Point72's Departure Signals Shift In Emerging Markets Investment

Table of Contents

Point72's Rationale Behind the Emerging Markets Retreat

Point72's decision to scale back its emerging market investments likely stems from a confluence of factors. Understanding these factors is crucial for other investors navigating this complex landscape.

-

Changing Macroeconomic Conditions: Several emerging markets are facing significant headwinds. Rising inflation, coupled with currency devaluations and increasing interest rates in many countries, presents a challenging investment environment. For example, recent reports highlight significant inflationary pressures in several Latin American economies, impacting investor confidence and returns.

-

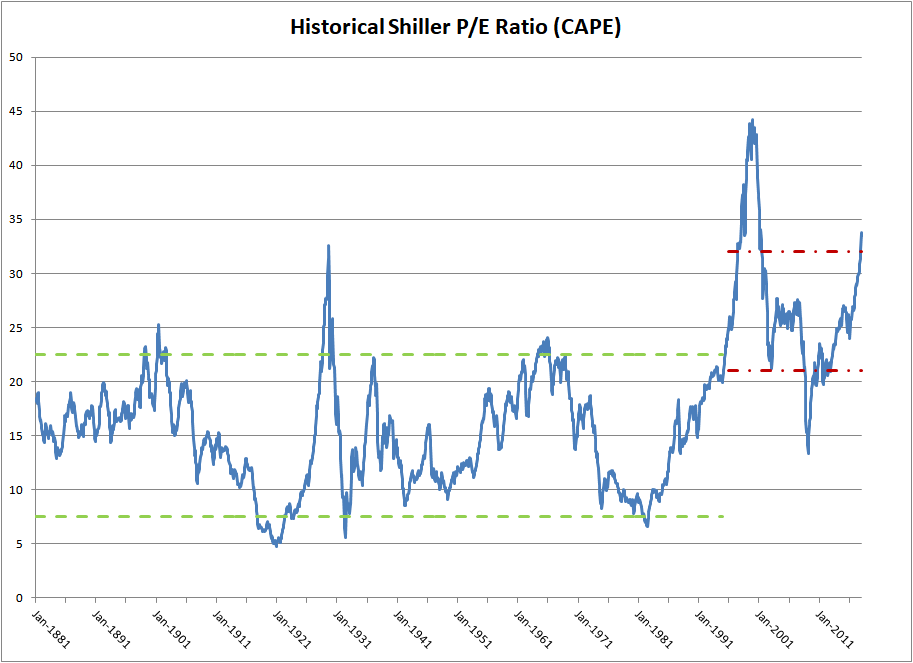

Valuation Concerns: Some analysts suggest that certain sectors within emerging markets might be overvalued, leading to concerns about potential future corrections. This is particularly relevant in technology and real estate sectors of some rapidly growing economies where valuations may have outpaced fundamentals.

-

Shift in Investment Strategy: Point72's move could also reflect a broader shift in its overall investment strategy. The firm may be reallocating capital towards other asset classes deemed less risky, such as developed market equities or fixed income, as part of a wider portfolio rebalancing exercise.

-

Geopolitical Risks: Geopolitical instability and escalating conflicts in certain regions pose significant risks to emerging market investments. This includes concerns about political uncertainty, regulatory changes, and potential disruptions to supply chains, all impacting the risk assessment for many investors.

News sources like the Financial Times and Bloomberg have reported on these challenges, citing concerns voiced by leading economists and financial analysts. This underscores the increasingly complex and nuanced nature of hedge fund strategies within emerging market investments.

Impact on Other Investors in Emerging Markets

Point72's decision is not an isolated event; it carries significant implications for other players in the emerging markets investment space.

-

Decreased Investor Confidence: A high-profile withdrawal like Point72's can trigger a decline in investor confidence, leading to a more cautious approach and potentially impacting the inflow of capital into affected regions.

-

Potential Capital Flight: This decreased confidence could result in capital flight from certain emerging markets, particularly those already grappling with economic challenges. This outflow can further exacerbate existing economic pressures.

-

Impact on Valuations and Market Liquidity: Reduced investor interest can depress valuations and decrease market liquidity, making it more difficult for other investors to enter or exit positions quickly. This is especially true for less liquid markets.

-

Opportunities for Bargain Hunting: Conversely, the pullback by some investors could create opportunities for others to acquire assets at discounted prices, provided they have a thorough understanding of the underlying risks and possess the necessary due diligence capabilities. Regions like Southeast Asia, which have shown resilience despite global headwinds, could present such opportunities.

Re-evaluation of Emerging Markets Investment Strategies

Point72's move should serve as a wake-up call, prompting a comprehensive re-evaluation of emerging markets investment strategies.

-

Enhanced Due Diligence and Risk Management: Investors need to perform significantly more thorough due diligence, focusing on both macroeconomic factors and micro-level company specifics. Robust risk management frameworks are crucial.

-

Diversification: Diversification across different emerging markets and asset classes becomes even more critical to mitigate risks associated with individual country or sector-specific challenges.

-

ESG Considerations: Integrating Environmental, Social, and Governance (ESG) factors into investment decisions is increasingly vital. Investors are increasingly focusing on sustainability and ethical considerations.

-

Sophisticated Risk Mitigation Techniques: Utilizing sophisticated hedging strategies and stress-testing models can help investors better prepare for unforeseen economic shocks and geopolitical events.

The Future of Emerging Markets Investment

Despite the short-term challenges highlighted by Point72's withdrawal, the long-term potential of emerging markets investment remains significant. Sustained economic growth in many emerging economies, fueled by technological advancements and a growing middle class, continues to offer attractive prospects. However, success will depend on careful consideration of the evolving landscape. Factors like political stability, regulatory reforms, and infrastructure development will be key determinants of future investment decisions. Thorough due diligence and a long-term investment horizon are crucial for navigating the inherent volatility and uncertainty of these markets.

Navigating the Shifting Sands of Emerging Markets Investment

Point72's departure underscores the need for a more nuanced and cautious approach to emerging markets investment. Careful risk management, portfolio diversification, and a thorough understanding of macroeconomic and geopolitical factors are paramount. While challenges exist, the long-term growth potential remains significant. Successfully investing in emerging markets requires a well-defined strategy that incorporates these key elements. Don't miss out on the opportunities; refine your emerging market investment approach today!

Featured Posts

-

Fighting The Worlds Richest An American Battleground Over Property Rights

Apr 26, 2025

Fighting The Worlds Richest An American Battleground Over Property Rights

Apr 26, 2025 -

Blockchain Analytics Leader Chainalysis Integrates Ai With Alterya Purchase

Apr 26, 2025

Blockchain Analytics Leader Chainalysis Integrates Ai With Alterya Purchase

Apr 26, 2025 -

Stock Market Valuations Bof A Explains Why Investors Shouldnt Be Concerned

Apr 26, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Be Concerned

Apr 26, 2025 -

The Next Fed Chair Inheriting Trumps Economic Challenges

Apr 26, 2025

The Next Fed Chair Inheriting Trumps Economic Challenges

Apr 26, 2025 -

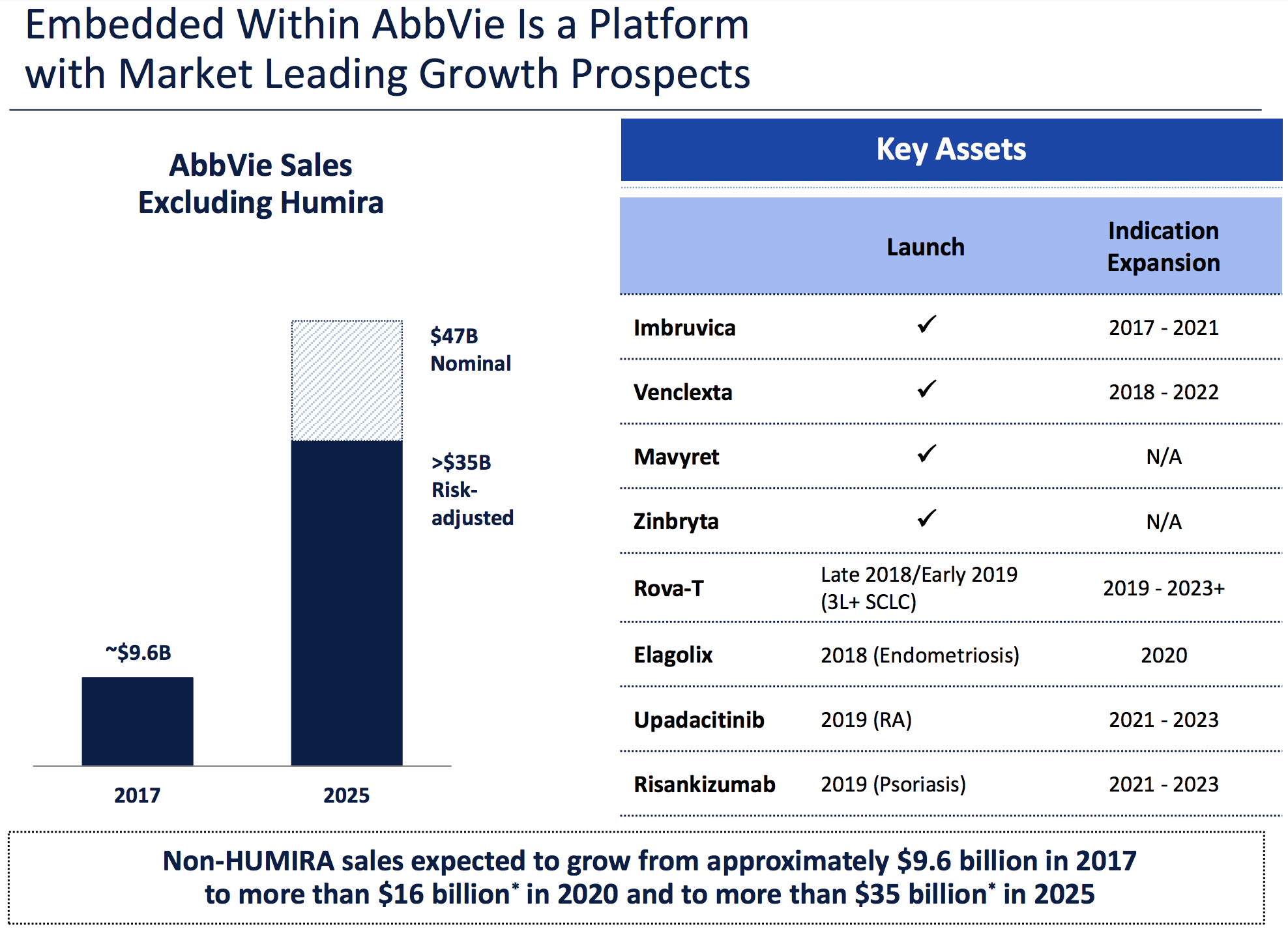

Stronger Than Expected Abb Vie Abbv Sales Fuel Profit Guidance Increase

Apr 26, 2025

Stronger Than Expected Abb Vie Abbv Sales Fuel Profit Guidance Increase

Apr 26, 2025