The Next Fed Chair: Inheriting Trump's Economic Challenges

Table of Contents

The Trump Tax Cuts and Their Long-Term Effects

The 2017 Tax Cuts and Jobs Act, a cornerstone of the Trump administration's economic policy, presents a significant challenge for the incoming Fed Chair. Its long-term effects are still unfolding, presenting both opportunities and risks.

Increased National Debt

The tax cuts significantly reduced government revenue, leading to increased budget deficits and a burgeoning national debt. This has several important implications:

- Increased budget deficits: The widening gap between government spending and revenue necessitates difficult choices regarding future fiscal policy.

- Reduced government revenue: Lower tax rates, while stimulating the economy in the short term, have reduced the government's ability to fund crucial social programs and infrastructure projects.

- Potential for higher interest rates: A larger national debt increases the demand for borrowing, potentially leading to higher interest rates, which can stifle economic growth.

The sustainability of these tax cuts is a major concern. The new Fed Chair must consider the potential long-term consequences, including the possibility of implementing policies to manage the debt, such as gradual tax increases or spending cuts. Navigating these fiscal complexities alongside monetary policy will be a key challenge.

Stimulative Effects and Inflationary Pressures

While the tax cuts initially stimulated economic growth through increased consumer spending and potential wage growth, they also fueled inflationary pressures.

- Increased consumer spending: Tax cuts placed more disposable income in the hands of consumers, leading to a short-term boost in economic activity.

- Potential wage growth: The increased demand for labor in a booming economy could have led to higher wages, although the actual impact varied across sectors.

- The Fed's role in managing inflation: The Federal Reserve's mandate includes price stability. The next Fed Chair will need to carefully manage monetary policy tools like quantitative easing and interest rate adjustments to control inflation without stifling growth.

The delicate balance between supporting economic growth and managing inflation will be a central focus for the next Fed Chair. Striking this balance will require a keen understanding of the economic landscape and the ability to adapt monetary policy to changing circumstances.

Trade Wars and Their Impact on Global Markets

The Trump administration's trade wars, characterized by escalating tariffs and trade disputes, significantly impacted global markets and created lasting challenges for the next Fed Chair.

Uncertainty and Supply Chain Disruptions

The imposition of tariffs disrupted global supply chains, leading to increased uncertainty for businesses and higher costs for consumers.

- Increased tariffs: Tariffs on imported goods raised prices and reduced the competitiveness of certain US industries.

- Disruptions to international trade: Trade disputes created uncertainty and instability in international markets, impacting business investment and growth.

- Impact on manufacturing and exports: US manufacturing and export sectors were particularly affected by retaliatory tariffs imposed by other countries.

The new Fed Chair will need to help businesses adapt to this changed global trade environment and mitigate the negative effects on economic growth. This includes assessing the long-term impacts on supply chains and developing strategies to bolster domestic production and diversification.

Impact on US Businesses and Employment

The trade wars resulted in job losses in certain sectors of the US economy, particularly those heavily reliant on exports or imports.

- Job losses in certain industries: Industries heavily reliant on international trade, such as agriculture and manufacturing, faced significant job losses.

- Impact on small businesses: Small businesses, often lacking the resources to navigate complex trade disputes, were disproportionately affected.

- Potential for reduced consumer confidence: Uncertainty surrounding trade policy and rising prices eroded consumer confidence, impacting overall economic growth.

The incoming Fed Chair must develop strategies to address the potential for further job losses and economic instability resulting from trade policy. This might involve targeted support programs for affected industries and monetary policy adjustments to stimulate growth and maintain employment.

The Legacy of Deregulation and Its Financial Risks

The Trump administration pursued a policy of deregulation across various sectors, creating potential financial risks that the next Fed Chair will need to address.

Increased Financial Instability

Deregulation, while potentially boosting economic activity in the short term, can increase systemic financial risk.

- Increased financial risk: Relaxed regulations can lead to increased risk-taking by financial institutions, potentially leading to financial instability.

- Potential for increased systemic risk: A failure of a large financial institution could have cascading effects throughout the financial system, causing a wider economic crisis.

- Challenges for financial regulation: The Fed will need to adapt its regulatory framework to address the increased complexity and risks resulting from deregulation.

The next Fed Chair must ensure robust oversight of the financial system and implement measures to mitigate potential risks. This includes strengthening stress tests for financial institutions and adapting banking regulations to reflect the changed regulatory environment.

Environmental Regulations and Economic Growth

The tension between environmental protection and economic growth, particularly in the context of deregulation, presents a significant challenge.

- Impact on environmental regulations: Relaxed environmental regulations can lead to increased pollution and environmental damage.

- Potential for increased pollution: Reduced environmental protection measures can harm public health and the environment.

- Long-term economic costs: The long-term economic costs of environmental damage, including healthcare costs and reduced agricultural productivity, can outweigh any short-term economic gains from deregulation.

The Fed Chair must balance economic concerns with the need for sustainable environmental practices. This requires a long-term perspective, considering the potential for economic damage from environmental degradation and the need for investments in green technologies and sustainable development.

Conclusion

The next Fed Chair faces significant economic challenges directly inherited from the Trump administration. From addressing the long-term consequences of the tax cuts and navigating the impact of trade wars to mitigating the risks associated with deregulation, the incoming chair will require a nuanced understanding of complex economic issues. Successfully managing these challenges will require a combination of fiscal and monetary policy adjustments, strategic decision-making, and a clear vision for sustainable economic growth. Understanding the full extent of Trump's economic legacy is critical for the next Fed Chair and for shaping the future of the US economy. Learn more about the potential challenges facing the next Fed Chair by exploring related articles and resources. Understanding the complexities of the Fed Chair role and Trump's economic legacy is crucial for navigating the economic future.

Featured Posts

-

Lab Owners Guilty Plea Faking Covid Test Results During Pandemic

Apr 26, 2025

Lab Owners Guilty Plea Faking Covid Test Results During Pandemic

Apr 26, 2025 -

Blue Origins Rocket Launch Postponed Vehicle Subsystem Malfunction

Apr 26, 2025

Blue Origins Rocket Launch Postponed Vehicle Subsystem Malfunction

Apr 26, 2025 -

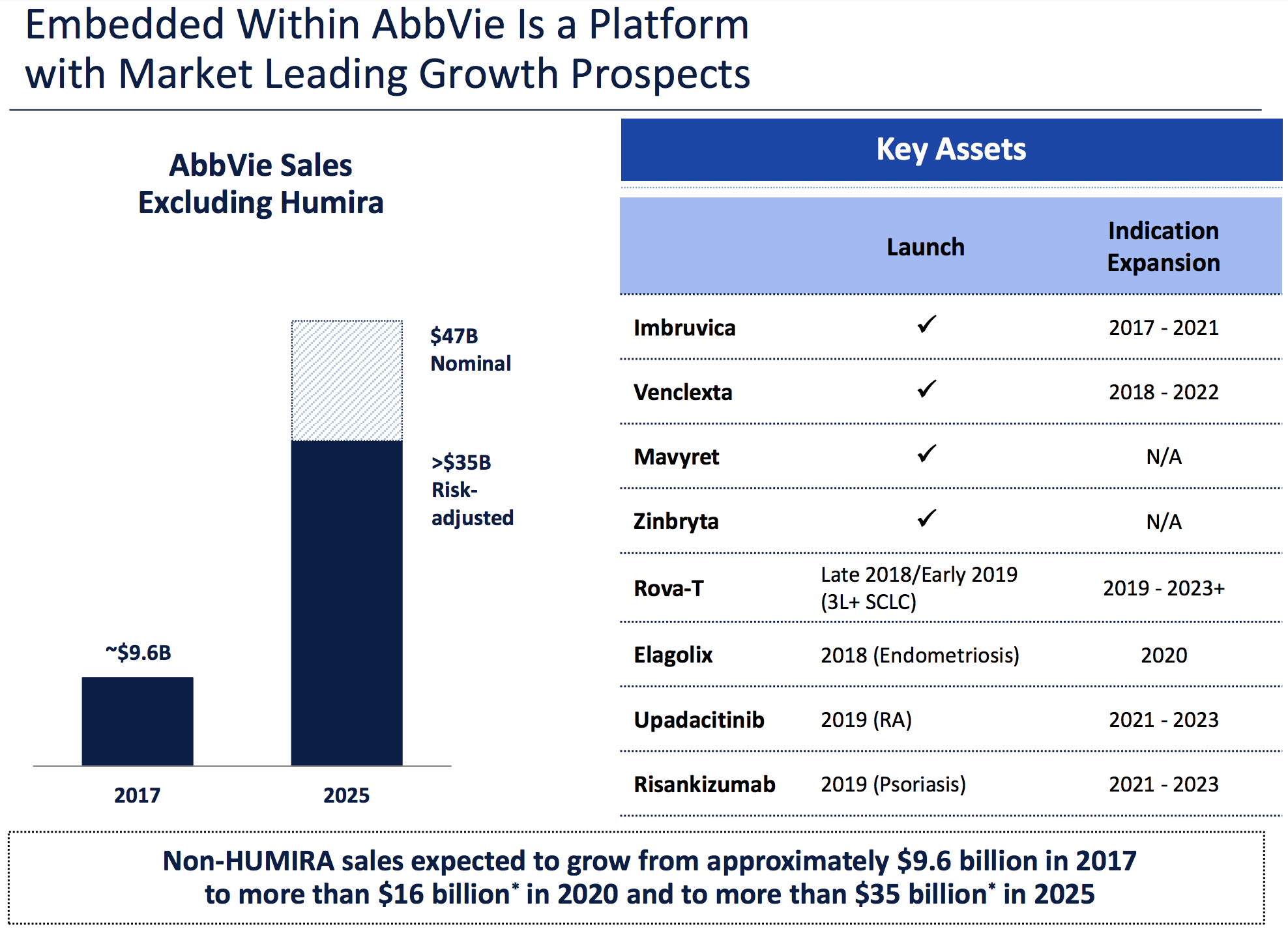

Stronger Than Expected Abb Vie Abbv Sales Fuel Profit Guidance Increase

Apr 26, 2025

Stronger Than Expected Abb Vie Abbv Sales Fuel Profit Guidance Increase

Apr 26, 2025 -

The Next Fed Chair Facing The Complexities Of The Trump Administrations Economic Policies

Apr 26, 2025

The Next Fed Chair Facing The Complexities Of The Trump Administrations Economic Policies

Apr 26, 2025 -

Chat Gpt And Open Ai The Ftc Investigation And Its Potential Impact

Apr 26, 2025

Chat Gpt And Open Ai The Ftc Investigation And Its Potential Impact

Apr 26, 2025