Land Your Dream Private Credit Role: 5 Do's And Don'ts To Follow

Table of Contents

5 DO's to Land Your Dream Private Credit Role

Do 1: Master the Fundamentals of Private Credit

A successful private credit career hinges on a solid understanding of core concepts. Proficiency in credit analysis, financial modeling, and valuation is non-negotiable. This means more than just theoretical knowledge; you need practical skills.

- Gain proficiency in financial modeling software: Excel is essential, but familiarity with Bloomberg Terminal and other industry-standard tools gives you a significant edge.

- Study credit risk assessment methodologies: Understand different models, including credit scoring, qualitative assessments, and covenant analysis.

- Develop a strong understanding of leveraged finance and debt structures: This includes various debt instruments, capital structures, and the intricacies of leveraged buyouts (LBOs).

- Network with professionals in the private credit industry: Attend industry events and connect with professionals on LinkedIn to gain insights and build relationships.

Do 2: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. A generic application won't cut it in the competitive private credit market. Target each application to the specific job description.

- Quantify achievements whenever possible: Instead of saying "Improved efficiency," say "Improved efficiency by 15% resulting in $X cost savings."

- Highlight relevant keywords from job descriptions: Use the same language used in the job posting to demonstrate you understand the requirements.

- Craft a compelling narrative: Show your passion for private credit and how your skills and experience align with the firm's investment strategy.

- Use action verbs: Strong action verbs make your accomplishments stand out (e.g., "managed," "analyzed," "developed," "implemented").

Do 3: Ace the Private Credit Interview

Private credit interviews are rigorous, testing both your technical skills and behavioral attributes. Preparation is key to success.

- Practice common interview questions: Prepare for both technical questions (e.g., "Walk me through a discounted cash flow (DCF) analysis," "Explain different types of credit risk") and behavioral questions (e.g., "Tell me about a time you failed," "Describe your teamwork experience").

- Research the firm and the interviewer thoroughly: Understand their investment strategy, recent deals, and the interviewer's background and experience.

- Prepare insightful questions to ask the interviewer: Demonstrates your interest and engagement. Avoid questions easily answered through basic research.

- Demonstrate your understanding of market trends in private credit: Stay updated on current events and market dynamics impacting the industry.

Do 4: Network Strategically within the Private Credit Industry

Networking is crucial for uncovering hidden job opportunities and establishing valuable relationships.

- Attend industry events and conferences: Network with professionals, learn about new trends, and make connections.

- Utilize LinkedIn effectively: Optimize your profile, connect with professionals in private credit, and engage in relevant conversations.

- Conduct informational interviews: Reach out to professionals for informational interviews to learn about their roles and gain insights.

- Join relevant professional organizations: Become a member of organizations focused on private credit or finance.

Do 5: Showcase Your Passion and Enthusiasm for Private Credit

Genuine interest and commitment are essential. Employers want dedicated individuals passionate about the industry.

- Stay updated on industry news and trends: Read industry publications, follow key players on LinkedIn, and attend webinars.

- Develop a strong understanding of the firm's investment strategy: Research the firm's portfolio, investment focus, and recent transactions.

- Demonstrate your eagerness to learn and contribute: Show that you're willing to put in the work and are a quick learner.

- Express a long-term commitment to a career in private credit: Convey your desire to build a career in the industry, not just secure a job.

5 DON'TS to Avoid When Seeking a Private Credit Role

Don't 1: Neglect Technical Skills

Lack of essential technical skills is a major disadvantage. You need a strong foundation in finance and accounting.

- Underestimating the importance of financial modeling: Mastering financial modeling is critical for success in private credit.

- Ignoring the need for strong analytical skills: You'll be analyzing complex financial data and making informed decisions based on your analysis.

- Lack of understanding of credit analysis principles: Understanding credit risk assessment and different debt structures is vital.

Don't 2: Submit a Generic Resume and Cover Letter

Using a generic application shows a lack of effort and reduces your chances of success.

- Failing to tailor your application to each specific role: Each application should be tailored to highlight skills relevant to the specific job description.

- Not highlighting relevant experience and skills: Focus on the skills and experience that directly relate to the job requirements.

- Using generic templates without personalization: Generic templates lack the personal touch that sets you apart from other applicants.

Don't 3: Underprepare for Interviews

Poor interview preparation reflects poorly on your professionalism and commitment.

- Lack of research about the firm and the interviewer: Research is essential to demonstrate your genuine interest.

- Failing to practice common interview questions: Practice answering common questions aloud to improve your delivery.

- Not having thoughtful questions to ask: Asking insightful questions demonstrates your curiosity and engagement.

Don't 4: Ignore Networking Opportunities

Networking is essential for discovering job opportunities and building relationships.

- Missing opportunities to connect with industry professionals: Actively seek out opportunities to connect with professionals in your field.

- Failing to build relationships that could lead to job leads: Networking is about building long-term relationships, not just collecting contacts.

- Not leveraging online platforms for networking: Utilize LinkedIn, industry forums, and other online platforms to expand your network.

Don't 5: Appear Unenthusiastic or Uninformed

A lack of interest or knowledge will quickly disqualify you.

- Showing limited understanding of private credit or the firm: Demonstrate your knowledge and understanding of the industry and the specific firm.

- Lack of engagement during interviews: Engage actively in the conversation, ask questions, and show your enthusiasm.

- Failing to demonstrate a genuine passion for the field: Show your passion and genuine interest in private credit.

Conclusion: Successfully Landing Your Private Credit Role

Securing your dream private credit role requires a strategic approach. Mastering technical skills, crafting a targeted application, and actively networking are key. By following the do's and avoiding the don'ts outlined in this article, you'll significantly increase your chances of landing your dream private credit role and embarking on a rewarding career in this dynamic field. Start applying these strategies today and take the first step towards your successful private credit career.

Featured Posts

-

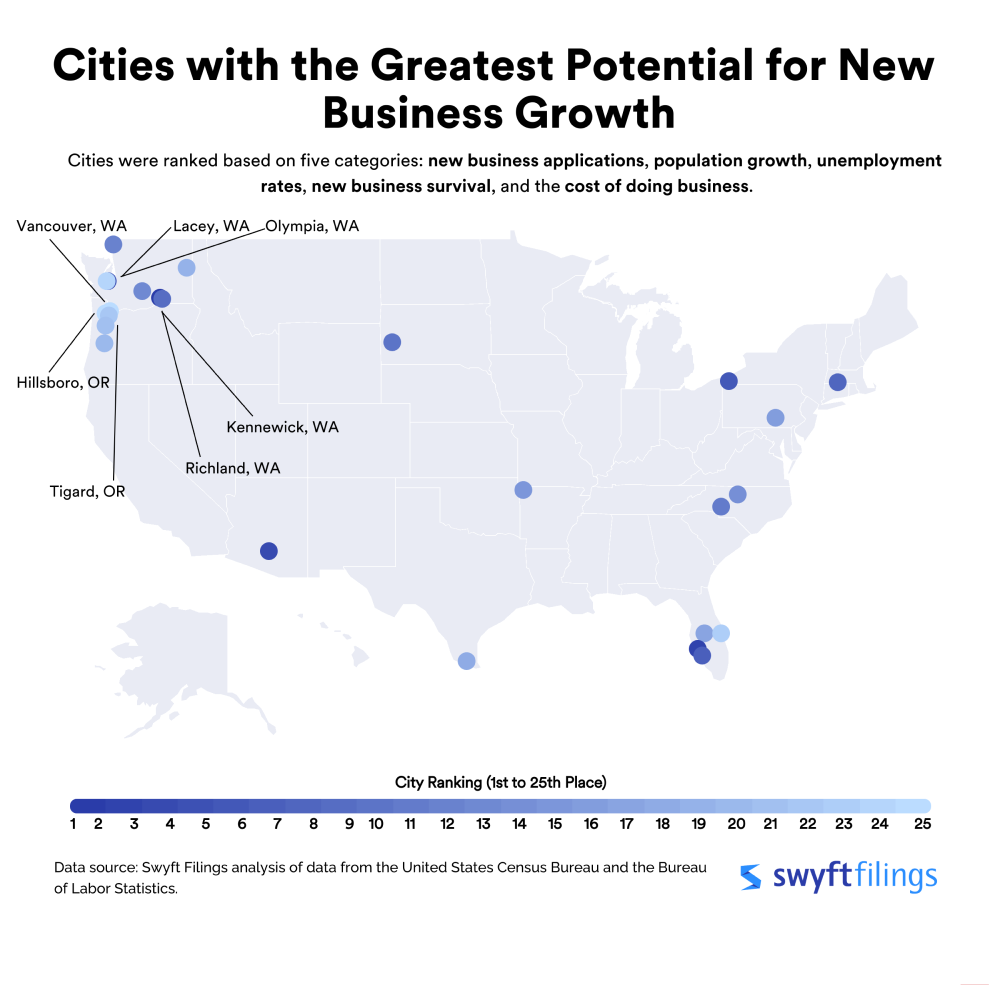

Mapping The Rise Of New Business Hubs Across The Nation

Apr 28, 2025

Mapping The Rise Of New Business Hubs Across The Nation

Apr 28, 2025 -

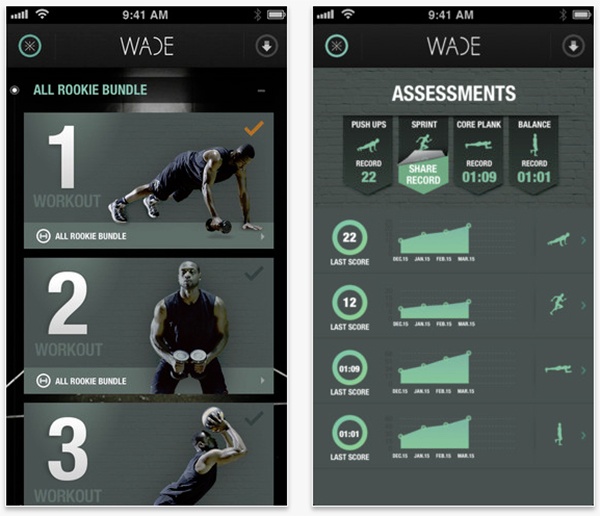

Doris Burke Earns Dwyane Wades Approval For Thunder Timberwolves Game Analysis

Apr 28, 2025

Doris Burke Earns Dwyane Wades Approval For Thunder Timberwolves Game Analysis

Apr 28, 2025 -

Examining The National Scope Of Trumps Campus Crackdown

Apr 28, 2025

Examining The National Scope Of Trumps Campus Crackdown

Apr 28, 2025 -

Over The Counter Birth Control Implications For Reproductive Rights After Roe V Wade

Apr 28, 2025

Over The Counter Birth Control Implications For Reproductive Rights After Roe V Wade

Apr 28, 2025 -

From Federal To State Local The Reality Of Job Hunting After Layoffs

Apr 28, 2025

From Federal To State Local The Reality Of Job Hunting After Layoffs

Apr 28, 2025