Brace For More Market Pain: Investors' Risky Strategy

Table of Contents

Ignoring Fundamental Analysis: A Recipe for Market Pain

Fundamental analysis, the process of evaluating a security by examining related economic and financial factors, is crucial for mitigating risk. Ignoring this bedrock principle in favor of short-term market trends or hype can lead to disastrous consequences. Instead of focusing on a company's intrinsic value, many investors are swayed by short-lived market fads and social media buzz.

- Overvaluing speculative assets: The recent frenzy around meme stocks and cryptocurrencies highlights the dangers of investing in assets without proper due diligence. These assets often lack fundamental value, making them highly volatile and susceptible to sharp price drops.

- Ignoring crucial financial ratios: Investors often neglect key financial indicators like the Price-to-Earnings ratio (P/E ratio), which reflects a company's valuation relative to its earnings, and the debt-to-equity ratio, indicating a company's financial leverage. Ignoring these ratios can lead to investing in overvalued or highly indebted companies.

- Chasing quick returns: The pursuit of rapid profits often leads investors to take excessive risks, neglecting the importance of long-term growth and sustainable returns.

Several companies have suffered significantly due to investors ignoring fundamental analysis. For instance, the dot-com bubble burst in the early 2000s saw many companies with inflated valuations collapse as their fundamentals couldn't support their price. Understanding and applying fundamental analysis is a critical component of a sound investment strategy.

Leverage and Margin Calls: Exacerbating Market Pain

Leverage, the use of borrowed funds to amplify potential returns, is a double-edged sword. While it can magnify profits, it equally magnifies losses. In volatile markets, this amplification effect can be devastating, leading to margin calls.

- The dangers of high leverage in volatile markets: High leverage significantly increases risk, particularly during market downturns. Small price fluctuations can lead to substantial losses, potentially wiping out an investor's entire portfolio.

- Understanding margin calls and their consequences: A margin call occurs when the value of an investor's leveraged position falls below a certain threshold, forcing the investor to deposit more funds to maintain the position. Failure to meet a margin call can result in the forced liquidation of assets at potentially unfavorable prices.

- Strategies for managing risk when using leverage: Investors should use leverage cautiously, if at all, and only when they fully understand the risks involved. Diversification and careful position sizing are crucial risk management techniques.

Numerous case studies illustrate the devastating effects of margin calls. During the 1987 Black Monday crash, many investors were forced to liquidate their positions due to margin calls, exacerbating the market decline. Careful leverage management is essential for surviving market volatility.

Emotional Investing: Letting Fear and Greed Dictate Your Strategy

Emotional investing, driven by fear, greed, and herd mentality, leads to poor decision-making. These psychological biases cloud judgment and cause investors to act irrationally.

- Panic selling during market downturns: Fear often prompts investors to sell assets at the worst possible time, locking in losses and missing out on potential recovery.

- FOMO (Fear Of Missing Out) driving impulsive investments: The pressure to participate in a seemingly successful investment can lead to impulsive decisions without proper due diligence, resulting in losses.

- Ignoring expert advice based on emotional reactions: Emotional reactions can override rational analysis, causing investors to ignore sound advice from financial professionals.

Strategies for emotional regulation include disciplined investment planning, sticking to a well-defined strategy, and seeking professional financial advice. Recognizing and mitigating emotional biases is key to making sound investment decisions.

Lack of Diversification: Concentrating Risk and Increasing Market Pain

Diversification, the practice of spreading investments across various asset classes and sectors, is a cornerstone of sound risk management. Concentrated holdings magnify the impact of market downturns.

- The benefits of asset class diversification: Diversifying across stocks, bonds, real estate, and other asset classes reduces the overall portfolio's vulnerability to market fluctuations.

- Geographic diversification: Investing in assets from different countries reduces exposure to country-specific risks.

- Sector diversification: Spreading investments across various industry sectors mitigates the impact of sector-specific downturns.

Historically, diversified portfolios have weathered market storms far better than concentrated ones. The 2008 financial crisis demonstrated the importance of diversification, as investors with well-diversified portfolios experienced significantly smaller losses than those with concentrated holdings.

Preparing for Future Market Pain: A Call to Action

Investors' risky strategies, such as ignoring fundamental analysis, employing excessive leverage, succumbing to emotional biases, and lacking diversification, can significantly amplify market pain. Careful analysis, robust risk management, and a well-diversified portfolio are essential for navigating turbulent markets. Don't let market pain catch you off guard. Learn to identify and avoid investors' risky strategies by focusing on fundamental analysis and diversification. Consider consulting a financial advisor for personalized guidance on building a resilient investment strategy. For further reading on effective risk management and investment strategies, explore resources from reputable financial institutions and academic publications.

Featured Posts

-

Post Fire Price Gouging In La Reality Tv Star Highlights Landlord Practices

Apr 22, 2025

Post Fire Price Gouging In La Reality Tv Star Highlights Landlord Practices

Apr 22, 2025 -

Increased Student Fear At Fsu Following Security Breach Despite Prompt Police Response

Apr 22, 2025

Increased Student Fear At Fsu Following Security Breach Despite Prompt Police Response

Apr 22, 2025 -

Identifying And Analyzing New Business Hotspots In The Country

Apr 22, 2025

Identifying And Analyzing New Business Hotspots In The Country

Apr 22, 2025 -

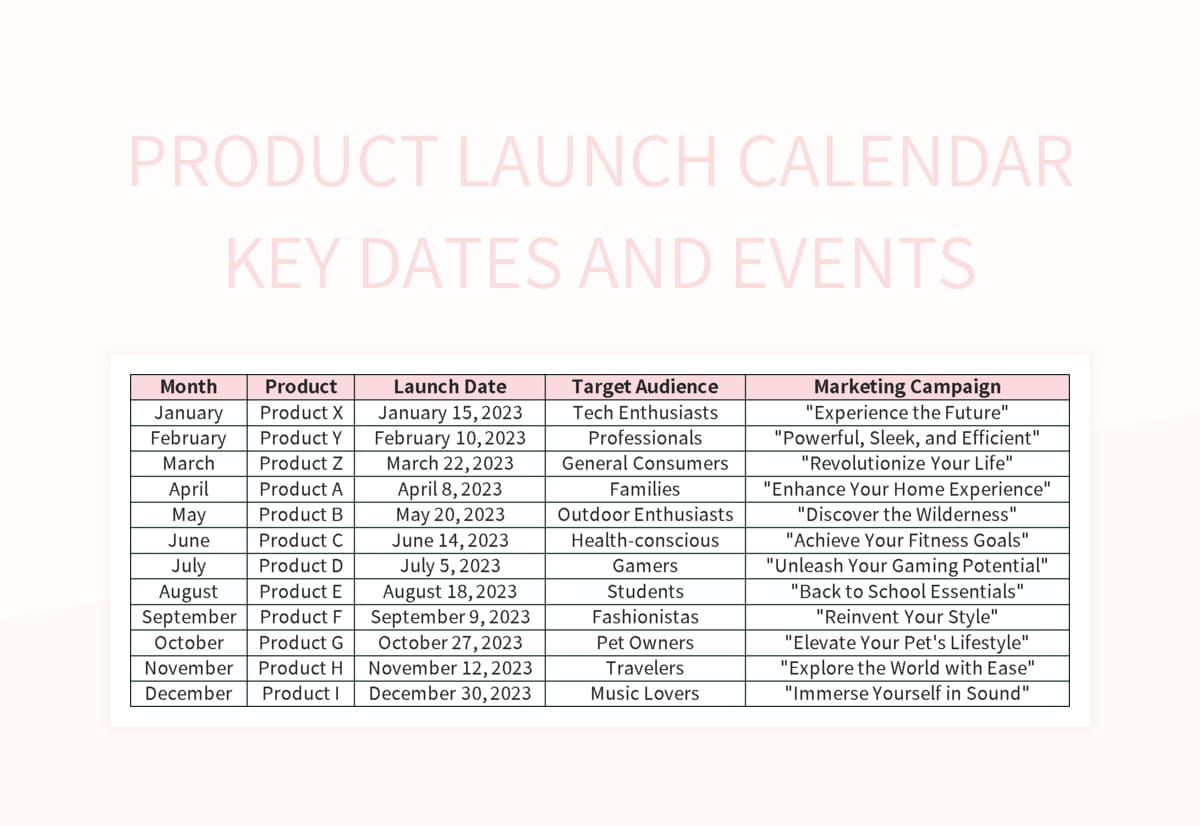

Karen Reads Murder Trials Key Dates And Events

Apr 22, 2025

Karen Reads Murder Trials Key Dates And Events

Apr 22, 2025 -

A World Mourns Pope Francis Champion Of Compassion Passes Away

Apr 22, 2025

A World Mourns Pope Francis Champion Of Compassion Passes Away

Apr 22, 2025