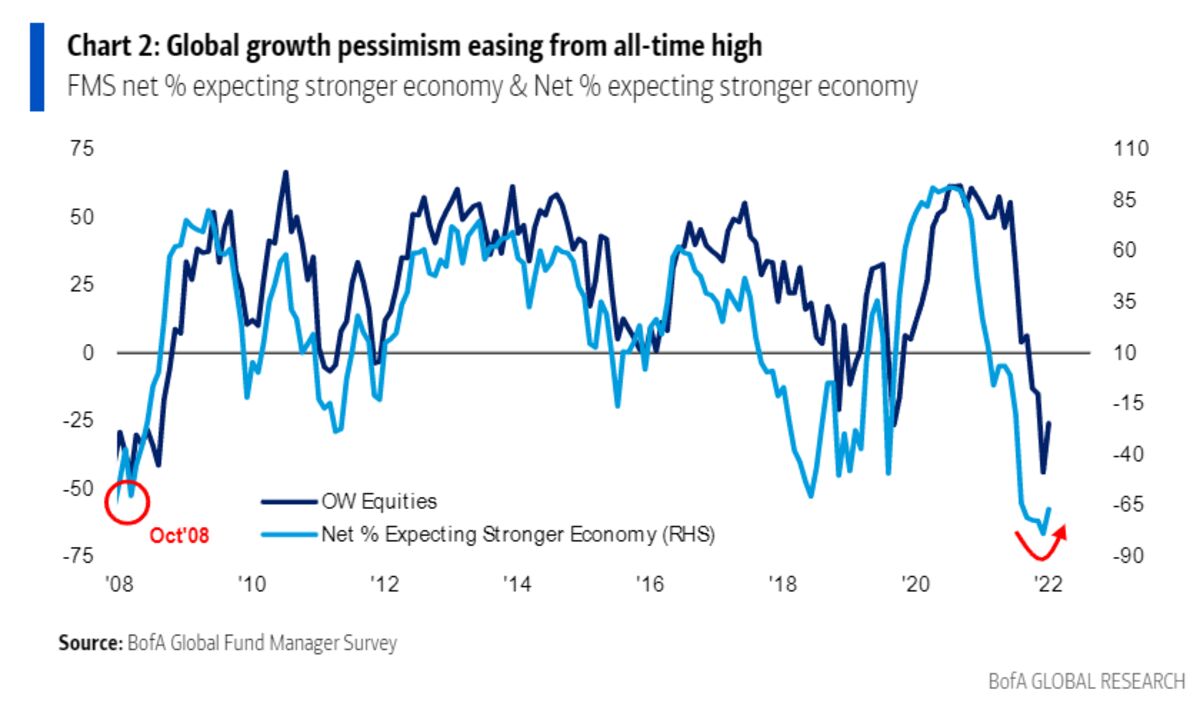

Despite BofA's optimism, several concerns regarding stock market valuations persist. Critics point to historical comparisons, highlighting potential bubbles and unsustainable growth. Let's address these concerns and examine BofA's counterarguments:

-

High P/E Ratios: While acknowledging that some P/E ratios appear elevated compared to historical averages, BofA counters that robust earnings growth justifies these valuations. They argue that focusing solely on historical comparisons without considering future growth prospects paints an incomplete picture.

-

Interest Rate Hikes: The concern about potential interest rate hikes impacting valuations is acknowledged by BofA. However, their analysis suggests that the anticipated rate increases are priced into the market and are manageable within the context of continued economic growth.

-

Market Bubble Concerns: BofA refutes arguments suggesting a market bubble by highlighting the underlying fundamental strength of many companies and the sustained demand driving their growth. They argue that while specific sectors might experience corrections, a broader market collapse is unlikely given the current economic landscape.

BofA's Investment Strategies and Recommendations for Investors

Based on their valuation analysis, BofA suggests a strategic approach to investing, emphasizing diversification and a long-term perspective. While they don't offer specific stock picks in their public analyses (individual investment advice would require a client relationship), they recommend a portfolio that incorporates a mix of growth and value stocks across various sectors.

-

Sector Diversification: BofA stresses the importance of diversifying across various sectors to mitigate risk and capitalize on different growth opportunities.

-

Risk Management Strategies: They advise investors to adopt a well-defined risk management strategy that aligns with their individual risk tolerance and financial goals.

-

Long-term Investment Horizon: This is a cornerstone of BofA's advice, as short-term market fluctuations should not dictate long-term investment strategies.

The Importance of Long-Term Investing in the Face of Valuation Concerns

Addressing stock market valuation concerns effectively requires a long-term investment horizon. Short-term market volatility is a normal occurrence; focusing on the long-term allows investors to weather these fluctuations and benefit from the overall upward trend of the market.

-

Historical Market Growth: Data consistently shows that the stock market has historically delivered positive returns over the long term, despite periods of significant volatility.

-

Emotional Discipline: Managing emotional responses to market fluctuations is crucial. Avoid impulsive decisions driven by fear or greed. Stick to your investment plan.

-

Disciplined Investing: Maintaining a disciplined investment approach, regularly reviewing your portfolio and rebalancing as needed, is vital for long-term success.

Conclusion: Navigating Stock Market Valuation Concerns with BofA's Guidance

BofA’s analysis offers a reassuring perspective on current stock market valuations, emphasizing the importance of considering robust earnings growth and future prospects alongside traditional valuation metrics. Their counterarguments to common concerns about high P/E ratios, interest rate hikes, and potential market bubbles provide valuable context for investors. Remember, however, that a long-term investment strategy and a thorough understanding of your own risk tolerance are crucial. Understand your own risk tolerance and consult with a financial advisor before making any investment decisions based on this analysis of stock market valuation concerns. For further in-depth research, explore BofA's published research reports.

Featured Posts

-

La Fire Aftermath Price Gouging Concerns Raised By Selling Sunset Cast Member

Apr 26, 2025

La Fire Aftermath Price Gouging Concerns Raised By Selling Sunset Cast Member

Apr 26, 2025 -

Stock Market Valuations Bof A Explains Why Investors Shouldnt Be Concerned

Apr 26, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Be Concerned

Apr 26, 2025 -

Following Nintendo Contact The End Of Ryujinx Switch Emulator Development

Apr 26, 2025

Following Nintendo Contact The End Of Ryujinx Switch Emulator Development

Apr 26, 2025 -

Ahmed Hassanein An Egyptians Path To The Nfl Draft

Apr 26, 2025

Ahmed Hassanein An Egyptians Path To The Nfl Draft

Apr 26, 2025 -

Trump Calls For Ban On Congressional Stock Trading In New Time Interview

Apr 26, 2025

Trump Calls For Ban On Congressional Stock Trading In New Time Interview

Apr 26, 2025