Recent Turmoil Highlights Pre-Existing Private Credit Risks: Credit Weekly Review

Table of Contents

Increased Volatility Exposes Liquidity Mismatches in Private Credit

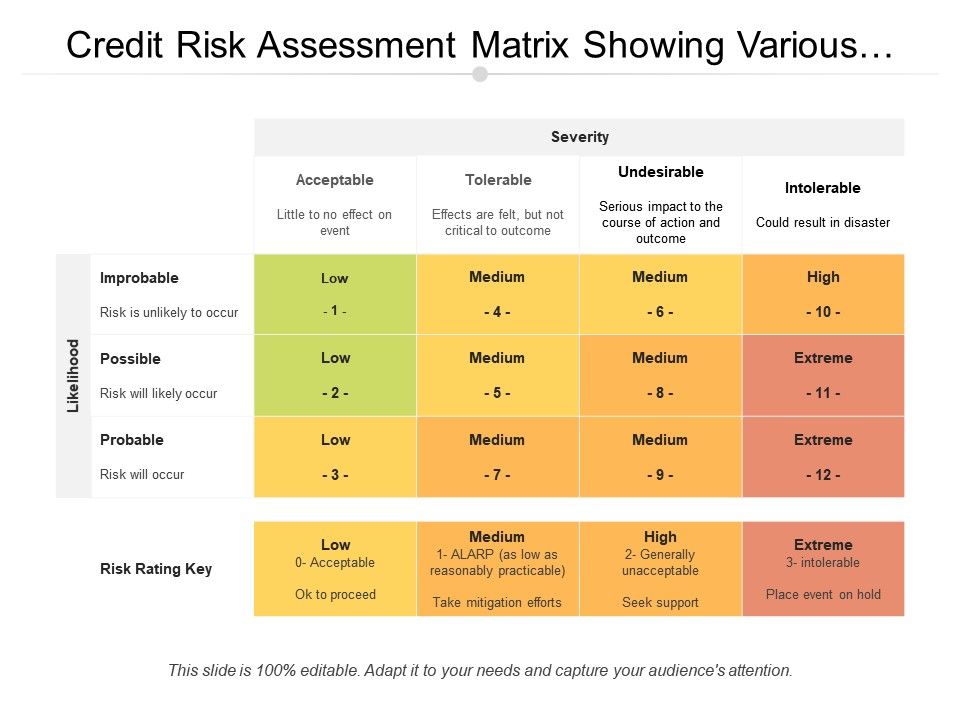

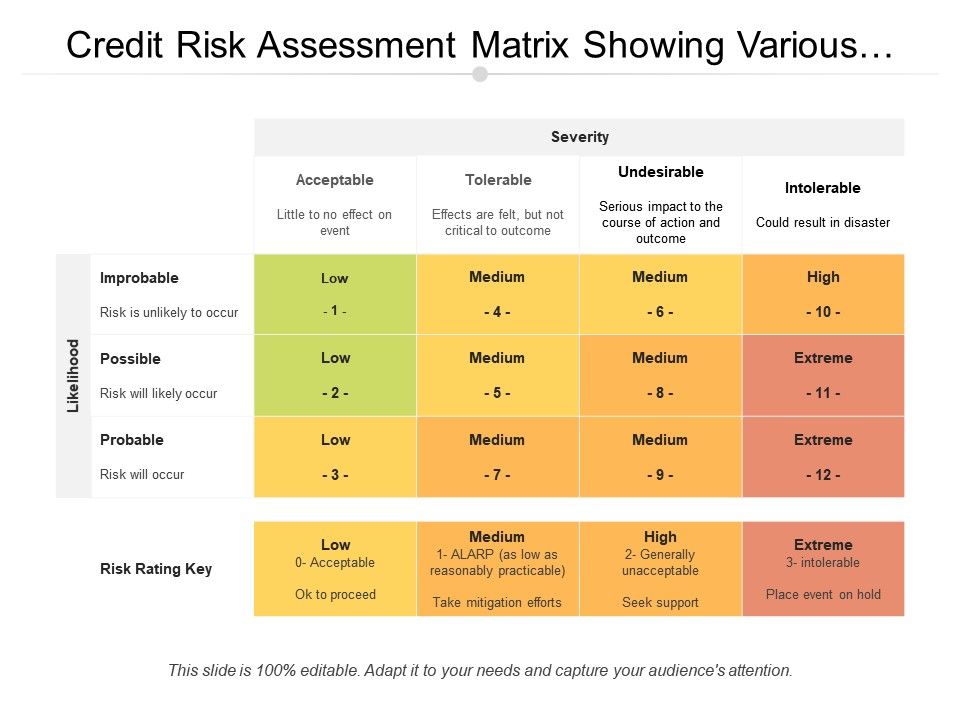

Liquidity mismatches represent a significant pre-existing private credit risk. Private credit funds often invest in illiquid assets, meaning they can't be easily converted to cash. This mismatch becomes critical during times of market stress. When investors seek to redeem their investments, funds may struggle to meet their obligations, potentially leading to a liquidity crisis. Recent events have starkly demonstrated this vulnerability.

- Examples of funds facing liquidity issues: Several private credit funds experienced redemption requests exceeding their capacity to liquidate assets quickly, forcing them to restrict withdrawals or even suspend redemptions altogether.

- Impact on investor redemptions: The inability to quickly liquidate assets has resulted in delays and difficulties for investors seeking to redeem their investments in private debt funds, impacting investor confidence.

- The role of leverage in exacerbating liquidity problems: High levels of leverage within private credit funds amplify both gains and losses. During times of stress, margin calls can force the liquidation of assets at potentially unfavorable prices, worsening liquidity issues. This emphasizes the importance of understanding private credit liquidity and managing illiquidity risk.

Valuation Challenges in the Private Credit Market

Accurately valuing private credit assets is inherently challenging, particularly during periods of uncertainty. Unlike publicly traded securities with readily available market prices, private credit instruments lack transparent and frequent pricing. This opaqueness creates significant hurdles, especially concerning pre-existing private credit risks.

- Challenges in obtaining reliable market data for private credit instruments: The lack of standardized valuation methodologies and the limited availability of comparable transactions make it difficult to determine the fair value of private credit assets, especially distressed debt.

- The impact of opaque pricing on investor transparency and confidence: Lack of transparency can lead to a lack of confidence amongst investors, impacting the stability of the overall market. This is further complicated by the lack of readily available market data.

- Potential for overvaluation or undervaluation leading to misallocation of capital: Inaccurate valuations can lead to misallocation of capital, exposing investors to unexpected losses. Robust valuation processes are crucial to mitigate this pre-existing private credit risk.

Concentrated Risk and Counterparty Risk in Private Credit Portfolios

Pre-existing private credit risks are amplified by portfolio concentration and counterparty risk. Many private credit funds concentrate their investments in specific sectors or individual borrowers. While this might generate higher returns in favorable conditions, it significantly increases risk during market downturns.

- Examples of concentrated exposures in specific industries: Over-reliance on a single sector or borrower increases vulnerability to sector-specific shocks and defaults.

- Increased default risk among borrowers: Market volatility can significantly increase the likelihood of defaults, particularly for borrowers with weaker credit profiles or those facing industry-specific challenges.

- The role of due diligence and risk management in mitigating these risks: Thorough due diligence, robust risk management frameworks, and careful portfolio diversification are critical to mitigate concentration risk and counterparty risk within private credit portfolios.

The Role of Leverage in Amplifying Private Credit Risks

Leverage is often employed in private credit strategies to amplify returns. However, it also significantly magnifies losses during market downturns. Rising interest rates further exacerbate this risk.

- Types of leverage employed in private credit funds: Various forms of leverage are used, including bank loans, repurchase agreements, and other debt financing mechanisms. Understanding these intricacies is crucial for assessing the overall private credit risk.

- The effect of margin calls during market downturns: During market downturns, margin calls can force the liquidation of assets, potentially leading to significant losses and exacerbating liquidity issues. This is a significant pre-existing private credit risk.

- Strategies for managing leverage effectively: Effective leverage management involves careful consideration of risk tolerance, diversification, and stress testing scenarios.

Mitigating Pre-Existing Private Credit Risks – A Call to Action

Recent market turmoil has underscored the importance of addressing pre-existing private credit risks. The key takeaways highlight the need for robust risk management, thorough due diligence, and careful leverage management. Investors and fund managers must prioritize diversification across sectors and borrowers, implement rigorous valuation processes, and proactively manage liquidity risks.

To navigate the complexities of the private credit market, investors should regularly review their portfolios and strategies, ensuring alignment with their risk tolerance and investment objectives. Seek professional advice to understand and effectively manage the inherent pre-existing private credit risks. Further resources on private credit risk management can be found [link to relevant resources]. By proactively addressing these pre-existing private credit risks, investors can enhance the resilience of their portfolios and navigate the evolving landscape of private credit investments.

Featured Posts

-

Belinda Bencic Reaches Abu Dhabi Open Final

Apr 27, 2025

Belinda Bencic Reaches Abu Dhabi Open Final

Apr 27, 2025 -

Office365 Security Breach Millions Stolen Criminal Charges Filed

Apr 27, 2025

Office365 Security Breach Millions Stolen Criminal Charges Filed

Apr 27, 2025 -

Canadian Election Carney Highlights Trumps Aggressive Trade Agenda

Apr 27, 2025

Canadian Election Carney Highlights Trumps Aggressive Trade Agenda

Apr 27, 2025 -

Bencics Stylish Abu Dhabi Open Victory

Apr 27, 2025

Bencics Stylish Abu Dhabi Open Victory

Apr 27, 2025 -

Whitecaps Eyeing New Stadium Pne Fairgrounds Talks Confirmed

Apr 27, 2025

Whitecaps Eyeing New Stadium Pne Fairgrounds Talks Confirmed

Apr 27, 2025

Latest Posts

-

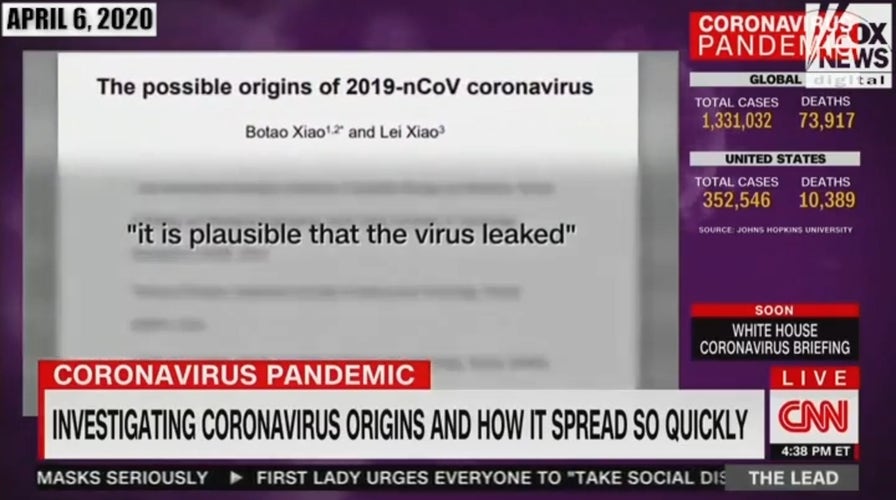

Pandemic Fraud Lab Owner Convicted Of Falsifying Covid Test Results

Apr 28, 2025

Pandemic Fraud Lab Owner Convicted Of Falsifying Covid Test Results

Apr 28, 2025 -

Covid 19 Test Fraud Lab Owner Admits To Falsifying Results

Apr 28, 2025

Covid 19 Test Fraud Lab Owner Admits To Falsifying Results

Apr 28, 2025 -

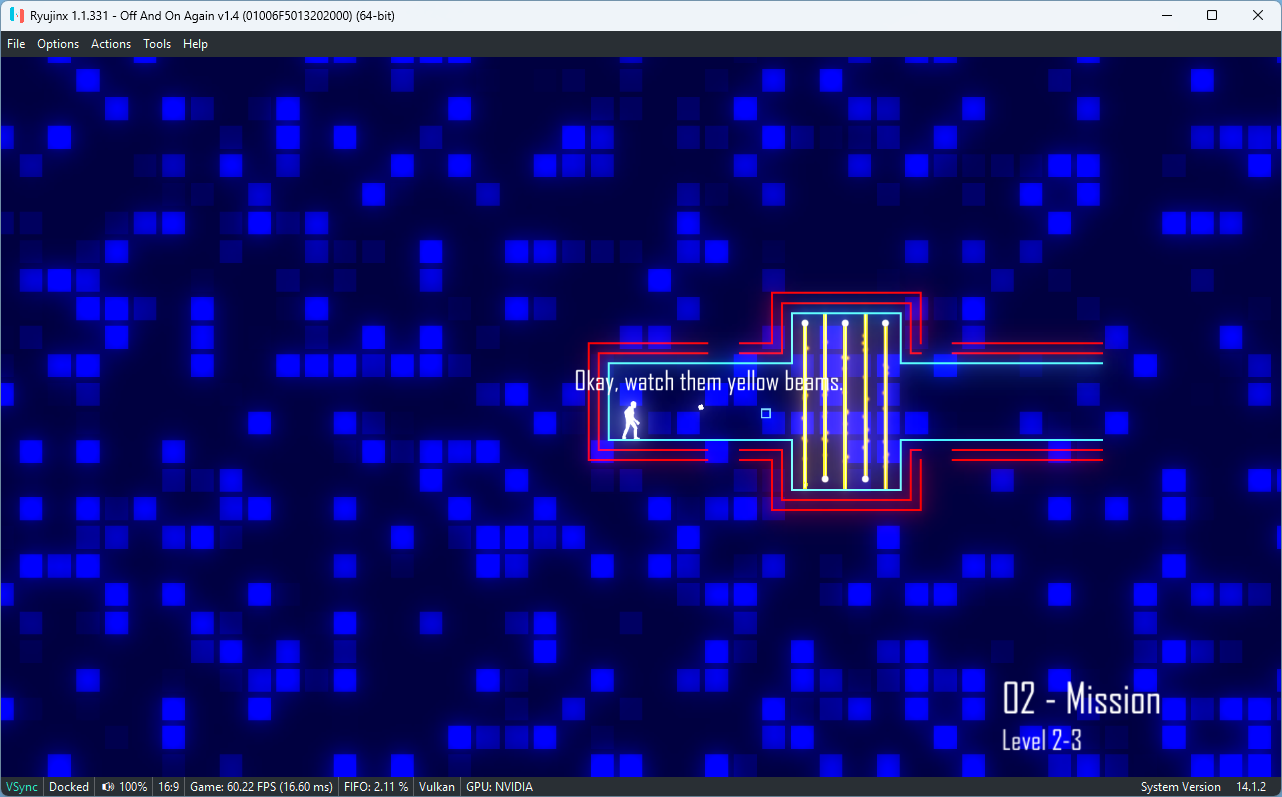

Nintendos Action Forces Ryujinx Emulator To Cease Development

Apr 28, 2025

Nintendos Action Forces Ryujinx Emulator To Cease Development

Apr 28, 2025 -

Lab Owner Pleads Guilty To Falsifying Covid 19 Test Results

Apr 28, 2025

Lab Owner Pleads Guilty To Falsifying Covid 19 Test Results

Apr 28, 2025 -

Can We Curb Americas Truck Bloat Exploring Potential Solutions

Apr 28, 2025

Can We Curb Americas Truck Bloat Exploring Potential Solutions

Apr 28, 2025