The Dax And German Politics: A Look At The Impact Of Elections And Economic Performance

Table of Contents

Understanding the DAX Index and its Significance

The DAX (Deutscher Aktienindex) is a blue-chip stock market index comprising the 40 largest German companies listed on the Frankfurt Stock Exchange. These companies represent a broad cross-section of the German economy, including sectors like automotive, technology, finance, and industrials. The DAX serves as a benchmark for the German economy, reflecting investor sentiment and overall market performance. Its movements are closely watched globally, making it a key indicator for international investment strategies.

- DAX as a barometer of German economic health: The DAX's performance often mirrors the overall health of the German economy. A rising DAX generally indicates positive economic growth, while a falling DAX often signals concerns about the economic outlook.

- Major companies included in the DAX and their sectors: Prominent DAX companies include giants like Volkswagen, Siemens, Allianz, BASF, and SAP, spanning various crucial sectors of the German economy.

- DAX's correlation with other major European and global indices: The DAX is closely correlated with other major European indices like the CAC 40 (France) and FTSE 100 (UK), as well as global indices like the S&P 500, reflecting interconnectedness in the global financial system.

The Impact of German Elections on the DAX

German federal elections significantly influence the DAX. Different political parties have varying economic platforms, impacting investor confidence and market volatility. The period leading up to and immediately following an election often sees increased market fluctuations. Analyzing the manifestos of major parties and their potential policies offers valuable insights into potential market movements.

- Examples of past elections and their immediate effect on the DAX: Historical data reveals varying responses to election outcomes. For example, elections leading to coalition governments with clear economic platforms sometimes result in more stable DAX performance than those with unpredictable outcomes.

- Analysis of investor reactions to different party victories: Investor sentiment varies based on the perceived economic impact of different parties. Parties perceived as fiscally conservative might be favored, leading to a rise in the DAX, while those seen as more interventionist might trigger uncertainty and volatility.

- The role of coalition governments and their impact on economic stability: Coalition governments often need to compromise on their economic policies, potentially leading to less drastic changes and more stability in the DAX compared to single-party governments with more radical agendas.

Specific Policy Areas and their Effect on the DAX

Specific policy areas have a direct influence on the DAX:

- Fiscal policy: Government spending and deficit levels significantly affect investor confidence. High deficits may lead to concerns about government debt and potentially trigger a sell-off in the DAX.

- Taxation: Corporate tax rates and changes in tax policies directly impact corporate profits and thus the DAX. Lower corporate taxes generally have a positive effect on company valuations and potentially the index.

- Regulation: Environmental regulations, labor laws, and financial regulations influence business costs and competitiveness. Stringent regulations could negatively impact profitability and the DAX, while more lenient regulations could have the opposite effect.

The Relationship Between Economic Performance and DAX Performance

A strong correlation exists between Germany's macroeconomic indicators (GDP growth, inflation, and unemployment) and the DAX's performance. Leading economic indicators, such as manufacturing PMI (Purchasing Managers' Index) and consumer confidence, often predict future DAX movements. Global economic events also significantly affect the German economy and consequently the DAX.

- Historical data illustrating the correlation between economic indicators and DAX performance: Statistical analysis reveals a strong positive correlation between GDP growth and DAX performance. Periods of economic expansion typically coincide with rising DAX levels, and recessions are associated with declines.

- Analysis of the impact of economic crises and recessions on the DAX: Major economic crises, such as the 2008 financial crisis, significantly impacted the DAX, leading to sharp declines. The speed and strength of recovery were also directly linked to the broader economic recovery.

- Discussion of the role of the European Central Bank (ECB) and its monetary policy decisions: The ECB's monetary policy decisions, particularly interest rate changes and quantitative easing programs, have a profound impact on the German economy and the DAX.

Managing Political Risk and Investing in the German Market

Investing in the German market involves managing political risk. Diversification across different sectors and asset classes is a crucial strategy to mitigate this risk. Hedging techniques, such as using options or futures contracts, can help protect against unexpected political events. Thorough due diligence on individual companies and a clear understanding of the political landscape are also essential.

- Different investment strategies for mitigating political risk: A diversified portfolio, including both German and international stocks, bonds, and other assets, can reduce the impact of negative political events.

- Importance of thorough due diligence before investing in German companies: Understanding a company’s exposure to specific political risks, such as regulatory changes or government policies affecting its sector, is vital before investment.

- The role of professional financial advice in navigating political uncertainty: Seeking guidance from experienced financial advisors can be invaluable, particularly during periods of political and economic uncertainty.

Conclusion

Understanding the interplay between the DAX, German politics, and the German economy is crucial for successful investment in the German market. German elections and resulting government policies significantly impact investor sentiment and market volatility. Economic performance, influenced by global events and ECB decisions, strongly correlates with the DAX's trajectory. By carefully analyzing political risks, employing diversification strategies, and staying informed about economic indicators, investors can make better-informed decisions regarding their DAX investments. Stay informed about upcoming elections and economic indicators to make well-informed decisions regarding your DAX investments.

Featured Posts

-

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Presence In Buildings

Apr 27, 2025

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Presence In Buildings

Apr 27, 2025 -

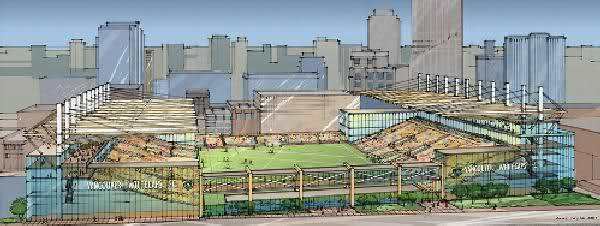

New Whitecaps Stadium Pne Fairgrounds A Potential Location

Apr 27, 2025

New Whitecaps Stadium Pne Fairgrounds A Potential Location

Apr 27, 2025 -

Dax Volatility The Role Of Bundestag Elections And Key Economic Figures

Apr 27, 2025

Dax Volatility The Role Of Bundestag Elections And Key Economic Figures

Apr 27, 2025 -

Trade Deal Delay Carney Suggests Canadas Strategic Wait And See Approach

Apr 27, 2025

Trade Deal Delay Carney Suggests Canadas Strategic Wait And See Approach

Apr 27, 2025 -

Understanding The Risks Ariana Grandes Transformation And The Importance Of Professional Advice

Apr 27, 2025

Understanding The Risks Ariana Grandes Transformation And The Importance Of Professional Advice

Apr 27, 2025