Analyzing The Economic Costs Of Trump's Policies

Table of Contents

The Impact of Trump's Trade Wars

The Trump administration's aggressive trade policies, characterized by increased tariffs and a confrontational approach to international trade, significantly impacted the US and global economies. Understanding the economic costs of these trade wars requires examining both the immediate effects and the long-term consequences.

Increased Tariffs and Retaliation

The imposition of tariffs, particularly on steel, aluminum, and Chinese goods, led to a cascade of negative consequences.

- Increased Consumer Prices: Tariffs increased the cost of imported goods, directly impacting consumer prices. For example, tariffs on steel increased the cost of automobiles and appliances. Studies by the Peterson Institute for International Economics estimated that tariffs cost the average American household hundreds of dollars annually.

- Losses for Businesses: US businesses reliant on imported materials faced higher input costs, reducing profitability and competitiveness. Many businesses passed these increased costs onto consumers, further fueling inflation.

- Retaliatory Tariffs: The imposition of US tariffs provoked retaliatory measures from other countries, impacting US exports and further disrupting global trade. China, the European Union, and other nations imposed tariffs on US goods, resulting in significant losses for US farmers and manufacturers.

Disruption of Global Supply Chains

Trump's trade wars significantly disrupted established global supply chains, creating bottlenecks and increasing costs for businesses.

- Industries Significantly Affected: The agricultural sector suffered greatly due to retaliatory tariffs imposed by China and other trading partners. Manufacturers reliant on imported components also faced significant challenges.

- Supply Chain Bottlenecks: Tariffs and trade disputes led to delays and disruptions in the flow of goods, increasing transportation costs and production delays.

- Loss of Export Markets: US businesses lost access to key export markets due to retaliatory tariffs and trade disputes, impacting revenue and employment.

Analysis of the 2017 Tax Cuts and Jobs Act

The 2017 Tax Cuts and Jobs Act, a cornerstone of Trump's economic agenda, significantly lowered corporate and individual income tax rates. While proponents claimed it would stimulate economic growth, its long-term effects remain a subject of ongoing debate regarding the economic costs of this policy.

Short-Term Economic Stimulus vs. Long-Term Debt

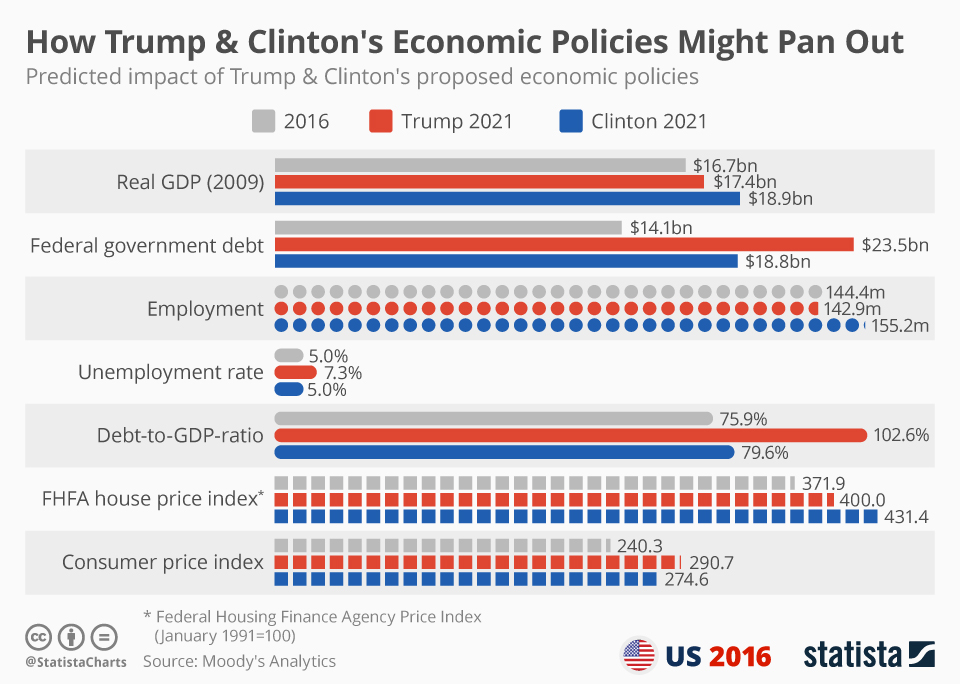

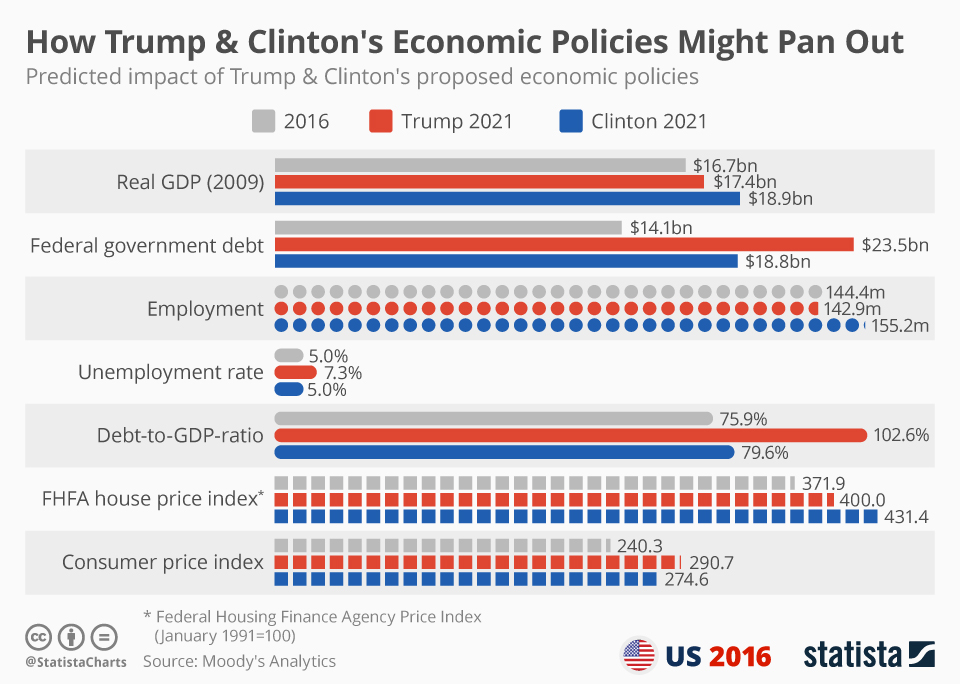

The tax cuts provided a short-term boost to the economy, but they also dramatically increased the national debt.

- Short-Term Economic Growth: Following the tax cuts, the economy experienced a period of modest growth. However, it is difficult to isolate the specific contribution of the tax cuts to this growth.

- Increase in National Debt: The tax cuts significantly increased the federal budget deficit and the national debt. This poses a long-term risk to economic stability.

- Wealth Inequality: The tax cuts disproportionately benefited wealthy individuals and corporations, exacerbating income inequality.

Impact on Corporate Investment and Job Creation

The tax cuts were intended to stimulate corporate investment and job creation. However, the evidence regarding their effectiveness in this area is mixed.

- Corporate Investment and Job Growth: While there was some increase in corporate investment and job growth, it is unclear how much of this can be attributed directly to the tax cuts.

- Comparison with Projected Outcomes: The actual outcomes fell short of the optimistic projections made by proponents of the tax cuts.

- Alternative Explanations for Economic Growth: Other factors, such as monetary policy and global economic conditions, also played a role in the economic growth experienced during this period.

The Economic Consequences of Deregulation

The Trump administration pursued a significant deregulation agenda, affecting various sectors of the economy. The economic costs of this approach are complex and multifaceted.

Environmental Regulations and Costs

Relaxing environmental regulations led to increased pollution and potential long-term environmental damage.

- Environmental Impacts: The rollback of environmental regulations resulted in increased greenhouse gas emissions, air and water pollution, and habitat destruction.

- Future Costs of Remediation: The long-term costs associated with environmental cleanup and remediation are likely to be substantial.

- Health Costs: Increased pollution can lead to significant health problems, resulting in substantial healthcare costs.

Financial Regulations and Risk

Easing financial regulations increased systemic risk and the potential for financial instability.

- Deregulation in the Financial Sector: The loosening of regulations in the financial sector reduced oversight and increased the potential for reckless behavior.

- Increased Systemic Risk: Reduced regulations increased the vulnerability of the financial system to shocks and crises.

- Financial Instability: While no major financial crisis occurred during this period, the increased risk remains a significant concern.

Conclusion

The economic costs of Trump's policies are substantial and multifaceted. The trade wars resulted in higher consumer prices, disrupted global supply chains, and harmed US businesses. The 2017 tax cuts, while providing a short-term economic boost, dramatically increased the national debt and exacerbated wealth inequality. Finally, deregulation in the environmental and financial sectors increased long-term risks and potential costs. Quantifying the precise economic impact is challenging, but it’s clear that these policies created significant economic challenges for many Americans and the global economy. To further investigate the economic costs of Trump's policies, explore independent analyses from organizations like the Congressional Budget Office, the Brookings Institution, and the Peterson Institute for International Economics. Continue your exploration of the economic costs of Trump's policies to fully understand their long-term effects.

Featured Posts

-

Resistance Mounts Car Dealers Reiterate Opposition To Ev Mandates

Apr 22, 2025

Resistance Mounts Car Dealers Reiterate Opposition To Ev Mandates

Apr 22, 2025 -

Exclusive Inside The Trump Administrations Plan To Cut Harvards Funding By 1 Billion

Apr 22, 2025

Exclusive Inside The Trump Administrations Plan To Cut Harvards Funding By 1 Billion

Apr 22, 2025 -

5 Dos And Don Ts For Landing A Private Credit Job

Apr 22, 2025

5 Dos And Don Ts For Landing A Private Credit Job

Apr 22, 2025 -

Land Your Dream Private Credit Job 5 Dos And Don Ts To Follow

Apr 22, 2025

Land Your Dream Private Credit Job 5 Dos And Don Ts To Follow

Apr 22, 2025 -

Assessing The Strengths And Weaknesses Of A Pan Nordic Military Alliance

Apr 22, 2025

Assessing The Strengths And Weaknesses Of A Pan Nordic Military Alliance

Apr 22, 2025