Stock Market Today: Dow Futures, Dollar, And Trade War Concerns

Table of Contents

Dow Futures: A Glimpse into Tomorrow's Market

Dow Futures contracts are derivative instruments that allow investors to speculate on the future price movements of the Dow Jones Industrial Average (DJIA). They essentially represent a bet on where the Dow will be at a specific future date. Understanding Dow Futures is key because they provide a valuable pre-market indicator, offering a glimpse into the potential direction of the stock market before the official opening bell. These futures contracts are actively traded throughout the night and early morning, reflecting the sentiment of market participants based on overnight news and events.

- Dow Futures and the DJIA: Dow Futures prices are closely correlated with the actual DJIA. Significant deviations can signal potential shifts in market sentiment or reveal underlying factors influencing investor expectations.

- Recent Dow Futures Trends: Analyzing recent trends is vital. A consistently upward-trending Dow Futures market often suggests a bullish outlook for the upcoming trading day, while downward trends may indicate bearish sentiment. Examining the magnitude of these movements provides further insights.

- Influencing Factors: Global events, such as geopolitical instability or unexpected economic data releases (e.g., inflation reports, employment figures), significantly impact Dow Futures. Positive news generally pushes futures higher, and vice versa.

- Tracking Dow Futures: Reliable sources for tracking Dow Futures include major financial news websites like Yahoo Finance, Google Finance, Bloomberg, and dedicated futures trading platforms. These platforms provide real-time data and charting tools for detailed analysis.

The Dollar's Role in Global Market Dynamics

The US dollar's strength (or weakness), as measured by the US Dollar Index (DXY), plays a significant role in global market dynamics. A strong dollar makes US exports more expensive and imports cheaper, affecting the profitability of multinational corporations and impacting the overall stock market. Trade tensions often exacerbate this effect, as currency fluctuations become another layer of uncertainty in international trade. The Forex (foreign exchange) market, where currencies are traded, reflects this intricate relationship.

- Impact on Company Profitability: A strong dollar can negatively impact US companies that rely heavily on exports, reducing their revenue and potentially depressing their stock prices. Conversely, it can benefit companies that import significant quantities of goods.

- Multinational Corporations: Currency fluctuations represent a major risk for multinational corporations, creating unpredictable changes in their earnings and impacting investment decisions. Hedging strategies are often employed to mitigate these risks.

- Historical Influence: Examining past periods of dollar strength or weakness reveals its clear influence on stock market performance. Historical data is a valuable tool for understanding these patterns.

- Tracking the Dollar: The US Dollar Index and exchange rates can be tracked via various sources, including those mentioned for Dow Futures tracking, as well as specialized Forex trading websites and apps.

Trade War Concerns and Their Market Impact

Ongoing trade wars, characterized by the imposition of tariffs and trade restrictions, introduce significant uncertainty into the global economy. This uncertainty directly impacts investor confidence, leading to increased market volatility. Specific sectors are disproportionately affected, experiencing heightened risk and potential for significant price swings. Geopolitical risk and investment risk assessments need to account for this ongoing situation.

- Impact on Specific Industries: Industries heavily reliant on international trade, such as manufacturing and agriculture, are particularly vulnerable to tariffs and trade disruptions. Stock prices in these sectors often reflect the impact of these trade policies.

- Impact on Investment and Spending: Trade uncertainty discourages business investment and can dampen consumer spending, creating a ripple effect throughout the economy and affecting stock market performance.

- Historical Examples: Studying historical trade wars and their consequences provides valuable insights into potential long-term market effects. These analyses reveal patterns and help predict potential outcomes.

- Mitigating Trade War Risks: Investors can mitigate trade war risks through diversification, hedging strategies, and careful stock selection, focusing on companies less exposed to international trade friction.

Conclusion

The stock market today is a dynamic environment influenced by the interconnectedness of various factors. Understanding the implications of Dow Futures, the dollar's strength, and the prevailing concerns surrounding trade wars is critical for informed investment decisions. Keeping a close eye on these indicators and their impact provides crucial insights into market trends and potential risks. Regularly monitoring the stock market today, analyzing these interconnected elements, and utilizing available resources for market analysis will allow you to develop a more robust investment strategy. Stay informed about daily market movements and the evolving landscape of global trade to navigate the stock market effectively.

Featured Posts

-

Russias Easter Truce Ends Renewed Fighting In Ukraine

Apr 22, 2025

Russias Easter Truce Ends Renewed Fighting In Ukraine

Apr 22, 2025 -

A Pan Nordic Defense Strategy Integrating Swedish Armor And Finnish Infantry

Apr 22, 2025

A Pan Nordic Defense Strategy Integrating Swedish Armor And Finnish Infantry

Apr 22, 2025 -

Why Robots Struggle To Produce Nike Sneakers A Detailed Look

Apr 22, 2025

Why Robots Struggle To Produce Nike Sneakers A Detailed Look

Apr 22, 2025 -

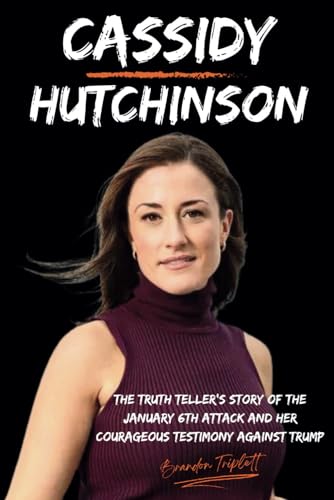

Cassidy Hutchinsons January 6th Memoir What To Expect This Fall

Apr 22, 2025

Cassidy Hutchinsons January 6th Memoir What To Expect This Fall

Apr 22, 2025 -

Lab Owner Pleads Guilty To Covid Test Result Fraud

Apr 22, 2025

Lab Owner Pleads Guilty To Covid Test Result Fraud

Apr 22, 2025