High Stock Valuations And Investor Concerns: BofA's Take

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's assessment of the current market is nuanced, avoiding a simple "bullish" or "bearish" label. While acknowledging the impressive growth seen in certain sectors, they express caution regarding the overall high stock valuations. Their analysis often incorporates predictions for slower economic growth compared to previous years, factoring in persistent inflation and the impact of interest rate hikes. Data from BofA's recent reports suggests a cautious outlook, with moderate growth forecasts tempered by significant uncertainties.

- Key Market Indicators: BofA monitors a range of indicators, including the S&P 500 price-to-earnings ratio (P/E), inflation rates, and consumer confidence indices. Their analysis incorporates these data points to create a comprehensive picture.

- Overvalued and Undervalued Sectors: BofA's research typically highlights specific sectors they deem overvalued (potentially vulnerable to corrections) and undervalued (offering potential opportunities). These designations are based on a multifaceted valuation approach, combining fundamental analysis with macroeconomic forecasts.

- Supporting Reports and Publications: For detailed insights, investors should refer to BofA's regularly published market commentaries, research notes, and client reports available through their professional channels. These documents provide a comprehensive foundation for understanding their full market outlook.

Identifying Sources of Investor Anxiety

The anxieties surrounding high stock valuations stem from several interconnected factors:

- Inflation's Impact: Persistent inflation erodes purchasing power and increases the cost of doing business, impacting corporate profitability and potentially triggering stock price corrections. BofA's analysis likely incorporates inflation projections and their potential consequences for different sectors.

- Interest Rate Hikes: Central banks' efforts to combat inflation through interest rate hikes increase borrowing costs for companies, reducing profitability and potentially impacting stock valuations. BofA’s forecasts regarding interest rate trajectories are critical for evaluating market risk.

- Geopolitical Risks and Market Uncertainty: Geopolitical events, such as the ongoing war in Ukraine and other global conflicts, introduce significant uncertainty into the market, affecting investor confidence and stock prices. BofA incorporates geopolitical risk assessment into their market projections.

- Recessionary Fears: The combination of high inflation, interest rate hikes, and geopolitical uncertainty raises concerns about a potential economic recession, further dampening investor sentiment and potentially impacting stock valuations significantly.

BofA's Recommendations for Investors

BofA generally advises a cautious yet strategic approach to investing in this environment of high stock valuations. They stress the importance of diversification and risk management.

- Portfolio Adjustments: BofA might suggest sector rotation, shifting investments from potentially overvalued sectors to those deemed more resilient or undervalued. They may advocate for incorporating more defensive stocks into portfolios.

- Asset Allocation: Their recommendations on asset allocation likely emphasize a balanced approach, potentially recommending a shift toward fixed-income securities or other less volatile asset classes to mitigate risk.

- Risk Management: BofA's guidance might include adopting hedging strategies to protect portfolios from market downturns. This could involve utilizing options or other derivative instruments.

- Long-Term Perspective: They consistently emphasize the importance of maintaining a long-term investment horizon, emphasizing that short-term market fluctuations should not dictate long-term investment strategies.

Alternative Investment Strategies

BofA might suggest diversifying into alternative investment strategies to mitigate the risks associated with high stock valuations.

- Bonds: While bond yields may be low relative to historical averages, they offer a relatively stable alternative to stocks in a volatile market. BofA might provide guidance on selecting appropriate bond types based on risk tolerance.

- Real Estate: Real estate investments can offer diversification and potential inflation hedging, though liquidity can be a concern. BofA's insights into the real estate market are valuable for assessing potential opportunities and risks.

Navigating High Stock Valuations: Actionable Insights from BofA

In conclusion, BofA's perspective on high stock valuations underscores the need for a cautious yet proactive approach to investing. Their analysis highlights the various factors contributing to investor anxiety, including inflation, interest rate hikes, and geopolitical risks. BofA's recommendations emphasize diversification, risk management, and a long-term investment strategy. By understanding BofA’s insights into managing high stock valuations, and incorporating their guidance regarding portfolio adjustments and alternative investment strategies, investors can better navigate this challenging environment. To gain a deeper understanding of BofA’s complete analysis and its implications for your portfolio, consult their latest research reports. For personalized financial advice tailored to your unique circumstances, seek guidance from a qualified financial advisor. Remember, effectively managing high stock valuation concerns requires a comprehensive and informed strategy.

Featured Posts

-

From Times Trump Interview Canada China And The Question Of A Third Term

Apr 28, 2025

From Times Trump Interview Canada China And The Question Of A Third Term

Apr 28, 2025 -

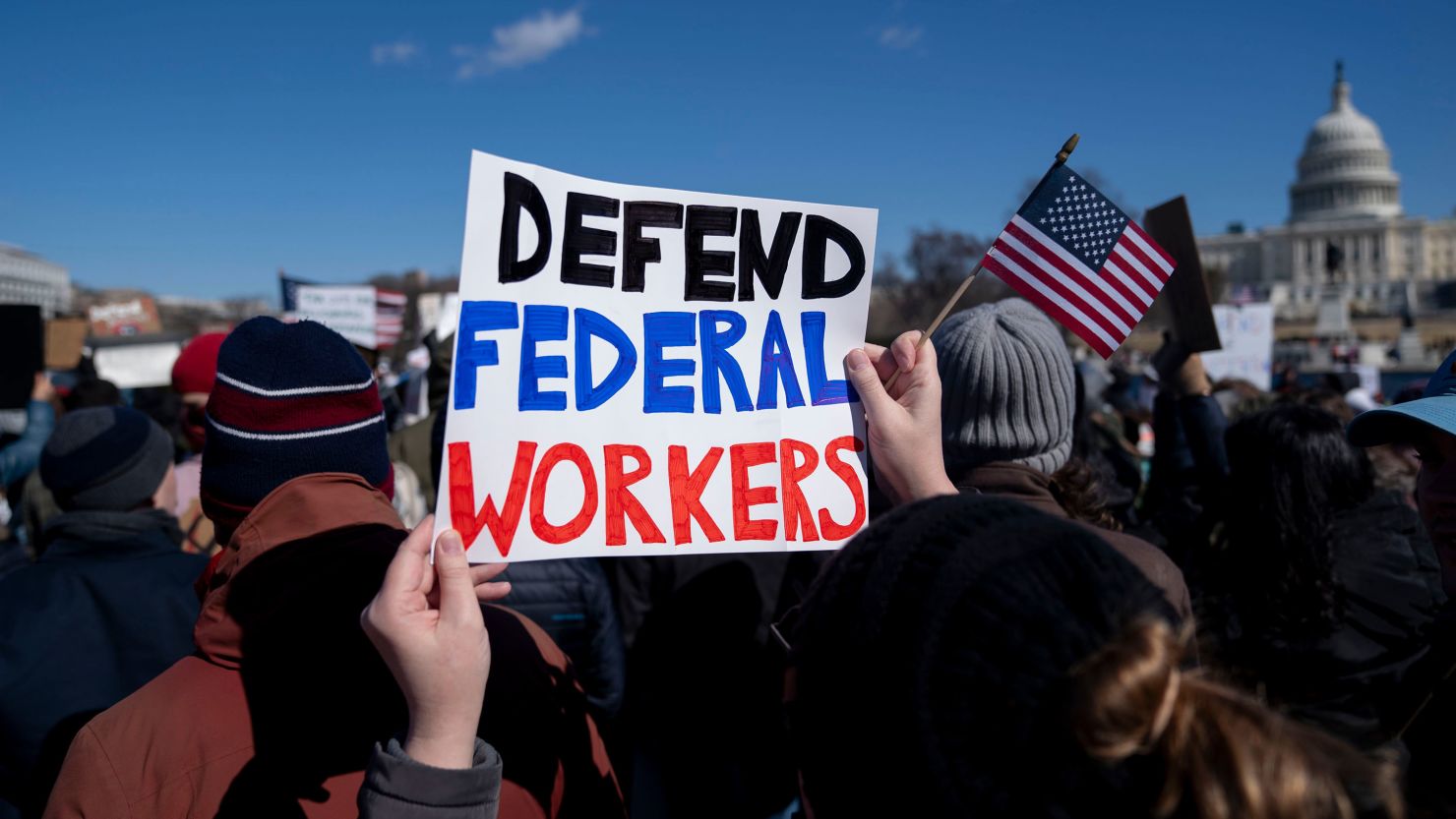

Laid Off Federal Workers Finding State And Local Jobs A Realistic Look

Apr 28, 2025

Laid Off Federal Workers Finding State And Local Jobs A Realistic Look

Apr 28, 2025 -

Is Kuxius Solid State Power Bank Worth The Higher Price

Apr 28, 2025

Is Kuxius Solid State Power Bank Worth The Higher Price

Apr 28, 2025 -

Funeral Of Pope Francis A Gathering Of World Leaders

Apr 28, 2025

Funeral Of Pope Francis A Gathering Of World Leaders

Apr 28, 2025 -

Understanding The Warning Signs Of A Silent Divorce

Apr 28, 2025

Understanding The Warning Signs Of A Silent Divorce

Apr 28, 2025

Latest Posts

-

Assessing The Economic Fallout The Canadian Travel Boycott And The Us Economy

Apr 28, 2025

Assessing The Economic Fallout The Canadian Travel Boycott And The Us Economy

Apr 28, 2025 -

Real Time Economic Analysis The Impact Of The Canadian Travel Boycott On The Us

Apr 28, 2025

Real Time Economic Analysis The Impact Of The Canadian Travel Boycott On The Us

Apr 28, 2025 -

Posthaste Canadian Travel Boycotts Real Time Impact On The Us Economy

Apr 28, 2025

Posthaste Canadian Travel Boycotts Real Time Impact On The Us Economy

Apr 28, 2025 -

Ev Mandate Opposition Car Dealerships Renew Their Fight

Apr 28, 2025

Ev Mandate Opposition Car Dealerships Renew Their Fight

Apr 28, 2025 -

Resistance Grows Car Dealers Challenge Ev Sales Quotas

Apr 28, 2025

Resistance Grows Car Dealers Challenge Ev Sales Quotas

Apr 28, 2025