Are High Stock Market Valuations A Concern? BofA Weighs In

Table of Contents

BofA's Stance on Current Market Valuations

BofA's stance on current high stock market valuations is nuanced. While acknowledging the historically high levels, they haven't issued a blanket warning of an imminent crash. Instead, their analysis suggests a cautious approach, highlighting the need for careful consideration of risk. Their reports often cite a combination of metrics to assess market valuation, avoiding reliance on any single indicator.

- Key Metrics: BofA employs various metrics to gauge valuations, including the widely used Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio), which considers inflation-adjusted earnings over a longer period. They also analyze sector-specific valuations, identifying pockets of both overvaluation and undervaluation.

- Sector-Specific Assessments: BofA's analysis often pinpoints specific sectors exhibiting particularly high valuations, suggesting potential areas of increased risk. These assessments often vary depending on the economic climate and prevailing market sentiment.

- Caveats: It's crucial to note that BofA's analysis usually includes caveats. They acknowledge that factors like low interest rates and robust corporate earnings can justify higher valuations to some extent. Their conclusions rarely involve definitive predictions, but rather emphasize the need for informed decision-making.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors have contributed to the current high stock market valuations. Understanding these factors is essential for evaluating the sustainability of these valuations.

- Low Interest Rates: Prolonged periods of low interest rates incentivize investors to seek higher returns in the stock market, driving up demand and, consequently, valuations. This shift in investment flows significantly impacts market valuation.

- Strong Corporate Earnings (and Expectations): Strong corporate earnings, or the expectation of future strong earnings, fuel investor confidence and push stock prices higher. This positive sentiment contributes to high stock market valuations.

- Government Stimulus Packages: Government stimulus measures aimed at boosting economic activity can inject liquidity into the market, further supporting higher stock prices and contributing to elevated market valuations. However, the long-term effects of such stimulus remain a subject of debate.

- Technological Advancements: Rapid technological advancements, especially in sectors like technology and biotechnology, often attract significant investment, driving up valuations in these specific areas. This sector-specific growth influences the overall market valuation picture.

Potential Risks Associated with High Valuations

While high stock market valuations can indicate a healthy economy, they also present significant risks that investors need to consider:

- Increased Market Volatility: High valuations often translate into increased market volatility, making the market more susceptible to sharp corrections or even crashes. This risk is amplified by unpredictable external factors.

- Asset Bubbles: High valuations can be indicative of asset bubbles, where prices are driven up by speculative investment rather than fundamental value. The bursting of such bubbles can lead to significant market downturns.

- Inflationary Pressures: Rising inflation can erode the value of future earnings, potentially impacting stock valuations and reducing real returns for investors. This is a significant risk to consider when analyzing market valuation.

- Geopolitical Risks: Geopolitical events and uncertainties can significantly impact market sentiment and lead to sharp corrections, regardless of underlying market valuations. These unexpected events add to the overall risk.

BofA's Recommendations for Investors

Given the current high stock market valuations, BofA typically recommends a cautious and diversified investment approach:

- Diversification: Diversifying across different asset classes (stocks, bonds, real estate, etc.) and sectors is crucial to mitigate risk. This reduces reliance on any single sector's performance.

- Sector-Specific Analysis: Instead of broad market exposure, BofA often suggests a more selective approach, focusing on sectors with strong fundamentals and reasonable valuations, avoiding those perceived as overvalued.

- Risk Management: Employing robust risk management techniques, such as stop-loss orders and hedging strategies, is essential to protect against potential market downturns. This proactive approach minimizes potential losses.

- Long-Term Perspective: BofA generally advocates a long-term investment horizon, suggesting that short-term market fluctuations should not dictate long-term investment strategies. A long-term approach is crucial to weather market volatility.

Conclusion: Addressing the Concerns of High Stock Market Valuations

BofA's analysis of high stock market valuations reveals a complex picture. While acknowledging the elevated levels, they don't necessarily predict an immediate crash but emphasize the need for caution and informed decision-making. The factors contributing to these valuations, such as low interest rates and strong corporate earnings, are balanced against the inherent risks associated with high valuations, including increased market volatility and the potential for asset bubbles. Understanding the complexities of high stock market valuations is crucial for informed investing. Continue your research, and consult with a financial professional to create a strategy that aligns with your individual risk profile and investment goals. Careful consideration of your risk tolerance is paramount when navigating the challenges posed by high stock market valuations.

Featured Posts

-

Who Will Bear The Brunt Of Trumps Economic Policies

Apr 22, 2025

Who Will Bear The Brunt Of Trumps Economic Policies

Apr 22, 2025 -

Google Doj Return To Court Battle Over Search Monopoly Heats Up

Apr 22, 2025

Google Doj Return To Court Battle Over Search Monopoly Heats Up

Apr 22, 2025 -

How Trumps Trade Policies Affected Americas Global Financial Position

Apr 22, 2025

How Trumps Trade Policies Affected Americas Global Financial Position

Apr 22, 2025 -

Debate Erupts Over Fsus Plan To Resume Classes Following Tragedy

Apr 22, 2025

Debate Erupts Over Fsus Plan To Resume Classes Following Tragedy

Apr 22, 2025 -

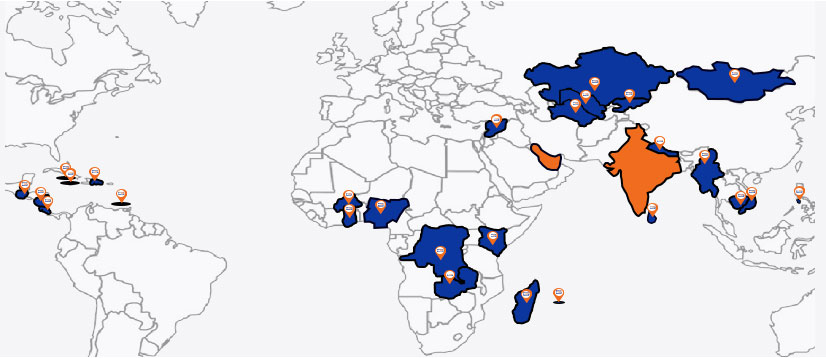

Mapping The Countrys Emerging Business Hotspots

Apr 22, 2025

Mapping The Countrys Emerging Business Hotspots

Apr 22, 2025