Why Current Stock Market Valuations Are Not A Cause For Alarm (BofA)

Table of Contents

The Role of Interest Rates in Shaping Market Valuations

Interest rates play a crucial role in shaping stock market valuations. The Federal Reserve's monetary policy directly influences bond yields, which in turn affect the discount rate used in stock valuation models. Higher interest rates generally lead to higher discount rates, lowering the present value of future earnings and thus impacting stock prices.

- Rising Interest Rates and Present Value: When interest rates rise, investors demand a higher return on their investments. This means future earnings are discounted more heavily, resulting in lower valuations for stocks.

- BofA's Interest Rate Outlook: BofA's analysts typically provide detailed forecasts on the trajectory of interest rates. Their projections, while acknowledging potential volatility, often incorporate a nuanced understanding of economic indicators and their impact on monetary policy. These projections are crucial for accurately assessing the impact of interest rates on stock valuations.

- Sophisticated Valuation Models: BofA utilizes sophisticated valuation models that incorporate interest rate adjustments, providing a more complete picture than simply looking at current interest rate levels. These models factor in the anticipated path of interest rates and their influence on future cash flows.

- Interest Rates Already Priced In?: A key consideration is whether the market has already priced in anticipated interest rate hikes. BofA's analysis would help determine if current valuations already reflect the expected changes in monetary policy, lessening the immediate impact of future rate adjustments.

BofA's analysis considers the interplay between interest rate changes, future earnings, and cash flows, leading to a more balanced perspective on current valuations. Their in-depth research helps separate genuine valuation concerns from market noise influenced by interest rate movements.

Earnings Growth Outpaces Valuation Concerns

While valuation metrics are important, it's crucial to consider the underlying fundamentals driving corporate performance. BofA's analysis suggests that robust earnings growth is currently offsetting some valuation concerns.

- BofA's Earnings Growth Projections: BofA provides detailed analysis of current corporate earnings and projects future revenue growth and profit margins for various sectors. These projections form the basis of their valuation assessments.

- Earnings Growth vs. Valuations: Strong earnings growth can justify higher price-to-earnings (P/E) ratios. BofA’s research would likely show how healthy earnings growth can offset even seemingly high valuations, rendering them less alarming in the context of future performance.

- P/E Ratio Comparisons: Comparing current P/E ratios with historical averages and industry-specific data provides valuable context. BofA's analysis would likely provide this comparative data, highlighting whether current valuations are truly excessive or fall within a reasonable range.

- Economic Slowdown Impact: While the economic outlook can influence earnings growth, BofA's forecasts attempt to factor in the potential impact of a slowdown, offering a more realistic valuation assessment.

BofA's research provides data-driven insights, demonstrating that the projected earnings growth supports the argument that current valuations are not necessarily cause for alarm. Their analysis goes beyond simple P/E ratios to provide a holistic view of corporate profitability and its impact on market valuation.

Sector-Specific Analysis Mitigates Overall Valuation Risks

A broad-brush approach to market valuation can be misleading. BofA's analysis advocates for a more nuanced, sector-specific approach.

- Sector Performance Variations: Different sectors experience varying levels of growth and profitability. Some sectors might be significantly undervalued, while others might justify higher valuations. BofA's research highlights these sector-specific differences.

- Attractive Valuations in Specific Sectors: BofA's reports would pinpoint sectors where valuations appear attractive despite overall market concerns. This provides opportunities for strategic investment.

- Stock Selection and Diversification: Strategic stock picking and portfolio diversification are vital for mitigating risk. BofA's insights can help investors identify potentially undervalued stocks and construct well-diversified portfolios.

- Risk Assessment Within Sectors: BofA analysts assess the risk profiles of individual sectors, enabling investors to make informed decisions aligned with their risk tolerance.

By focusing on sector-specific analysis, BofA mitigates the risks associated with generalized concerns about overall market valuations. Their research provides the tools for a more targeted and potentially more profitable investment strategy.

Long-Term Investment Strategy Remains Crucial

Market fluctuations are inevitable. The key is to maintain a long-term perspective.

Current market valuations shouldn't deter long-term investors with a well-defined investment strategy and appropriate risk tolerance. A buy-and-hold strategy, coupled with regular rebalancing, often proves more effective than attempting to time the market. Avoiding emotional decisions based on short-term market volatility is crucial for long-term success.

Conclusion

In summary, BofA's analysis suggests that current stock market valuations, while seemingly high in some contexts, are not necessarily a cause for widespread alarm. The impact of interest rates is often nuanced and potentially already reflected in current pricing; strong earnings growth offsets some valuation concerns; and a sector-specific analysis reveals attractive opportunities within a diverse market. BofA's perspective emphasizes the importance of understanding the underlying fundamentals, embracing a long-term investment horizon, and employing sound risk management strategies.

Don't let fear dictate your investment decisions. Understand the nuances of current stock market valuations and make informed choices for your financial future. Further research into BofA's market analysis will provide a more comprehensive understanding and support your investment strategy.

Featured Posts

-

Espn Forecasts Red Soxs 2025 Season

Apr 28, 2025

Espn Forecasts Red Soxs 2025 Season

Apr 28, 2025 -

Nascar Jack Link 500 At Talladega Expert Prop Bets And Best Bets For 2025

Apr 28, 2025

Nascar Jack Link 500 At Talladega Expert Prop Bets And Best Bets For 2025

Apr 28, 2025 -

Hudsons Bay Store Closing Sale Find Deep Discounts Up To 70

Apr 28, 2025

Hudsons Bay Store Closing Sale Find Deep Discounts Up To 70

Apr 28, 2025 -

Ev Mandate Opposition Car Dealerships Renew Their Fight

Apr 28, 2025

Ev Mandate Opposition Car Dealerships Renew Their Fight

Apr 28, 2025 -

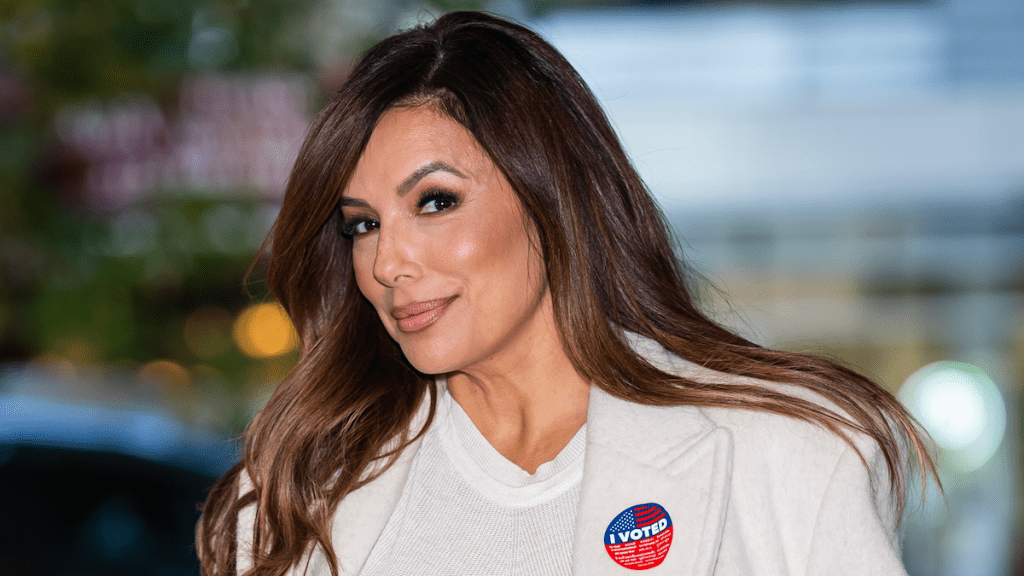

Fishermans Stew A World Class Chefs Recipe Wins Over Eva Longoria

Apr 28, 2025

Fishermans Stew A World Class Chefs Recipe Wins Over Eva Longoria

Apr 28, 2025