FTC Appeals Microsoft-Activision Merger Ruling

Table of Contents

The FTC's Arguments Against the Merger

The FTC's opposition to the Microsoft-Activision merger rests on several key concerns, primarily focused on market dominance and its potential negative impact on competition and consumers.

Concerns about Market Domination

The FTC argues that the merger would grant Microsoft an unfair competitive advantage, potentially stifling competition in the console and cloud gaming markets. This concern stems from several factors:

- Microsoft's dominance in the Xbox console market: While not the outright leader, Microsoft holds a significant market share, and the acquisition of Activision Blizzard's substantial portfolio would further enhance this position.

- Concerns about exclusive titles hindering competition from PlayStation and Nintendo: The FTC worries that key Activision Blizzard titles, especially Call of Duty, could become exclusive to Xbox, disadvantaging competitors like PlayStation and Nintendo. This could lead to a decline in market share and innovation for these companies.

- The potential for higher prices and fewer choices for gamers: Reduced competition could result in higher prices for games and gaming subscriptions, and fewer choices for consumers. The FTC's analysis suggests this merger could limit the availability of popular titles across different platforms.

- Analysis of Microsoft's market share in gaming: The FTC's argument hinges on a comprehensive analysis of Microsoft's existing market share and the projected increase resulting from the Activision Blizzard acquisition. This analysis is central to their case.

Impact on Game Developers

The FTC also alleges that the merger could harm independent game developers by limiting their access to distribution channels and potentially forcing them into unfavorable contracts.

- Discussion on the potential for anti-competitive practices against smaller studios: The FTC suggests that Microsoft could leverage its increased market power to disadvantage smaller studios, potentially squeezing them out of the market.

- Impact on innovation and diversity in the gaming market: Less competition could stifle innovation and reduce the diversity of games available to consumers. The loss of independent developers could lead to a homogenization of the gaming landscape.

- Analysis of the long-term effects on game development: The FTC's concerns extend beyond immediate impacts, analyzing the potential long-term effects on the health and dynamism of the game development industry.

Call of Duty's Significance

The FTC emphasizes the importance of Call of Duty, arguing its exclusivity would severely damage competitors like PlayStation.

- Analysis of Call of Duty's market share and popularity: Call of Duty is a consistently top-selling franchise, and its potential exclusivity is a major point of contention in the FTC's argument.

- Discussion of potential strategies Microsoft could use to leverage Call of Duty's dominance: The FTC outlines potential strategies Microsoft could use to leverage Call of Duty's dominance to further its market share and harm competitors.

- Examination of potential remedies proposed by the FTC: The FTC has proposed remedies aimed at preventing Microsoft from leveraging Call of Duty to stifle competition.

Microsoft's Defense

Microsoft has countered the FTC's arguments, emphasizing the benefits of the merger and proposing remedies to address antitrust concerns.

Arguments for the Merger's Benefits

Microsoft claims the acquisition will benefit gamers by expanding access to games and fostering innovation.

- Arguments for increased game availability on various platforms: Microsoft argues that the merger will actually increase the availability of Activision Blizzard games across different platforms.

- Promises of investment in game development and technology: Microsoft promises increased investment in game development and technology, leading to improved gaming experiences for consumers.

- Claims of benefits for consumers through lower prices or subscription services: Microsoft suggests that the merger could lead to lower prices or more attractive subscription services for gamers.

Addressing Antitrust Concerns

Microsoft has proposed various remedies to address the FTC's concerns, including commitments to keep Call of Duty available on other platforms.

- Detailed breakdown of the proposed remedies: Microsoft has outlined specific remedies designed to address the FTC's concerns.

- Evaluation of the effectiveness of these proposed solutions: The effectiveness of these proposed solutions is a key point of debate in the ongoing legal battle.

- Comparison of Microsoft's proposed solutions with those of similar mergers: Microsoft's proposals are being compared to the remedies proposed in similar mergers to gauge their adequacy.

Implications for the Future of Gaming Mergers

The FTC Appeals Microsoft-Activision Merger case sets a significant precedent for future mergers and acquisitions in the gaming industry and has broad implications for regulators.

Setting a Precedent

This case could significantly influence future mergers and acquisitions in the gaming industry.

- Analysis of how the outcome might influence future regulatory decisions: The outcome will shape future regulatory decisions regarding mergers in the gaming sector.

- Discussion of the long-term consequences for industry consolidation: The case's outcome will have long-term implications for industry consolidation and competition.

- Impact on investment strategies in the gaming industry: The decision will significantly impact investment strategies within the gaming industry.

The Role of Regulators

The FTC's appeal demonstrates increased scrutiny of large tech mergers by regulatory bodies worldwide.

- Analysis of the global regulatory landscape for technology mergers: The case highlights the evolving global regulatory landscape for tech mergers.

- Discussion on the evolving role of government oversight in the tech industry: The case reflects the changing role of government oversight in the tech industry.

- Comparison with similar antitrust cases involving tech giants: The case is compared to similar antitrust cases involving other tech giants to provide context.

Conclusion

The FTC's appeal of the Microsoft-Activision merger decision marks a critical juncture in the ongoing debate surrounding antitrust regulations in the gaming industry. The arguments presented, and the eventual outcome, will profoundly impact future mergers, the competitive landscape, and ultimately, the gaming experience for consumers. Staying informed about the progression of this FTC Appeals Microsoft-Activision Merger is crucial for anyone interested in the future of gaming. Keep checking back for updates on this significant antitrust case.

Featured Posts

-

The China Factor Analyzing The Struggles Of Bmw Porsche And Other Automakers

Apr 26, 2025

The China Factor Analyzing The Struggles Of Bmw Porsche And Other Automakers

Apr 26, 2025 -

Cnn Anchors Top Pick Why He Loves Florida

Apr 26, 2025

Cnn Anchors Top Pick Why He Loves Florida

Apr 26, 2025 -

Alterya Acquired By Chainalysis A Boost For Blockchain Security And Analysis

Apr 26, 2025

Alterya Acquired By Chainalysis A Boost For Blockchain Security And Analysis

Apr 26, 2025 -

Bmw Porsche And The Shifting Sands Of The Chinese Automotive Landscape

Apr 26, 2025

Bmw Porsche And The Shifting Sands Of The Chinese Automotive Landscape

Apr 26, 2025 -

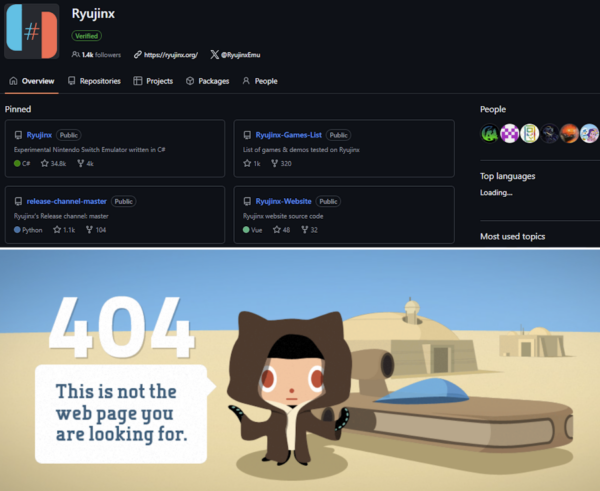

Nintendos Action Shuts Down Ryujinx Switch Emulator Development

Apr 26, 2025

Nintendos Action Shuts Down Ryujinx Switch Emulator Development

Apr 26, 2025