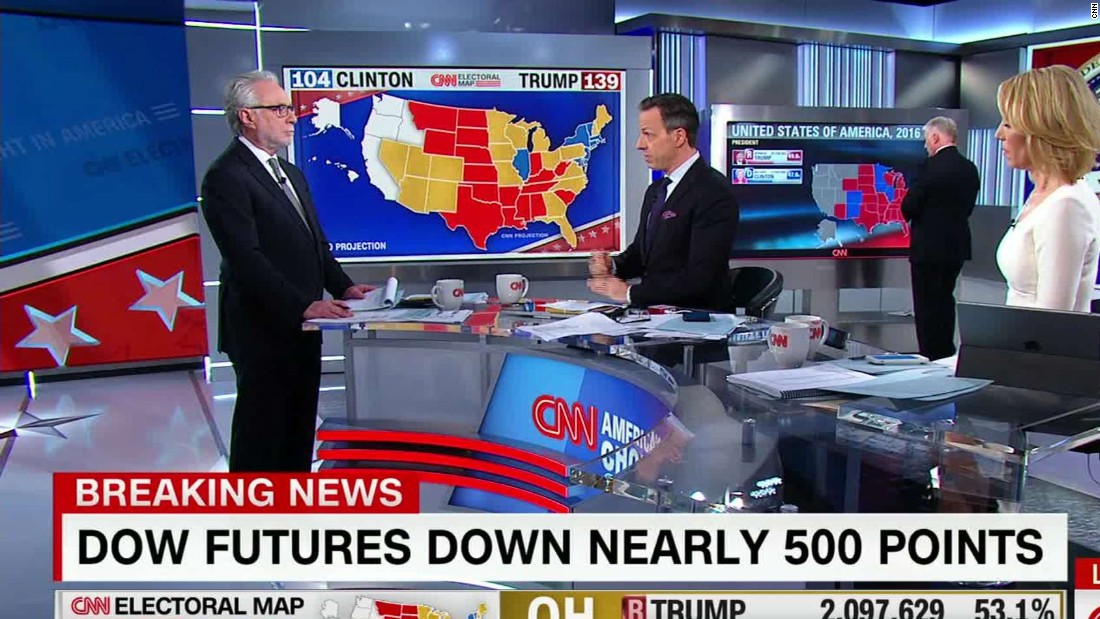

Trade War Impact: Live Updates On Dow Futures And Dollar Movement

Table of Contents

Dow Futures: Tracking the Impact of Trade Tensions

The Dow Jones Industrial Average (DJIA) futures contracts are a highly sensitive barometer of investor sentiment regarding trade tensions. Analyzing their movement provides crucial insights into the market's reaction to trade policy changes.

-

Recent Dow Futures Movements: Recent announcements regarding new tariffs or trade negotiations often trigger immediate and sometimes dramatic shifts in Dow futures. A sudden escalation in trade disputes can lead to sharp declines, reflecting investor concerns about reduced corporate profits and slower economic growth. Conversely, positive developments in trade talks can result in significant gains.

-

Tariff Implementation and Dow Futures Performance: The correlation between specific tariff implementations and Dow futures performance is often quite strong. For instance, the imposition of tariffs on specific goods from a major trading partner can negatively impact the futures market, particularly for companies heavily reliant on those imports or exports.

-

Investor Sentiment and Futures Prices: Investor sentiment, heavily influenced by news related to trade wars, plays a dominant role in shaping Dow futures prices. Fear and uncertainty generally lead to sell-offs, while optimism about trade resolutions tends to drive prices upward.

-

Historical Examples: Historical data shows consistent patterns. Past trade escalations, such as the initial imposition of tariffs in 2018, triggered significant declines in Dow futures. Conversely, periods of de-escalation and trade agreement announcements were often followed by market rallies.

-

Predicting Future Dow Movements: While precisely predicting future Dow movements is impossible, carefully analyzing current trade negotiations, assessing investor sentiment, and studying past reactions to similar events can help form informed predictions. Monitoring news sources and expert commentary is crucial for making sound investment decisions in this volatile environment.

Dollar Movement: A Safe Haven or a Victim of Uncertainty?

The US dollar's role as a global reserve currency makes it particularly susceptible to the effects of trade wars. Its performance reflects the overall confidence in the US economy and its position in the global trade system.

-

Safe-Haven Currency: During periods of heightened trade uncertainty, the dollar often acts as a safe-haven asset. Investors tend to move towards the dollar, seeking stability amidst global market turmoil. This increased demand often strengthens the dollar against other major currencies.

-

Trade War News Impact: Negative trade news often weakens the dollar. Concerns about a weakening US economy, trade deficits, and retaliatory tariffs can decrease investor confidence, driving down the dollar's value against currencies like the Euro, Yen, and British Pound.

-

Interest Rate Differentials and Central Bank Policies: Interest rate differentials between the US and other countries also significantly influence the dollar's value. The Federal Reserve's monetary policy decisions play a crucial role, with interest rate hikes tending to strengthen the dollar and vice versa.

-

Trade Imbalances: Persistent trade imbalances can gradually weaken the dollar in the long term. If the US consistently imports more than it exports, this can put downward pressure on the currency.

-

Future Dollar Movements: Predicting future dollar movements requires careful consideration of ongoing trade developments, global economic growth forecasts, and central bank policies. Monitoring these factors allows for a better understanding of potential future trends.

Understanding the Interplay Between Dow Futures and Dollar Movement

Dow futures and dollar movement are intricately linked, creating complex interactions that investors must understand.

-

Strong/Weak Dollar and Dow Futures: A strong dollar can negatively impact Dow futures, as it makes US exports more expensive and less competitive globally, potentially affecting corporate earnings. Conversely, a weak dollar can boost Dow futures by making US goods cheaper for international buyers.

-

Investment Diversification and Risk Management: Understanding the relationship between the dollar and Dow futures is crucial for effective investment diversification. Investors can use this correlation to create more resilient portfolios that are less vulnerable to trade war volatility.

-

Hedging Strategies: Businesses and investors employ various hedging strategies to mitigate the risks associated with trade war fluctuations. These strategies can involve using currency futures contracts or other derivative instruments to offset potential losses.

-

Sectoral Impacts: Different economic sectors experience varying impacts from these movements. For example, export-oriented manufacturing companies are particularly sensitive to dollar fluctuations, while technology firms may be less affected depending on their reliance on international trade.

-

Interconnectedness of Global Markets: This interplay highlights the interconnectedness of global markets. Trade wars don't exist in isolation; their impacts ripple through the financial system, affecting stock markets and currency exchange rates worldwide.

Analyzing Specific Trade Deals and Their Immediate Consequences

Analyzing the immediate market reactions to specific trade deals, such as the USMCA (United States-Mexico-Canada Agreement), is vital for understanding the short-term and long-term consequences.

-

Real-Time Analysis: Real-time data analysis of market reactions allows us to quickly assess the market's initial response to specific trade agreements and their impact on Dow futures and the dollar.

-

Short-Term and Long-Term Effects: While the immediate market reaction may be swift, the longer-term effects can unfold over months or even years, depending on the nature of the agreement and its implications for various industries and countries.

-

Impact on Countries and Industries: Different countries and industries experience differential effects based on their involvement and dependence on specific trade relationships. Some sectors may benefit significantly, while others could face challenges.

Conclusion

This article has provided live updates on the impact of the trade war on Dow futures and dollar movement, highlighting their interconnectedness and the implications for investors. Understanding these dynamics is crucial for navigating the complexities of the current economic climate.

Call to Action: Stay informed about the ever-changing landscape of global trade by regularly checking back for live updates on the impact of the trade war on Dow futures and dollar movement. Develop a robust investment strategy that considers the volatility created by trade tensions. Learn more about effective risk management techniques to navigate these challenging market conditions. Understanding the interplay between trade war impacts, Dow futures, and dollar movement is key to successful financial planning.

Featured Posts

-

The China Factor Analyzing Challenges For Premium Car Brands Like Bmw And Porsche

Apr 22, 2025

The China Factor Analyzing Challenges For Premium Car Brands Like Bmw And Porsche

Apr 22, 2025 -

Facebooks Future Zuckerbergs Strategy Under The Trump Administration

Apr 22, 2025

Facebooks Future Zuckerbergs Strategy Under The Trump Administration

Apr 22, 2025 -

E Bay And Section 230 A Judges Ruling On Banned Chemical Listings

Apr 22, 2025

E Bay And Section 230 A Judges Ruling On Banned Chemical Listings

Apr 22, 2025 -

Double Trouble In Hollywood Writers And Actors Strike Brings Industry To Standstill

Apr 22, 2025

Double Trouble In Hollywood Writers And Actors Strike Brings Industry To Standstill

Apr 22, 2025 -

Ftc Probe Into Open Ai Implications For Ai Development And Use

Apr 22, 2025

Ftc Probe Into Open Ai Implications For Ai Development And Use

Apr 22, 2025