Analysis: Dow Futures And The Impact Of China's Economic Policies Amid Trade Tensions

Table of Contents

China's Economic Policies and Their Global Ripple Effect

China's economic policies, encompassing monetary, fiscal, and trade decisions, exert a profound influence on global markets, significantly impacting Dow Futures. These policies, often intertwined and reacting to both domestic and international pressures, create a complex web of cause and effect that investors must carefully consider.

Monetary Policy Adjustments

Changes in China's interest rates and reserve requirements directly influence capital flows and global investment sentiment, creating ripples that affect the US dollar and consequently, Dow Futures.

-

Increased interest rates: Can attract foreign investment, strengthening the US dollar and potentially boosting Dow Futures. This is because higher returns in China can draw capital away from other markets, including the US, increasing demand for the dollar.

-

Decreased interest rates: Can lead to capital outflows from China, weakening the US dollar and negatively impacting Dow Futures. Investors may seek higher returns elsewhere, leading to reduced investment in US assets.

-

Unexpected policy shifts: Create significant volatility in the markets. Unforeseen changes in monetary policy can trigger rapid shifts in investor sentiment, leading to sharp fluctuations in Dow Futures.

Fiscal Policy Decisions

China's government spending and tax policies significantly impact economic growth and global trade, with consequential effects on Dow Futures.

-

Large-scale infrastructure projects: Boost demand for raw materials, influencing the prices of commodities and affecting US companies involved in their production and export. Increased demand for steel, for instance, can benefit US steel producers whose stock prices are components of the Dow.

-

Stimulus packages and tax cuts: Can stimulate consumer spending both domestically in China and globally, indirectly influencing Dow Futures through increased demand for goods and services from US companies.

-

Fiscal policy uncertainty: Can lead to market instability and decreased investor confidence, resulting in volatility in Dow Futures. Unpredictable government spending can make it difficult for businesses to plan, impacting investment decisions and affecting stock markets.

Trade Policies and Tariffs

Trade wars and tariffs between the US and China have a direct and immediate impact on specific sectors, with these effects clearly reflected in Dow Futures.

-

Tariffs on Chinese goods: Increase prices for US consumers and can negatively impact the profitability of US companies reliant on Chinese imports or facing increased competition from domestically produced substitutes. This directly translates to lower stock prices for some Dow components.

-

Supply chain disruptions: Due to trade tensions can cause significant price fluctuations. Companies dependent on Chinese manufacturing might experience production delays and increased costs, negatively impacting their stock performance and Dow Futures.

-

Retaliatory tariffs from China: Can negatively impact US exports and lead to a decrease in Dow Futures. These retaliatory measures can reduce the competitiveness of US goods in the Chinese market, hurting company profits and stock prices.

Analyzing the Correlation Between Dow Futures and Key Chinese Economic Indicators

Understanding the correlation between Dow Futures and key Chinese economic indicators is crucial for effective market analysis and investment strategy.

GDP Growth

China's GDP growth is strongly correlated with Dow Futures performance.

-

Strong Chinese GDP growth: Generally supports positive sentiment in global markets, including Dow Futures, as it indicates increased economic activity and potential for higher profits for multinational companies with operations in China.

-

Slowdown in Chinese GDP: Can negatively impact Dow Futures, reflecting reduced demand for goods and services and potentially impacting the profitability of US companies with significant exposure to the Chinese market.

-

Unexpected changes in GDP growth forecasts: Create market volatility, as investors adjust their expectations and potentially re-evaluate their investment strategies.

Inflation and Currency Fluctuations

Inflation in China and subsequent currency fluctuations impact the value of the Yuan, influencing the US dollar and ultimately Dow Futures.

-

High inflation in China: Can weaken the Yuan, making Chinese exports cheaper but potentially impacting trade with the US and the value of Dow Futures.

-

Currency fluctuations: Create uncertainty for investors, leading to volatility in Dow Futures as exchange rate risks affect investment decisions and trade flows.

-

Central bank interventions: To manage currency value can significantly influence Dow Futures by affecting market expectations and investor confidence.

Consumer and Business Confidence

Shifts in consumer and business confidence in China impact investment decisions and are reflected in Dow Futures.

-

Decreased consumer confidence: Can signal reduced demand for goods and services, impacting US companies that export to China and potentially lowering Dow Futures.

-

Low business confidence: May lead to reduced investment and hiring in China, impacting global supply chains and affecting Dow Futures.

-

Monitoring leading indicators: Such as purchasing manager indexes (PMI), provides valuable insights for predicting future trends in the Chinese economy and their potential impact on Dow Futures.

Conclusion

This analysis highlights the significant influence of China's economic policies on Dow Futures, emphasizing the interconnected nature of the global economy. Understanding the intricate relationship between China's monetary and fiscal policies, trade decisions, and key economic indicators is critical for navigating the complexities of the financial markets. By closely monitoring these factors and their impact on global trade and investor sentiment, investors can make more informed decisions regarding Dow Futures trading and risk management. Staying informed on China's economic policies and their impact on Dow Futures is paramount for successful investment strategies.

Featured Posts

-

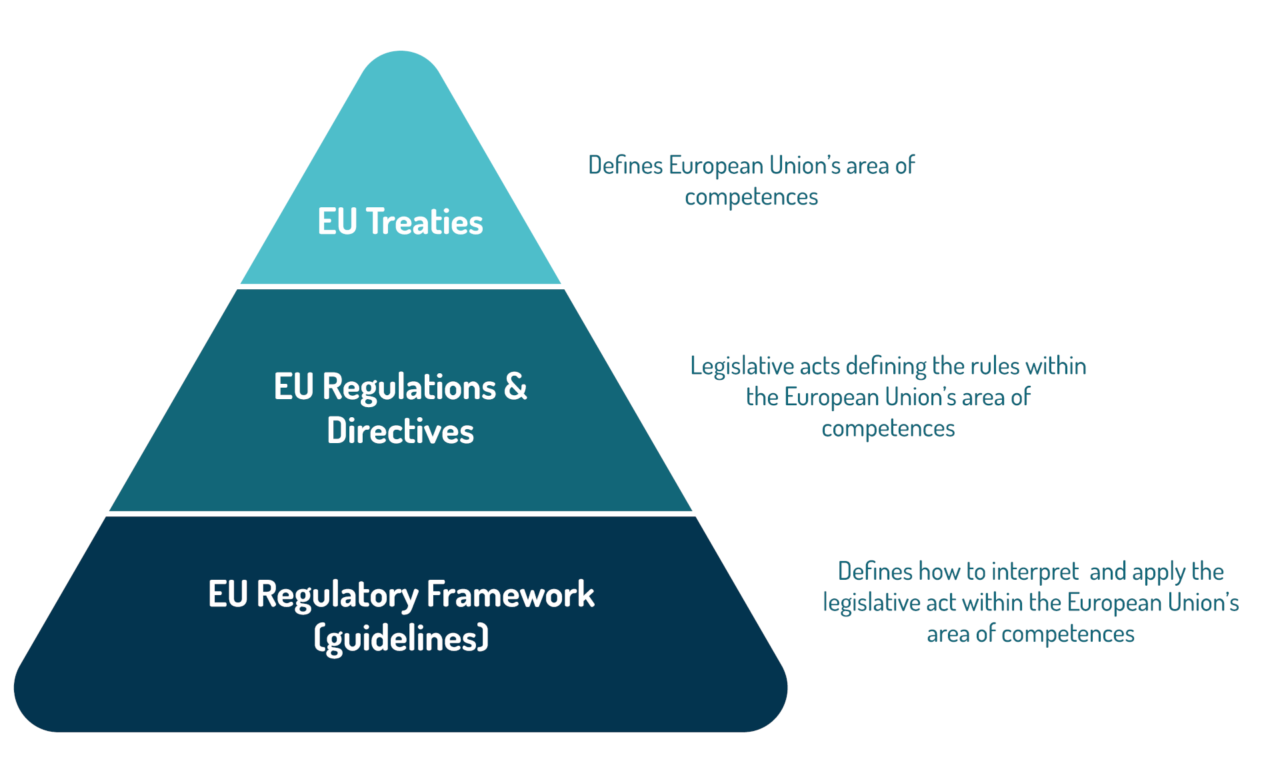

Ai Regulation In Europe The Impact Of Trump Administration Pressure

Apr 26, 2025

Ai Regulation In Europe The Impact Of Trump Administration Pressure

Apr 26, 2025 -

Understanding The Value Of Middle Managers Benefits For Companies And Their Teams

Apr 26, 2025

Understanding The Value Of Middle Managers Benefits For Companies And Their Teams

Apr 26, 2025 -

Ray Epps Sues Fox News For Defamation Over January 6th Coverage

Apr 26, 2025

Ray Epps Sues Fox News For Defamation Over January 6th Coverage

Apr 26, 2025 -

Trumps Tariffs Ceos Express Concerns About Economic Fallout

Apr 26, 2025

Trumps Tariffs Ceos Express Concerns About Economic Fallout

Apr 26, 2025 -

Trade Wars And Gold Why Bullion Prices Are Surging

Apr 26, 2025

Trade Wars And Gold Why Bullion Prices Are Surging

Apr 26, 2025