Trade Wars And Gold: Why Bullion Prices Are Surging

Table of Contents

Safe Haven Asset in Times of Uncertainty

Gold has historically served as a safe haven asset during periods of economic uncertainty and geopolitical instability. When investors feel uneasy about the future, they often flock to gold, viewing it as a store of value that holds its worth even amidst market turmoil. This is particularly true during escalating trade wars.

- Increased geopolitical risks: The ongoing trade disputes between major economic powers, such as the US and China, create significant uncertainty in global markets. The threat of further escalation and retaliatory measures contributes to investor anxiety.

- Currency devaluation fears: Trade wars often lead to currency devaluation fears. As trade tensions rise, the value of national currencies can fluctuate significantly, making investors seek the stability of gold.

- Investor flight to safety from volatile stock markets: When stock markets become volatile due to trade war uncertainties, investors often pull funds from stocks and invest in safer assets like gold to minimize potential losses.

- Gold's non-correlated nature with other asset classes: Unlike stocks and bonds, gold's price typically doesn't move in tandem with other asset classes. This lack of correlation makes it an attractive diversification tool during times of uncertainty, mitigating overall portfolio risk.

These factors combine to create increased demand for gold bullion, driving its price upward. The inherent scarcity of gold, coupled with its perceived safety, further fuels this demand.

Inflationary Pressures Fueled by Trade Wars

Trade wars can exert significant inflationary pressures on an economy. The imposition of tariffs on imported goods increases the cost of those goods for consumers, directly contributing to inflation.

- Tariffs increasing the cost of imported goods: Tariffs act as a tax on imported goods, raising prices for consumers and businesses.

- Supply chain disruptions causing price hikes: Trade wars can disrupt global supply chains, leading to shortages and higher prices for various goods and services.

- Potential for retaliatory tariffs escalating the situation: Retaliatory tariffs imposed by affected countries can exacerbate the situation, further disrupting trade and contributing to inflation.

- Gold as a hedge against inflation: Gold has traditionally served as a hedge against inflation. As the purchasing power of fiat currencies diminishes due to inflation, gold's value tends to hold steady or increase, preserving investors' wealth.

Inflation erodes the value of fiat currencies, making gold a more attractive investment as it retains its purchasing power even during inflationary periods fueled by trade wars.

Weakening US Dollar and its Impact on Gold Prices

There's an inverse relationship between the US dollar and gold prices. A weaker US dollar typically leads to higher gold prices, and vice versa. Trade wars can significantly impact the US dollar's strength.

- Trade wars impacting the US dollar's strength: Uncertainty caused by trade wars can weaken investor confidence in the US dollar, leading to a decline in its value.

- Uncertainty about future economic policies affecting the dollar: Unpredictable economic policies related to trade can further destabilize the dollar, making investors less confident in holding it.

- How a weaker dollar makes gold more affordable for international buyers, increasing demand: When the dollar weakens, gold becomes cheaper for buyers using other currencies, boosting global demand and driving up prices.

The US dollar's role as the global reserve currency significantly influences gold's value. Any weakening of the dollar tends to increase demand for alternative assets, including gold.

Increased Investment Demand for Gold Bullion

Investors are increasing their gold holdings through various avenues, further pushing up prices.

- Increased purchases of gold ETFs (Exchange Traded Funds): Gold ETFs offer a convenient and accessible way for investors to gain exposure to gold without physically owning the metal.

- Rising demand for physical gold bars and coins: Many investors prefer the tangible security of owning physical gold bars and coins.

- Central banks accumulating gold reserves as a safe haven: Central banks worldwide are increasing their gold reserves as a safeguard against economic and geopolitical uncertainty.

- Growing interest in gold mining stocks: As gold prices rise, investors also show increased interest in gold mining companies, further boosting the sector.

The participation of institutional investors significantly impacts market prices. Their large-scale investments in gold amplify the price increases driven by other factors.

Conclusion

The surge in gold prices is a complex phenomenon driven by several interconnected factors. Trade wars create significant economic uncertainty, leading to inflationary pressures, a weakening US dollar, and increased investment demand for gold as a safe haven asset. Understanding the relationship between Trade Wars and Gold is crucial for informed investment decisions. Don't let trade wars and market volatility catch you off guard. Explore the potential of gold as a safe haven asset and invest wisely. Learn more about protecting your portfolio with gold bullion today!

Featured Posts

-

Lab Owners Guilty Plea Faking Covid Test Results During Pandemic

Apr 26, 2025

Lab Owners Guilty Plea Faking Covid Test Results During Pandemic

Apr 26, 2025 -

Should You Return To A Company That Laid You Off

Apr 26, 2025

Should You Return To A Company That Laid You Off

Apr 26, 2025 -

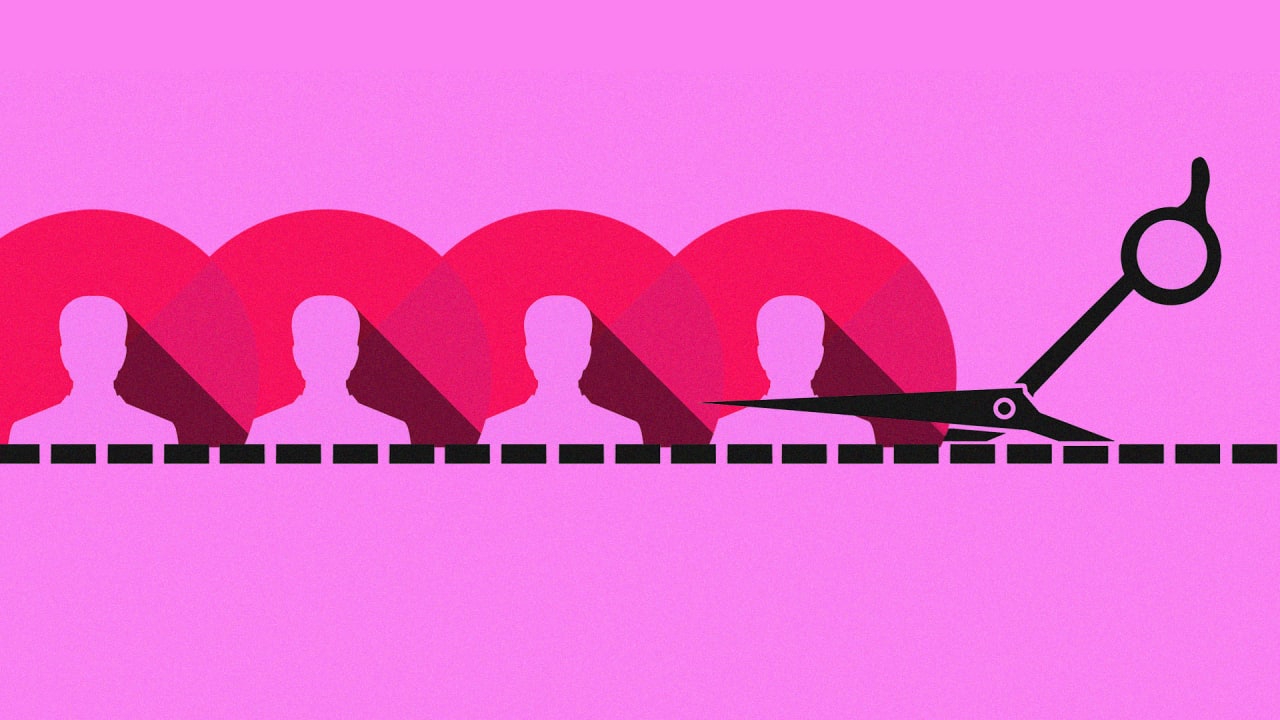

Thursday Night Football Nfl Draft First Round In Green Bay

Apr 26, 2025

Thursday Night Football Nfl Draft First Round In Green Bay

Apr 26, 2025 -

Development Of Ryujinx A Nintendo Switch Emulator Officially Ends

Apr 26, 2025

Development Of Ryujinx A Nintendo Switch Emulator Officially Ends

Apr 26, 2025 -

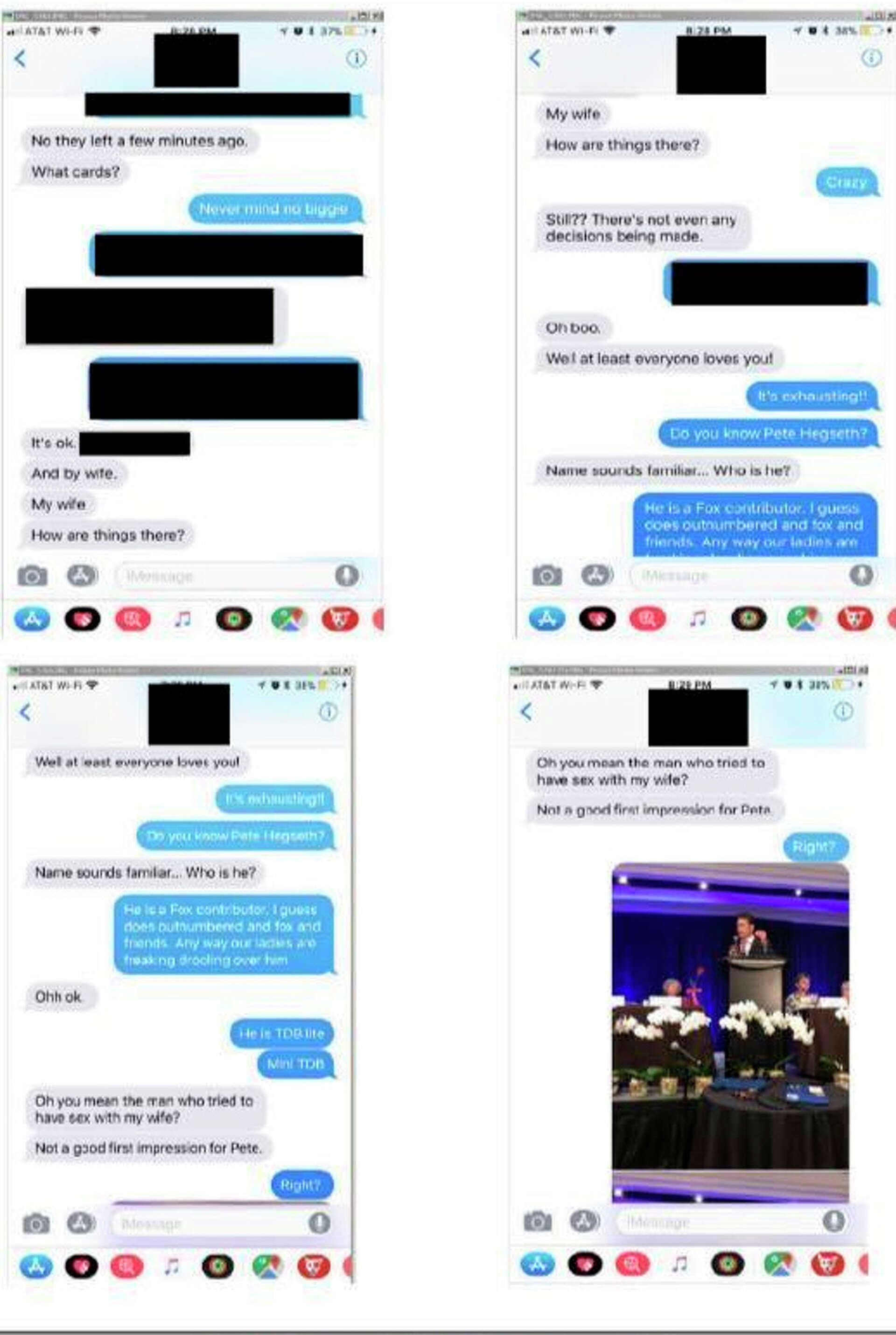

Pentagon Chaos Exclusive Report On Hegseth Leaks And Infighting

Apr 26, 2025

Pentagon Chaos Exclusive Report On Hegseth Leaks And Infighting

Apr 26, 2025