Stock Market Update: Dow Futures Fluctuate As China Promises Economic Support Amid Tariffs

Table of Contents

H2: Dow Futures Volatility and its Drivers

Dow futures have shown significant fluctuation in recent trading sessions, with indices experiencing [insert percentage change and specific numbers for Dow futures, e.g., a 1.5% drop followed by a 0.8% rebound]. This volatility isn't solely attributable to the China situation; several other factors are at play.

-

Impact of inflation reports and interest rate expectations: Recent inflation data [cite source], coupled with speculation about further interest rate hikes by the Federal Reserve, is creating uncertainty among investors. Higher interest rates increase borrowing costs for businesses, potentially impacting corporate growth and stock valuations.

-

Influence of corporate earnings announcements: A mixed bag of corporate earnings reports [cite source] is adding to market uncertainty. Strong performance from some sectors is countered by weaker-than-expected results from others, contributing to the overall volatility.

-

Geopolitical tensions beyond the US-China trade relationship: Ongoing geopolitical events around the globe [mention specific examples, cite sources], such as the war in Ukraine and regional conflicts, further exacerbate market anxiety, creating a climate of uncertainty that impacts Dow futures.

H2: China's Economic Support Package and its Market Impact

In response to slowing economic growth, China has announced a new economic stimulus package [cite source] aimed at boosting domestic demand and investment. Details remain somewhat vague, but the package reportedly includes:

-

Specific policies announced: This includes targeted tax cuts for businesses, increased infrastructure spending on key projects (mention specific examples if available), and potential measures to support the struggling real estate sector.

-

Assessment of the potential impact on Chinese growth: The effectiveness of these measures remains to be seen. While some analysts are optimistic about a short-term boost, others caution that the measures may not address underlying structural issues in the Chinese economy.

-

Analysis of investor confidence following the announcement: Initial market reaction has been mixed. While some investors see the package as a positive sign, others remain skeptical about its long-term impact, contributing to the ongoing volatility in Dow futures.

H2: The Ongoing Impact of Tariffs on Global Trade

The ongoing trade tensions between the US and China, marked by the imposition of tariffs on various goods, continue to cast a long shadow over global markets.

-

Specific sectors most affected by tariffs: Sectors like technology, agriculture, and manufacturing have been disproportionately impacted by these tariffs, leading to increased costs and reduced competitiveness for businesses.

-

Long-term economic consequences of trade wars: The long-term consequences of prolonged trade disputes include potential disruptions to global supply chains, reduced economic growth, and increased inflation.

-

Possible resolutions to the ongoing trade disputes: While there have been some tentative steps toward de-escalation, a significant breakthrough remains elusive, leaving the future of US-China trade relations uncertain and impacting Dow futures significantly.

H3: Analyzing the Interplay Between Dow Futures, China's Actions, and Tariffs

The connection between Dow futures, China's economic policies, and the ongoing tariff disputes is undeniable. China's stimulus package, while intended to boost its own economy, could indirectly impact US markets. If successful, it may alleviate some global supply chain disruptions caused by tariffs, potentially having a positive effect on US businesses. Conversely, if the package proves ineffective, it could worsen global economic uncertainty, impacting Dow futures negatively. The interconnectedness of these factors makes precise prediction difficult. Different scenarios, ranging from cautious optimism to sustained volatility, remain plausible.

3. Conclusion

This update highlights the significant volatility in Dow futures, directly linked to China's economic support plans amidst the ongoing impact of tariffs. The interconnectedness of these factors creates a complex and uncertain market environment. While China's efforts to stimulate its economy may offer some positive counterbalance to tariff-related disruptions, the ultimate impact on Dow futures and global markets remains to be seen. A cautious outlook is warranted, with close monitoring of economic data and geopolitical developments essential. Stay tuned for further updates on the Dow Futures market and the ongoing implications of China's economic strategy amidst fluctuating tariffs. Regularly check back for the latest analysis on Dow Futures and global market trends.

Featured Posts

-

Nfl Drafts First Round A Green Bay Preview

Apr 26, 2025

Nfl Drafts First Round A Green Bay Preview

Apr 26, 2025 -

Trade Wars And Gold Why Bullion Prices Are Surging

Apr 26, 2025

Trade Wars And Gold Why Bullion Prices Are Surging

Apr 26, 2025 -

Construction Resumes On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025

Construction Resumes On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025 -

California Economy Fourth Largest Globally Outpacing Japan

Apr 26, 2025

California Economy Fourth Largest Globally Outpacing Japan

Apr 26, 2025 -

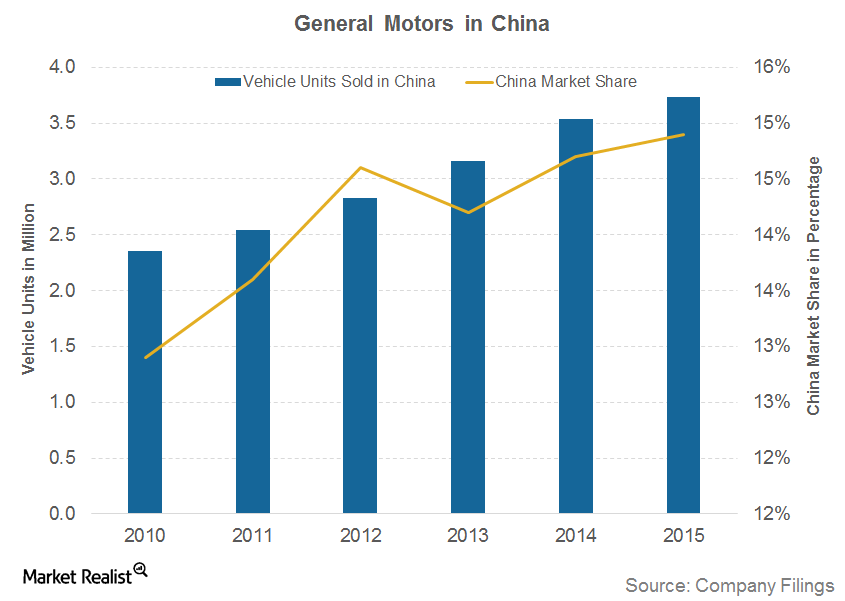

Are Chinese Cars The Next Big Thing A Look At The Global Auto Market

Apr 26, 2025

Are Chinese Cars The Next Big Thing A Look At The Global Auto Market

Apr 26, 2025