Stock Market Valuations: BofA's Reassuring View For Investors

Table of Contents

BofA's Key Arguments for a Less Overvalued Market

BofA's reassessment of stock market valuations rests on several key pillars, offering a more nuanced picture than simply looking at headline P/E ratios.

Focus on Earnings Growth

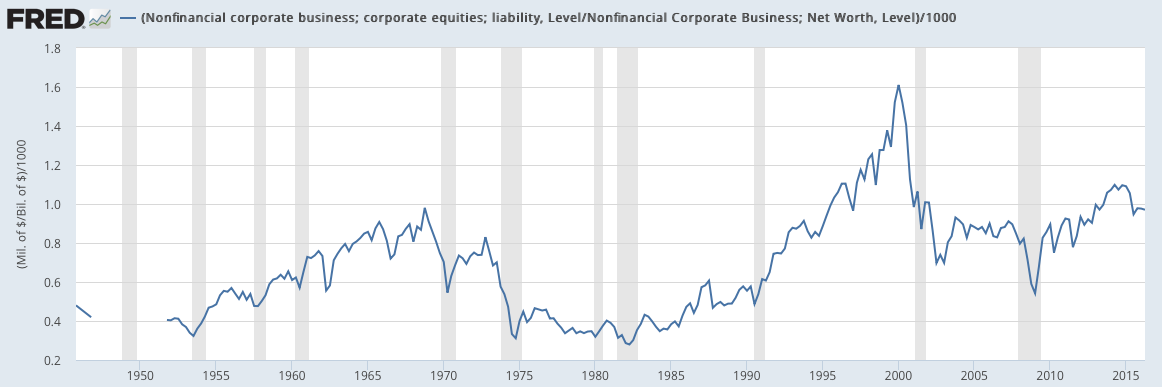

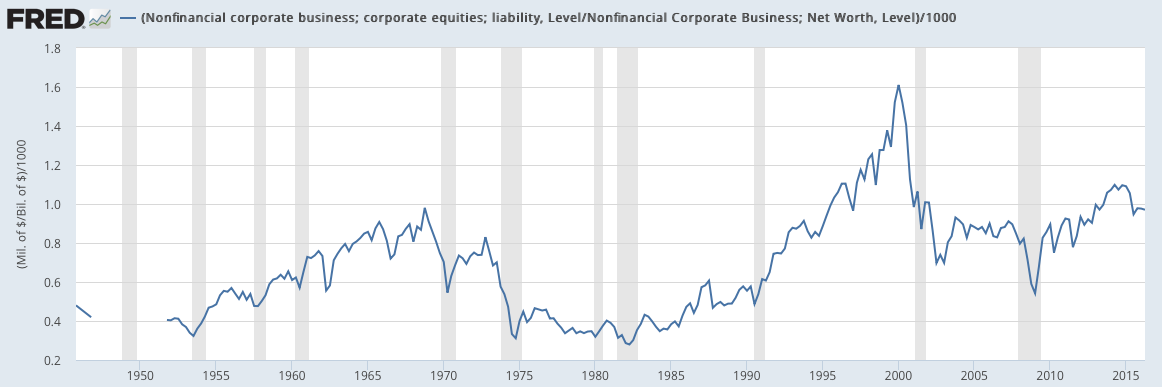

BofA emphasizes that judging stock market valuations solely on current price-to-earnings (P/E) ratios is short-sighted. The real story lies in future earnings growth. High valuations can be entirely justified if companies demonstrate strong and sustainable earnings expansion. Their analysis goes beyond simple projections.

- Analysis of projected earnings growth across various sectors: BofA likely utilizes sophisticated models to forecast earnings growth, taking into account industry trends, economic indicators, and company-specific factors. This granular approach allows for a more accurate assessment of valuation than broad market indices alone.

- Comparison of current P/E ratios to historical averages, adjusted for earnings growth: Instead of relying on static historical P/E ratios, BofA likely adjusts these figures to account for projected growth, giving a more relevant benchmark for current valuations. This allows for a more informed comparison between current market conditions and past periods with similar growth trajectories.

- Discussion of the impact of technological innovation on future earnings: Technological advancements are a key driver of earnings growth across various sectors. BofA likely incorporates the potential impact of disruptive technologies and innovation cycles into their earnings projections, contributing to a more dynamic and future-oriented valuation analysis.

Differentiation Between Sectors

BofA’s analysis doesn't paint the market with a single brush. They highlight the significant disparity in valuations across different market sectors. Some sectors might indeed be overvalued, while others present compelling investment opportunities, showcasing the importance of targeted analysis.

- Identification of undervalued and overvalued sectors: BofA likely identifies specific sectors that are trading at a discount relative to their earnings potential and others trading at a premium. This granular approach is vital for informed investment decision-making.

- Explanation of the factors driving the valuation discrepancies: These discrepancies aren't random; BofA's analysis would pinpoint the underlying reasons—sector-specific growth prospects, regulatory changes, technological disruptions, or macroeconomic factors—causing these differences.

- Examples of specific sectors and their respective valuations: The report likely offers specific examples of sectors deemed undervalued or overvalued, providing concrete illustrations to support their assessment of stock market valuations and facilitating better understanding for investors.

The Role of Interest Rates

Interest rates play a crucial role in influencing stock valuations. Rising interest rates can increase borrowing costs for companies and make alternative investments like bonds more attractive, putting downward pressure on stock prices. However, BofA’s assessment likely incorporates projections for future interest rate movements.

- Discussion of the correlation between interest rates and stock valuations: BofA’s analysis likely explores the historical relationship between interest rate changes and subsequent stock market performance. This helps investors understand the potential impact of future rate hikes or cuts.

- Analysis of the Federal Reserve's monetary policy and its potential influence on the market: The Federal Reserve's actions significantly influence interest rates. BofA’s assessment likely incorporates an analysis of the Fed's likely future policy moves and their potential impact on stock valuations.

- Consideration of alternative investment options in a rising interest rate environment: With rising rates, bonds become more appealing. BofA's analysis may discuss how investors can strategically allocate assets across different asset classes to mitigate risks associated with fluctuating interest rates.

Implications for Investors

BofA's findings have significant implications for how investors should approach the market.

Strategic Portfolio Adjustments

Based on BofA's assessment of stock market valuations, investors may need to re-evaluate their portfolio allocation.

- Recommendations for adjusting portfolio allocations based on BofA’s analysis: Investors might shift assets toward sectors identified as undervalued by BofA, potentially increasing their overall portfolio returns.

- Strategies for mitigating risk in a potentially volatile market: Even with a positive outlook, the market can be volatile. BofA's insights may offer guidance on risk mitigation strategies.

- Importance of diversification across different asset classes: Diversification remains a cornerstone of sound investment strategy. BofA's analysis may underscore the importance of diversification across various sectors and asset classes to reduce overall portfolio risk.

Long-Term Investment Perspective

BofA likely reinforces the importance of a long-term investment perspective. Short-term market fluctuations are normal and shouldn't dictate long-term investment decisions.

- The benefits of a buy-and-hold investment strategy: A buy-and-hold approach can help investors weather short-term volatility and capitalize on long-term market growth.

- The importance of ignoring short-term market noise: Focusing on fundamental analysis and long-term goals helps investors avoid emotional reactions to temporary market swings.

- Long-term growth potential of the stock market: Despite short-term volatility, the stock market has historically demonstrated strong long-term growth potential.

Conclusion

BofA's analysis offers a more nuanced and reassuring view on current stock market valuations than headlines might suggest. Their emphasis on future earnings growth, sector-specific differences, and the role of interest rates provides a framework for investors to make informed decisions. While acknowledging potential risks, BofA suggests opportunities for strategic portfolio adjustments and underscores the importance of a long-term investment horizon. Remember to conduct thorough due diligence and consider seeking professional financial advice before making any investment decisions based on any single analysis, including BofA's assessment of stock market valuations. Understanding stock market valuations is crucial for success, so keep learning and adapting your investment strategy.

Featured Posts

-

Kyivs Dilemma Weighing Trumps Plan To End The Ukraine Conflict

Apr 22, 2025

Kyivs Dilemma Weighing Trumps Plan To End The Ukraine Conflict

Apr 22, 2025 -

Why Robots Struggle To Produce Nike Sneakers A Detailed Look

Apr 22, 2025

Why Robots Struggle To Produce Nike Sneakers A Detailed Look

Apr 22, 2025 -

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 22, 2025

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 22, 2025 -

From Scatological Data To Podcast Success Leveraging Ai For Content Creation

Apr 22, 2025

From Scatological Data To Podcast Success Leveraging Ai For Content Creation

Apr 22, 2025 -

Blue Origin Rocket Launch Delayed Subsystem Malfunction Reported

Apr 22, 2025

Blue Origin Rocket Launch Delayed Subsystem Malfunction Reported

Apr 22, 2025