The Broadcom-VMware Deal: A 1,050% Price Hike For AT&T And Potentially Others?

Table of Contents

Understanding the Broadcom-VMware Merger and its Market Dominance

The $61 billion acquisition of VMware by Broadcom represents a significant consolidation of power in the technology sector. Broadcom, already a major player in networking hardware, now controls VMware, a leading provider of virtualization and cloud software. This merger creates a behemoth with immense market influence over crucial aspects of enterprise IT infrastructure. Broadcom's history reveals a pattern of acquisitions followed by adjustments in pricing strategies, raising concerns about the potential for monopolistic practices.

- Market Share: Before the merger, Broadcom and VMware held significant individual market shares in their respective sectors. Their combined market power significantly increases the potential for price manipulation.

- Key Products and Services: Broadcom's portfolio includes networking chips, wireless communication technologies, and storage solutions, while VMware offers virtualization software, cloud management platforms, and security solutions. The combined entity offers a comprehensive suite of enterprise IT solutions.

- Broadcom's Acquisition Track Record: Broadcom has a history of acquiring companies and subsequently raising prices. This pattern has fueled concerns about the potential for similar behavior following the VMware acquisition.

The AT&T Case: A 1,050% Price Hike and its Implications

The reported 1,050% price increase for AT&T following the Broadcom-VMware merger is alarming. While the specifics of the contracts remain largely undisclosed, this dramatic increase illustrates the potential for significant cost escalation for large enterprises. Understanding the reasons behind this surge is crucial for anticipating future pricing trends.

- Contracts and Agreements: The exact details of the contracts between AT&T and the merged entity are not publicly available. However, the sheer magnitude of the price increase suggests a significant shift in pricing strategies.

- AT&T's Response: AT&T's response to the price hike has not been publicly detailed. However, the scale of the increase undoubtedly necessitates a thorough review of their existing agreements and a reassessment of their IT infrastructure strategy.

- Justification for the Increase: Broadcom/VMware needs to provide a clear justification for this massive price increase. It's essential to examine whether this hike is due to increased costs, increased market power, or simply a strategic decision to maximize profits.

Potential Impact on Other Businesses and the Broader Market

The AT&T case serves as a stark warning for other businesses reliant on VMware and Broadcom products. Telecom companies, particularly, are expected to face significant price pressures. Smaller businesses, often lacking the bargaining power of larger corporations, are even more vulnerable to these price hikes. This situation could lead to regulatory scrutiny and antitrust concerns.

- Companies Potentially Affected: Numerous companies across various sectors rely on VMware and Broadcom solutions. Telecom providers, cloud service providers, and large enterprises are particularly vulnerable.

- Mitigation Strategies: Businesses need to develop strategies to mitigate the potential impact of these price hikes. This might include exploring alternative vendors, negotiating favorable contracts, and optimizing their IT infrastructure.

- Regulatory Investigations: The significant price increase raises serious antitrust concerns. Regulatory bodies worldwide are likely to investigate the merger's impact on competition and pricing.

Alternatives and Mitigation Strategies for Businesses

Facing potential price gouging, businesses need to explore proactive strategies. Fortunately, alternatives exist, offering pathways to reduce dependence on Broadcom and VMware. Careful planning and negotiation are key to navigating this challenging landscape.

- Alternative Vendors and Technologies: Several companies offer competing products and services in the networking and virtualization space. Researching and evaluating these alternatives is crucial.

- Negotiating Enterprise Software Contracts: Effective negotiation strategies can help secure favorable pricing and contract terms. Understanding market dynamics and having alternative options strengthens your bargaining position.

- Open-Source Alternatives: Open-source alternatives offer a cost-effective approach, although they may require additional expertise and integration efforts.

Conclusion: Navigating the Post-Merger Landscape of Broadcom and VMware

The Broadcom-VMware merger has significant implications for businesses worldwide. The potential for substantial price increases, as evidenced by the AT&T case, underscores the need for proactive planning. Businesses must carefully analyze their current contracts, explore alternative vendors and technologies, and prepare for potential price increases resulting from this monumental deal. Understanding the implications of this merger for your business's future VMware and Broadcom software costs is paramount to maintaining profitability and competitiveness. Don't wait until you face a 1,050% price hike – take action now to protect your bottom line.

Featured Posts

-

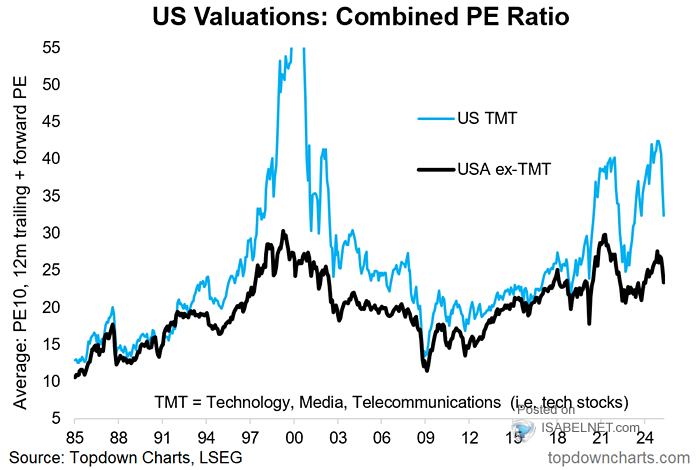

Bof A On Stock Market Valuations Why Investors Can Remain Calm

Apr 28, 2025

Bof A On Stock Market Valuations Why Investors Can Remain Calm

Apr 28, 2025 -

New York Mets Roster Moves Nez Optioned Megill Promoted

Apr 28, 2025

New York Mets Roster Moves Nez Optioned Megill Promoted

Apr 28, 2025 -

Dwyane Wade Praises Doris Burkes Thunder Timberwolves Analysis

Apr 28, 2025

Dwyane Wade Praises Doris Burkes Thunder Timberwolves Analysis

Apr 28, 2025 -

Red Sox Manager Alters Lineup For First Game Of Doubleheader

Apr 28, 2025

Red Sox Manager Alters Lineup For First Game Of Doubleheader

Apr 28, 2025 -

Gpu Market Volatility Explaining The Current Price Fluctuations

Apr 28, 2025

Gpu Market Volatility Explaining The Current Price Fluctuations

Apr 28, 2025