BofA Says: Don't Worry About Stretched Stock Market Valuations

Table of Contents

BofA's Rationale: Why Stretched Valuations Aren't Necessarily a Red Flag

BofA's positive outlook on stretched stock market valuations rests on several key pillars. Their analysis considers not just current price levels but also future growth prospects and macroeconomic factors.

-

Robust Economic Forecasts: BofA's economists predict continued, albeit moderated, economic growth. This forecast supports their belief that corporate earnings will continue to rise, justifying, at least partially, the current valuations. Stronger-than-expected GDP growth could further bolster these valuations.

-

Earnings Growth Outpaces Valuation Concerns: The bank's analysis suggests that projected corporate earnings growth is expected to outpace the current valuation increases, mitigating the risk associated with seemingly high price-to-earnings (P/E) ratios. This is crucial in determining if current stock market valuations are truly "stretched."

-

Interest Rate Expectations and Inflation: BofA's relatively benign outlook on inflation and interest rates plays a significant role. They anticipate a gradual increase in interest rates, not a sharp hike that could significantly impact corporate profitability and investor sentiment. A stable interest rate environment typically supports higher stock market valuations.

-

Specific Sector Analysis: While BofA acknowledges valuation concerns across the board, their report highlights specific sectors and stocks that appear less vulnerable due to strong fundamentals and resilient earnings potential. They are likely to mention these sectors in their detailed report.

-

Re-evaluation of Valuation Metrics: BofA likely uses a more nuanced approach to assessing valuation metrics than simply relying on traditional P/E ratios. They may incorporate factors such as discounted cash flow analysis and other more forward-looking metrics to assess the true value.

Understanding the Current Market Environment: Factors Influencing Valuations

Several factors contribute to the current market environment and influence how investors perceive stock market valuations.

-

Inflation and Interest Rate Dynamics: Inflation remains a key concern, impacting both corporate profits and investor behavior. Interest rate hikes by central banks aim to control inflation but can also slow down economic growth, influencing stock prices.

-

Geopolitical Risks and Supply Chain Disruptions: Global geopolitical instability and ongoing supply chain issues create uncertainty, potentially affecting stock valuations and influencing investor risk aversion. These events can create short-term volatility, making accurate valuations more complex.

-

Economic Growth Projections: Forecasts for future economic growth are paramount. Positive growth projections tend to support higher valuations, while concerns about a recession often lead to lower valuations. Analyzing historical trends in relation to growth forecasts is crucial.

-

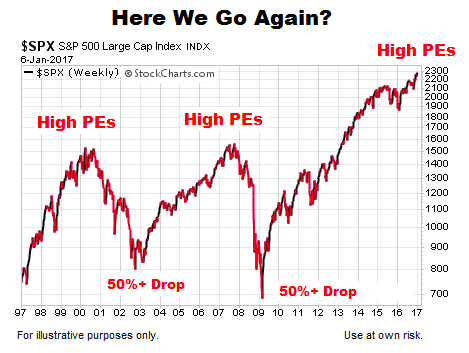

Comparison to Previous High Valuation Periods: BofA's analysis likely includes a comparison of the current market environment with previous periods characterized by high valuations. This historical context helps determine if current levels are truly exceptional or within a reasonable range considering broader economic factors.

BofA's Investment Recommendations: Strategies for Navigating the Market

Based on their analysis, BofA likely suggests a strategic approach to navigating the market, focusing on mitigating risks while capitalizing on potential growth opportunities.

-

Portfolio Diversification: BofA's investment advice probably emphasizes the importance of diversifying across different asset classes (stocks, bonds, real estate) and sectors to reduce overall portfolio risk.

-

Risk Management Techniques: They likely advise investors to employ risk management strategies such as stop-loss orders and hedging to protect against potential market downturns.

-

Sector Allocation: BofA likely provides guidance on sector allocation, recommending overweighting sectors deemed less vulnerable to valuation concerns and underweighting those perceived as more at risk.

-

Asset Allocation Strategies: They likely propose tailored asset allocation strategies based on individual investor risk tolerance and financial goals. This includes considering the time horizon for investment and risk appetite.

-

Active Stock Picking: While acknowledging market-wide valuations, they may advise actively picking stocks based on their individual fundamentals, rather than simply reacting to market sentiment.

Considering Alternative Investment Options Beyond Stocks

A well-diversified portfolio often includes alternative investment options to mitigate risk. These could include:

-

Bonds: Offering a different risk profile than stocks, bonds can provide stability and income during periods of market uncertainty.

-

Real Estate: Real estate can serve as a hedge against inflation and offer diversification benefits in a portfolio.

-

Other Alternatives: Depending on risk tolerance and investment goals, other alternatives such as commodities or private equity may be considered.

Conclusion

BofA's report offers a more nuanced perspective on stretched stock market valuations. While acknowledging the high price levels relative to historical earnings, they emphasize the importance of considering future growth prospects, macroeconomic factors, and a comprehensive approach to valuation metrics. Their recommendations focus on strategic diversification, risk management, and a careful selection of assets tailored to individual investor needs. Don't let concerns about stretched stock market valuations deter you from developing a well-informed investment strategy. Learn more about BofA's analysis of stock market valuations and develop a robust investment strategy based on BofA's insights and your own due diligence. Remember to consider your personal risk tolerance and financial goals when making any investment decisions. Understanding the factors influencing stock market valuations is key to making informed choices in the current market.

Featured Posts

-

Vehicle Subsystem Issue Forces Blue Origin Launch Cancellation

Apr 22, 2025

Vehicle Subsystem Issue Forces Blue Origin Launch Cancellation

Apr 22, 2025 -

Cassidy Hutchinsons Fall Memoir Insights From A Key January 6th Witness

Apr 22, 2025

Cassidy Hutchinsons Fall Memoir Insights From A Key January 6th Witness

Apr 22, 2025 -

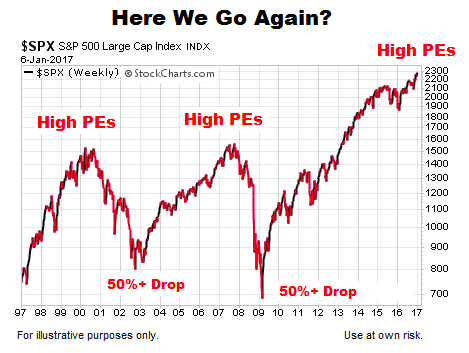

Alterya Acquired By Chainalysis A Strategic Move In Blockchain Technology

Apr 22, 2025

Alterya Acquired By Chainalysis A Strategic Move In Blockchain Technology

Apr 22, 2025 -

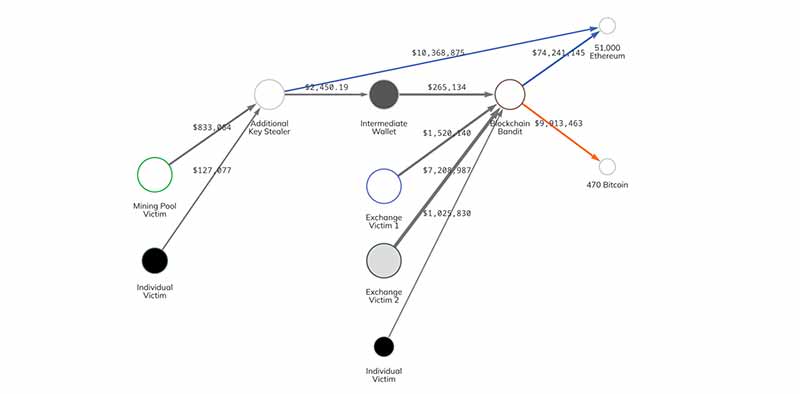

Mapping The Countrys Emerging Business Hotspots

Apr 22, 2025

Mapping The Countrys Emerging Business Hotspots

Apr 22, 2025 -

T Mobiles 16 Million Data Breach Fine Three Years Of Security Failures

Apr 22, 2025

T Mobiles 16 Million Data Breach Fine Three Years Of Security Failures

Apr 22, 2025