Are High Stock Market Valuations A Concern? BofA Says No. Here's Why.

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Red Flag

BofA's argument against viewing current valuations as excessively high rests on several key pillars. They contend that several economic factors mitigate the risks typically associated with high stock market valuations. Instead of signaling an impending market crash, BofA suggests these valuations reflect a unique economic environment.

-

Low interest rates justify higher Price-to-Earnings (P/E) ratios: Historically low interest rates make borrowing cheaper for companies, boosting profitability and supporting higher stock valuations. A lower discount rate applied to future earnings translates into higher present values, justifying higher P/E multiples. For example, a company with projected strong future earnings might command a higher P/E ratio in a low-interest-rate environment compared to a similar company during periods of higher interest rates.

-

Strong corporate earnings growth offsets valuation concerns: BofA points to robust corporate earnings growth as a key counterbalance to high valuations. Many companies have demonstrated impressive profit growth, driven by factors such as technological innovation and increased consumer demand. This robust earnings growth can justify premium valuations, as investors are willing to pay more for companies demonstrating exceptional performance.

-

Technological advancements and innovation support premium valuations in specific sectors: BofA highlights the impact of technological disruption. Sectors like technology, renewable energy, and biotechnology are experiencing rapid innovation, leading to premium valuations for companies at the forefront of these trends. Companies demonstrating disruptive potential often command higher valuations reflecting future growth expectations. For instance, companies developing groundbreaking AI technologies or sustainable energy solutions are frequently valued at a premium.

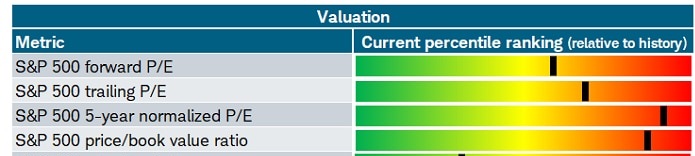

Analyzing Key Valuation Metrics: A Deeper Dive

Understanding BofA's perspective requires examining key valuation metrics. Let's look at some commonly used metrics and how they might be interpreted within the context of BofA's analysis:

-

Price-to-Earnings Ratio (P/E): This metric compares a company's stock price to its earnings per share. A high P/E ratio can suggest high expectations for future growth, but it can also indicate overvaluation if earnings don't materialize. BofA likely considers the P/E ratio in relation to historical averages and interest rates.

-

Price/Earnings to Growth ratio (PEG): The PEG ratio adjusts the P/E ratio for a company's growth rate. It provides a more nuanced view than the P/E ratio alone, offering a better understanding of valuation relative to growth potential. A lower PEG ratio is generally considered more favorable.

-

Shiller PE Ratio (CAPE): Also known as the cyclically adjusted price-to-earnings ratio, this metric smooths out earnings fluctuations over a 10-year period, providing a more stable measure of valuation. BofA may use the CAPE ratio to compare current valuations to those seen during past market cycles.

In a low-interest-rate environment, these ratios might appear higher than in previous periods, but BofA likely argues that these elevated ratios are justified given the combination of low borrowing costs and strong corporate earnings growth. Comparing current ratios to historical averages within similar economic conditions is crucial to avoid misinterpretations.

Counterarguments and Potential Risks: A Balanced Perspective

While BofA presents a positive outlook, it's crucial to acknowledge potential counterarguments and risks:

-

Market Corrections: High valuations inherently increase the risk of a market correction. A sudden drop in investor confidence or an unexpected economic downturn could trigger a significant market decline.

-

Rising Interest Rates: A shift towards higher interest rates could negatively impact stock valuations. Higher borrowing costs would reduce corporate profitability, potentially leading to lower stock prices. This is a significant factor that could invalidate BofA's optimistic predictions.

-

Geopolitical Instability: Unforeseen geopolitical events, such as international conflicts or trade wars, could significantly impact market sentiment and trigger a sell-off, regardless of underlying valuations.

Diversification and robust risk management strategies are critical for investors, regardless of the prevailing market sentiment. A well-diversified portfolio can help mitigate the impact of potential market downturns.

Investing Strategies in a High-Valuation Market: BofA's Implicit Advice

BofA's analysis implicitly suggests several investment strategies:

-

Focus on companies with strong growth prospects: In a high-valuation market, selecting companies with consistent earnings growth and a strong competitive advantage becomes even more crucial.

-

Long-term investing is key: Avoid reacting to short-term market fluctuations. A long-term investment horizon allows investors to weather market corrections and benefit from the long-term growth potential of well-chosen investments.

-

Consider sector-specific opportunities: Based on BofA's emphasis on technological innovation, investors may consider allocating more capital to sectors like technology, renewable energy, and healthcare, which often demonstrate significant long-term growth potential.

Conclusion: Navigating High Stock Market Valuations – A Call to Action

BofA's analysis suggests that while high stock market valuations present legitimate concerns, the current economic environment, characterized by low interest rates and strong corporate earnings, offers a nuanced perspective. While the potential for market corrections and risks associated with high valuations remain, understanding the underlying factors supporting these valuations is crucial. Conduct your own thorough research and consider your individual risk tolerance before making investment decisions. Learn more about BofA's investment strategy and develop a robust investment strategy to navigate high stock market valuations effectively. Understanding the nuances of high stock market valuations is key to making informed decisions in today's dynamic market.

Featured Posts

-

Where To Invest Identifying The Countrys Top Business Locations

Apr 26, 2025

Where To Invest Identifying The Countrys Top Business Locations

Apr 26, 2025 -

Analysis Dow Futures And The Impact Of Chinas Economic Policies Amid Trade Tensions

Apr 26, 2025

Analysis Dow Futures And The Impact Of Chinas Economic Policies Amid Trade Tensions

Apr 26, 2025 -

Colgate Cl Q Quarter Number Earnings Sales And Profit Decline Due To Tariffs

Apr 26, 2025

Colgate Cl Q Quarter Number Earnings Sales And Profit Decline Due To Tariffs

Apr 26, 2025 -

Turning Poop Into Prose An Ai Powered Podcast Revolution

Apr 26, 2025

Turning Poop Into Prose An Ai Powered Podcast Revolution

Apr 26, 2025 -

Point72 Traders Exit Emerging Markets Focused Fund

Apr 26, 2025

Point72 Traders Exit Emerging Markets Focused Fund

Apr 26, 2025