Analyzing The Long-Term Effects Of Trump's Trade Strategies On US Financial Strength

Table of Contents

The Impact of Tariffs on US Industries and Consumers

Trump's administration implemented significant tariffs on various imported goods, aiming to protect domestic industries and reduce the trade deficit. However, these tariffs had multifaceted consequences for US industries and consumers.

Increased Prices for Consumers

Tariffs directly increased the prices of imported goods, leading to higher costs for American consumers. This, in turn, impacted consumer spending and contributed to inflation.

- Examples: Tariffs on steel and aluminum increased the cost of automobiles and construction materials. Tariffs on Chinese goods affected a wide range of consumer products, from electronics to clothing.

- Inflation Data: Inflation rates during the period of increased tariffs showed a noticeable uptick, although attributing this solely to tariffs is complex, as other economic factors were at play. Further research is needed to isolate the precise impact of tariffs on inflation.

Effects on Specific US Industries

The impact of tariffs varied significantly across different US industries. Some sectors benefited from increased protection against foreign competition, while others suffered due to retaliatory tariffs imposed by other countries.

- Beneficiaries: Certain domestic steel and aluminum producers saw increased demand and higher prices due to tariffs.

- Sufferers: The agricultural sector faced significant challenges due to retaliatory tariffs imposed by China, impacting exports of soybeans and other agricultural products. Manufacturing sectors reliant on imported components also experienced increased costs.

- Statistical Data: Detailed analysis of industry-specific data is required to fully quantify the benefits and drawbacks of tariffs for various sectors.

Retaliatory Tariffs and Their Consequences

The US imposition of tariffs provoked retaliatory measures from several major trading partners, leading to a decline in US exports and further impacting the economic impact of Trump's trade strategies.

- Examples: China imposed retaliatory tariffs on US agricultural products, significantly impacting farmers. The European Union also introduced counter-tariffs, affecting various US exports.

- Trade Deficits: While the overall trade deficit was not significantly altered, specific trade flows were disrupted, negatively impacting certain sectors of the US economy.

Renegotiation of Trade Deals and Their Long-Term Implications

Trump's administration actively sought to renegotiate existing trade deals, arguing they were unfair to the US. The long-term implications of these renegotiations remain a subject of ongoing debate.

USMCA (formerly NAFTA)

The renegotiation of NAFTA, resulting in the USMCA, introduced several changes to the trade agreement between the US, Canada, and Mexico.

- NAFTA vs. USMCA: USMCA included stricter rules of origin for automobiles, aimed at boosting North American manufacturing. Labor and environmental provisions were also strengthened.

- Benefits and Drawbacks: While the USMCA aimed to create a more balanced trade relationship, its long-term economic benefits and drawbacks are still being assessed, and ongoing research is needed to fully understand the overall economic impact of this shift.

- Trade Flows: Data on post-USMCA trade flows between the three countries are needed for a complete assessment of the agreement’s impact.

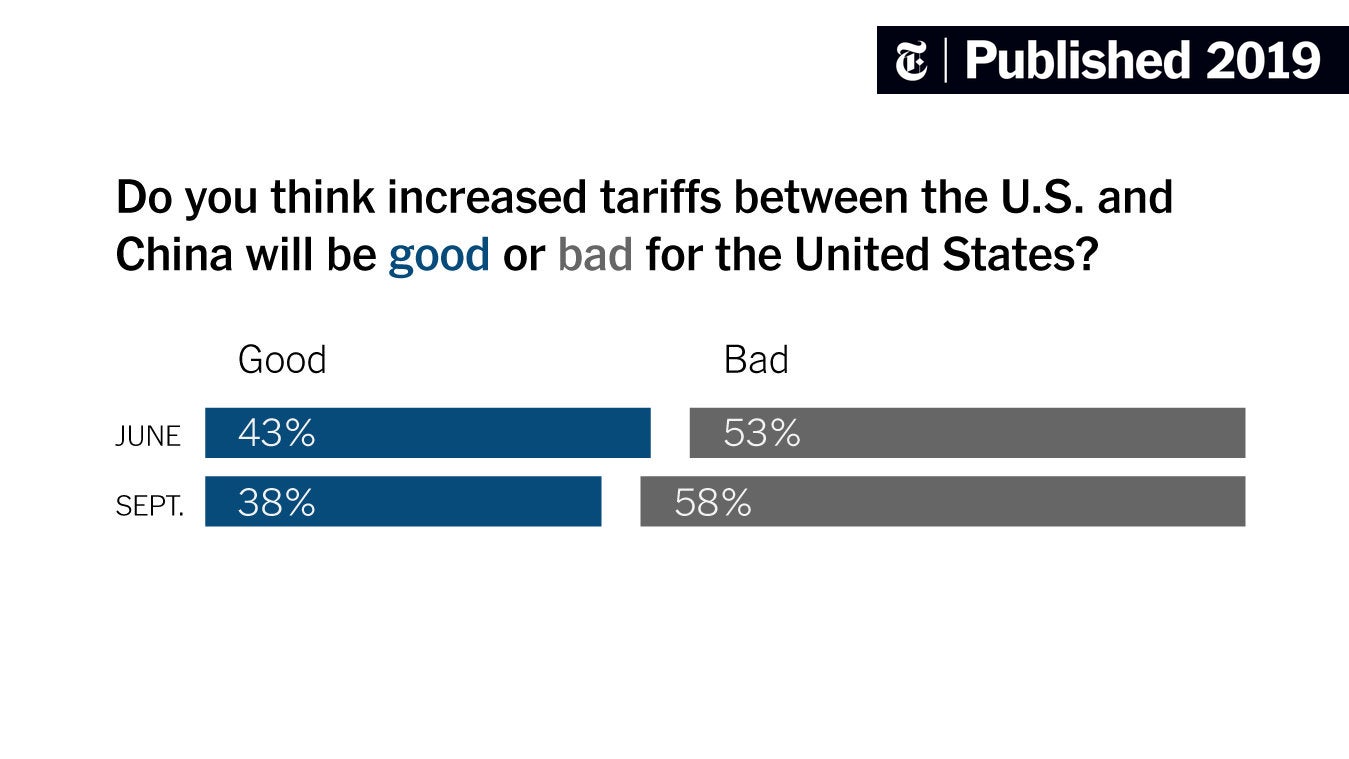

Trade Relations with China

The trade war with China, characterized by escalating tariffs and trade disputes, significantly impacted the global economy and US-China relations.

- Phases of the Trade War: The trade war involved multiple phases of escalating tariffs and negotiations, creating uncertainty for businesses and investors.

- Impact on Specific Industries: The tech sector, particularly, was significantly impacted, with supply chains disrupted and investment flows affected.

- Long-Term Implications: The long-term consequences of the trade war, particularly for technological competition and bilateral relations, continue to unfold. Further study of the economic ramifications is vital.

- Trade Volumes: A detailed analysis of the trade volumes between the US and China before, during, and after the trade war is critical to assess its overall economic impact.

Overall Impact on Global Trade

Trump's trade policies had broader implications for the global trading system and international cooperation.

- WTO Rules: Trump's administration challenged the authority of the World Trade Organization (WTO), raising concerns about the future of multilateral trade agreements and global trade governance.

- Rise of Protectionism: Trump's policies contributed to a broader trend of rising protectionism globally, potentially hindering economic growth and international cooperation.

Assessing the Long-Term Effects on US Financial Strength

Evaluating the full long-term effects of Trump's trade strategies on US financial strength requires a comprehensive analysis of various economic indicators.

GDP Growth and Economic Stability

The impact of Trump's trade policies on GDP growth, job creation, and overall economic stability is a subject of ongoing debate and requires further analysis.

- GDP Growth Rates: Data on GDP growth rates during and after the implementation of these policies are needed to determine their overall influence on economic growth.

- Job Creation/Loss: Analyzing job creation and loss in specific sectors affected by tariffs and trade disputes is crucial to understand the employment impact.

National Debt and Budgetary Implications

Trade wars can significantly impact the national debt and government spending.

- Costs of Trade Disputes: Government subsidies provided to industries affected by tariffs and trade disputes added to the national debt.

- Changes in National Debt: An analysis of changes in the national debt during this period is needed to evaluate the fiscal implications of Trump's trade policies.

Investment and Capital Flows

Trump's trade policies may have influenced foreign direct investment (FDI) in the US and capital flows.

- FDI Inflows/Outflows: Data on FDI inflows and outflows during Trump's presidency are crucial to assess the impact of his trade strategies on foreign investment.

- US Role as Global Investor: The impact on the US's role as a global investor and recipient of investment requires thorough research and analysis.

Conclusion: Summarizing the Long-Term Effects of Trump's Trade Strategies on US Financial Strength

Analyzing the long-term effects of Trump's trade strategies on US financial strength reveals a complex picture with both positive and negative impacts. While some industries benefited from protectionist measures, others faced significant challenges due to retaliatory tariffs and disruptions to global supply chains. The impact on consumer prices, national debt, and global trade cooperation requires ongoing scrutiny and detailed research. The long-term consequences for various sectors of the US economy and the global trading system are still unfolding. Predicting long-term outcomes with complete certainty remains challenging due to the interconnectedness of global markets and the multitude of factors influencing economic growth.

To gain a deeper understanding of the lasting effects of these policies, further research is essential. We encourage readers to delve deeper into the available data and engage in critical analysis of the "trade policy impact," "economic analysis," and the prospects for the "US economic future," focusing on specific aspects discussed in this article, using reputable sources and economic models. By understanding the complexities of Trump's trade strategies, we can better inform future trade policy decisions and improve the resilience of the US economy in a globalized world.

Featured Posts

-

Ryujinx Emulator Development Halted Nintendo Contact Confirmed

Apr 22, 2025

Ryujinx Emulator Development Halted Nintendo Contact Confirmed

Apr 22, 2025 -

Open Ai Under Ftc Scrutiny Chat Gpts Future In Question

Apr 22, 2025

Open Ai Under Ftc Scrutiny Chat Gpts Future In Question

Apr 22, 2025 -

The Selection Of A New Pope A Deep Dive Into Papal Conclaves And Their History

Apr 22, 2025

The Selection Of A New Pope A Deep Dive Into Papal Conclaves And Their History

Apr 22, 2025 -

Harvards 1 Billion Funding In Jeopardy Exclusive Details On Trump Administrations Actions

Apr 22, 2025

Harvards 1 Billion Funding In Jeopardy Exclusive Details On Trump Administrations Actions

Apr 22, 2025 -

Understanding The Importance Of Middle Managers In Todays Workplace

Apr 22, 2025

Understanding The Importance Of Middle Managers In Todays Workplace

Apr 22, 2025