Investor Concerns About Stock Market Valuations: BofA's Response

Table of Contents

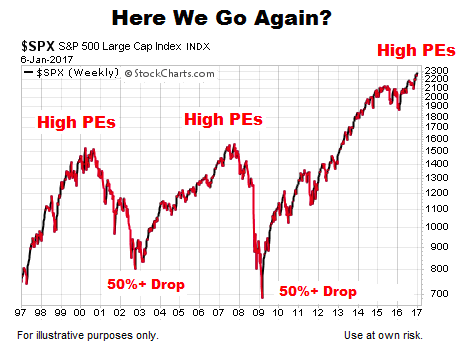

Elevated Stock Market Valuations: A Closer Look

Understanding the current market landscape requires a close examination of valuation metrics and their implications.

Understanding Current Valuation Metrics

Key valuation metrics like the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), and Price-to-Book ratio (P/B) are crucial for assessing whether stocks are fairly valued. High multiples relative to historical averages can indicate overvaluation, raising investor concerns.

- P/E Ratio: Currently, the average P/E ratio for the S&P 500 might be higher than its historical average, indicating potentially elevated valuations.

- P/S Ratio: Similar to the P/E, the P/S ratio can show if companies are trading at a premium compared to their revenue. A high P/S often suggests future growth expectations, but this is not always guaranteed.

- Impact of Interest Rate Hikes: Increased interest rates generally decrease valuations because they increase the discount rate used in discounted cash flow models, reducing the present value of future earnings.

Identifying Sectors with High Valuations

Certain sectors are currently exhibiting significantly higher valuations than others, presenting potential risks for investors.

- Examples of Potentially Overvalued Sectors (Note: This is for illustrative purposes only and may change rapidly): Technology (particularly growth stocks), consumer discretionary, and certain areas within healthcare.

- Sector-Specific Factors: High valuations in specific sectors might be driven by factors like technological disruptions, anticipated growth, or regulatory changes. These factors must be analyzed carefully before investment decisions.

BofA's Assessment of Stock Market Valuations

BofA, through its extensive research and analysis, provides valuable perspectives on current market conditions and potential strategies.

BofA's Stance on Current Market Conditions

BofA regularly publishes reports and analyses assessing stock market valuations. These reports often incorporate economic forecasts, interest rate predictions, and geopolitical factors to predict future market movements. (Note: Specific quotes and reports should be included here, citing the source.)

BofA's Strategies for Navigating High Valuations

In light of potentially elevated valuations, BofA likely advocates for a cautious approach, emphasizing risk management.

- Diversification: Spreading investments across various asset classes and sectors helps mitigate risk associated with overvalued sectors.

- Sector Rotation: Shifting investments from potentially overvalued sectors to undervalued ones can improve portfolio performance.

- Risk Mitigation: BofA might recommend strategies such as hedging, using options, or focusing on value stocks to reduce risk associated with high valuations.

Addressing Specific Investor Concerns

Several major concerns drive investor anxieties about stock market valuations.

Concerns about Inflation and its Impact on Valuations

Inflation erodes purchasing power and can impact corporate profitability, affecting stock prices. BofA’s analysis of inflation trends and its expected impact on earnings is crucial for assessing valuations.

Concerns about Interest Rate Hikes and Their Effect on Valuations

Higher interest rates increase borrowing costs for businesses, potentially reducing investment and slowing economic growth. This usually impacts stock valuations negatively. BofA’s projections of future interest rate hikes are therefore critical to evaluating market prospects.

Concerns about Geopolitical Instability and its Impact on Valuations

Geopolitical events introduce uncertainty, impacting investor sentiment and market valuations. BofA's analysis of global risks and their potential impact on stock prices is crucial for informed decision-making.

Conclusion: Navigating Investor Concerns about Stock Market Valuations

Understanding stock market valuations is crucial for successful investing. This article highlighted investor anxieties and BofA’s assessment, including valuation metrics, sector-specific risks, and the impact of inflation, interest rates, and geopolitical factors. Key takeaways emphasize the need for diversified investment strategies, careful analysis of valuation metrics, and continuous monitoring of market trends. To make well-informed investment choices, conduct further research, consider seeking professional financial advice, and stay abreast of BofA's analysis of stock market valuations and its ongoing assessment of market risks; effectively managing stock market valuation risks requires diligent monitoring and adaptation. By actively engaging with these aspects, you can better assess stock market valuations and build a robust investment strategy.

Featured Posts

-

Bof A Says Dont Worry About Stretched Stock Market Valuations

Apr 22, 2025

Bof A Says Dont Worry About Stretched Stock Market Valuations

Apr 22, 2025 -

Russias Aerial Assault On Ukraine Us Peace Plan Amidst Rising Tensions

Apr 22, 2025

Russias Aerial Assault On Ukraine Us Peace Plan Amidst Rising Tensions

Apr 22, 2025 -

The Growing Market For Wildfire Bets Examining The Los Angeles Situation

Apr 22, 2025

The Growing Market For Wildfire Bets Examining The Los Angeles Situation

Apr 22, 2025 -

Fsu Security Flaw And Student Safety Concerns A Case Study In Rapid Response And Lingering Anxiety

Apr 22, 2025

Fsu Security Flaw And Student Safety Concerns A Case Study In Rapid Response And Lingering Anxiety

Apr 22, 2025 -

Recent Us Protests Key Issues And Trumps Response

Apr 22, 2025

Recent Us Protests Key Issues And Trumps Response

Apr 22, 2025