Addressing Regulatory Burden: ECB Establishes New Task Force For Banking

Table of Contents

The Growing Regulatory Burden on European Banks

European banks operate under a heavy weight of regulations, designed to ensure financial stability and protect consumers. However, the sheer volume and complexity of these regulations present significant challenges. The ever-evolving nature of these rules necessitates constant adaptation, leading to substantial costs and operational complexities.

- Increased compliance costs: Meeting stringent regulatory requirements necessitates significant investments in technology, personnel, and internal processes, directly impacting profitability.

- Difficulties in adapting to evolving regulations: The frequent changes and updates to existing regulations require continuous adjustments, diverting resources from core banking activities.

- Impact on innovation and competitiveness: The regulatory burden can stifle innovation by increasing the time and resources required to develop and launch new products and services. This can hinder the competitiveness of European banks in the global market.

- Examples of specific regulations impacting banks: Regulations like Basel III, aimed at strengthening capital adequacy, and GDPR, focusing on data protection, significantly increase compliance demands and operational costs. These regulations, while crucial for stability, also contribute to the overall regulatory burden.

The ECB's New Task Force: Objectives and Composition

The ECB's creation of this task force reflects its commitment to addressing the growing concerns regarding regulatory burden. Recognizing the negative impact on the sector's efficiency and competitiveness, the ECB aims to create a more streamlined and effective regulatory framework. The task force comprises experts from various areas of banking regulation, including economists, legal professionals, and experienced banking practitioners.

- Specific goals of the task force: The primary objective is to simplify and clarify existing regulations, reducing ambiguity and improving the efficiency of compliance processes. They also aim to identify and address areas where regulatory burdens are disproportionately high.

- Timeline for achieving objectives: The task force has a defined timeline for delivering recommendations, with interim reports and a final report outlining concrete proposals for regulatory reform.

- Key areas of focus: The task force will concentrate on simplifying capital requirements, streamlining reporting procedures, and improving the overall clarity and transparency of regulations.

Potential Impacts of the Task Force's Work

The potential impact of the task force's work is multifaceted. Positive outcomes could include significant improvements in efficiency and reduced compliance costs. However, potential risks and challenges must also be considered.

- Improved regulatory efficiency: Streamlined regulations could lead to significant improvements in operational efficiency for banks, freeing up resources for core business activities.

- Reduced compliance costs: Simplified processes and clearer guidelines could significantly reduce the financial burden associated with meeting regulatory requirements.

- Increased operational flexibility for banks: A less burdensome regulatory environment could enable banks to adapt more quickly to changing market conditions and pursue innovative solutions.

- Potential risks and challenges in implementation: The successful implementation of the task force's recommendations will require careful coordination and collaboration between the ECB, national authorities, and the banking sector.

Comparison with Other Regulatory Initiatives

The ECB's initiative is part of a broader global trend towards reviewing and reforming banking regulations. Several other regulatory bodies worldwide have undertaken similar initiatives to address the growing concerns about regulatory burden.

- Examples of similar initiatives in other jurisdictions: Regulatory bodies in the US, UK, and other jurisdictions have implemented various reforms aiming to improve the efficiency and effectiveness of banking regulations.

- Key differences and similarities in approach: While the specific approaches may differ, the common goal is to reduce unnecessary complexities and improve the clarity of regulations.

- Potential for international collaboration on regulatory issues: The ECB's work could contribute to increased international collaboration on regulatory issues, leading to more harmonized and efficient standards globally.

Conclusion: The Path Forward in Addressing Regulatory Burden

The ECB's establishment of a task force dedicated to addressing regulatory burden signifies a crucial step toward improving the efficiency and stability of the European banking sector. By simplifying regulations and streamlining compliance processes, the task force aims to reduce costs, enhance innovation, and foster a more competitive environment. The success of this initiative will depend on the effective implementation of its recommendations and continued collaboration between the ECB, national authorities, and the banking industry itself. Stay updated on how the ECB is addressing regulatory burden to understand the evolving landscape and its impact on European banks. Learn more about the ongoing initiatives to reduce regulatory burden on European banks to stay informed about this crucial development. Efficient and effective banking regulation is essential for the long-term health and stability of the European financial system.

Featured Posts

-

Alberto Ardila Olivares Garantia De Gol

Apr 27, 2025

Alberto Ardila Olivares Garantia De Gol

Apr 27, 2025 -

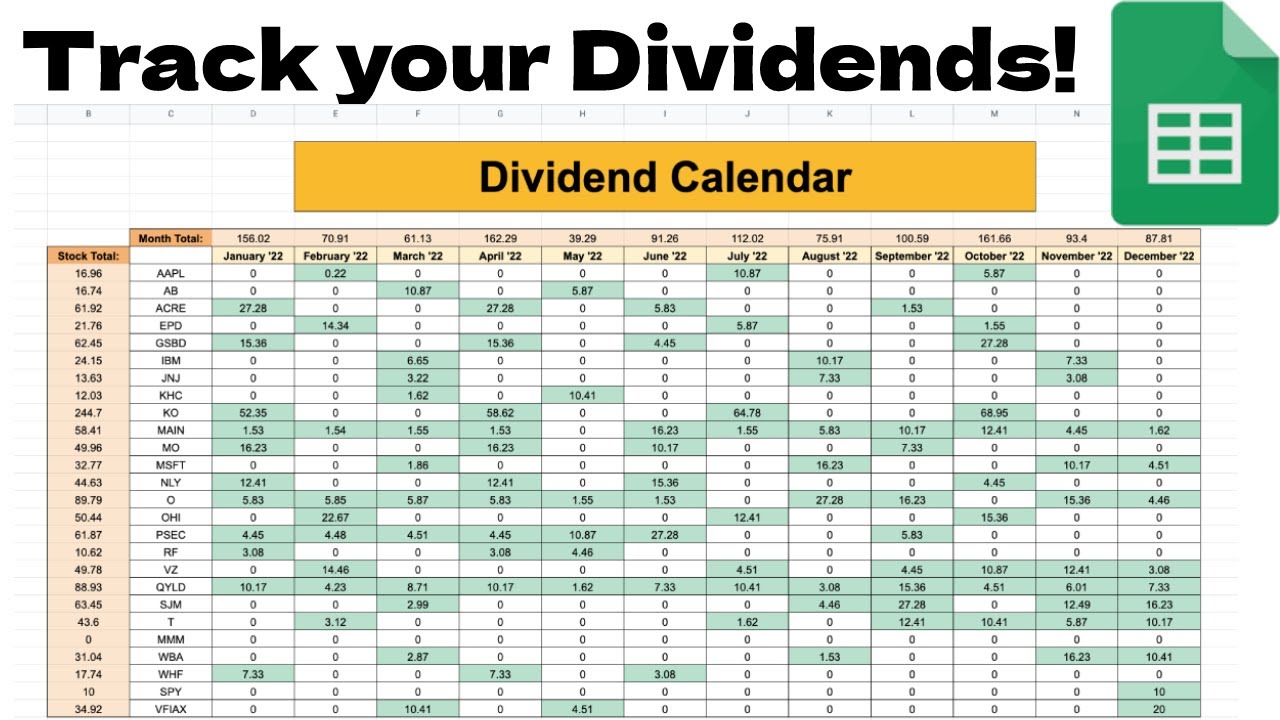

Pfc Dividend 2025 March 12 Announcement Of 4th Cash Reward

Apr 27, 2025

Pfc Dividend 2025 March 12 Announcement Of 4th Cash Reward

Apr 27, 2025 -

Carneys Claim Canada Holds Leverage In Us Trade Deal Negotiations

Apr 27, 2025

Carneys Claim Canada Holds Leverage In Us Trade Deal Negotiations

Apr 27, 2025 -

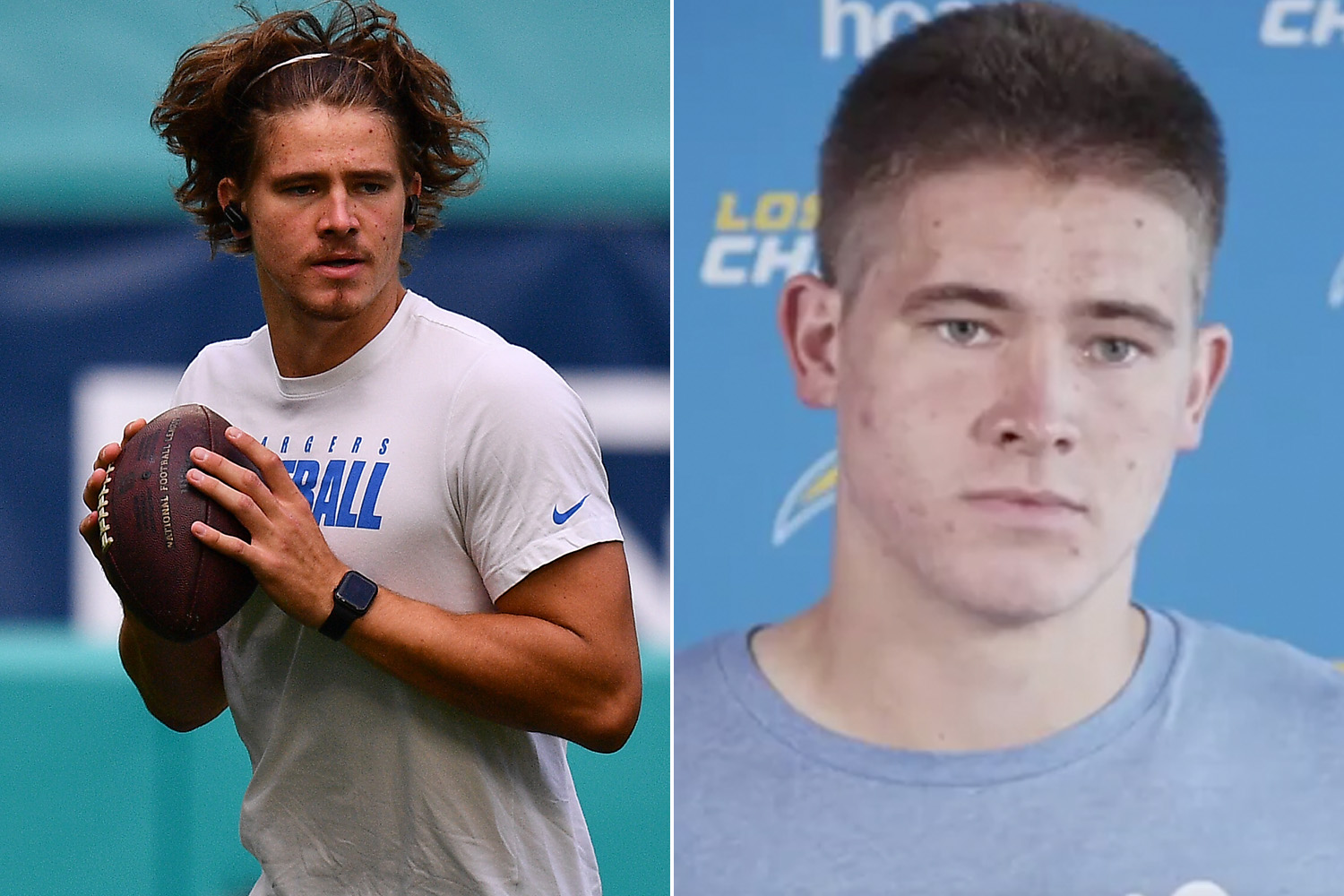

2025 Nfl Season Brazil Hosts Chargers And Justin Herbert

Apr 27, 2025

2025 Nfl Season Brazil Hosts Chargers And Justin Herbert

Apr 27, 2025 -

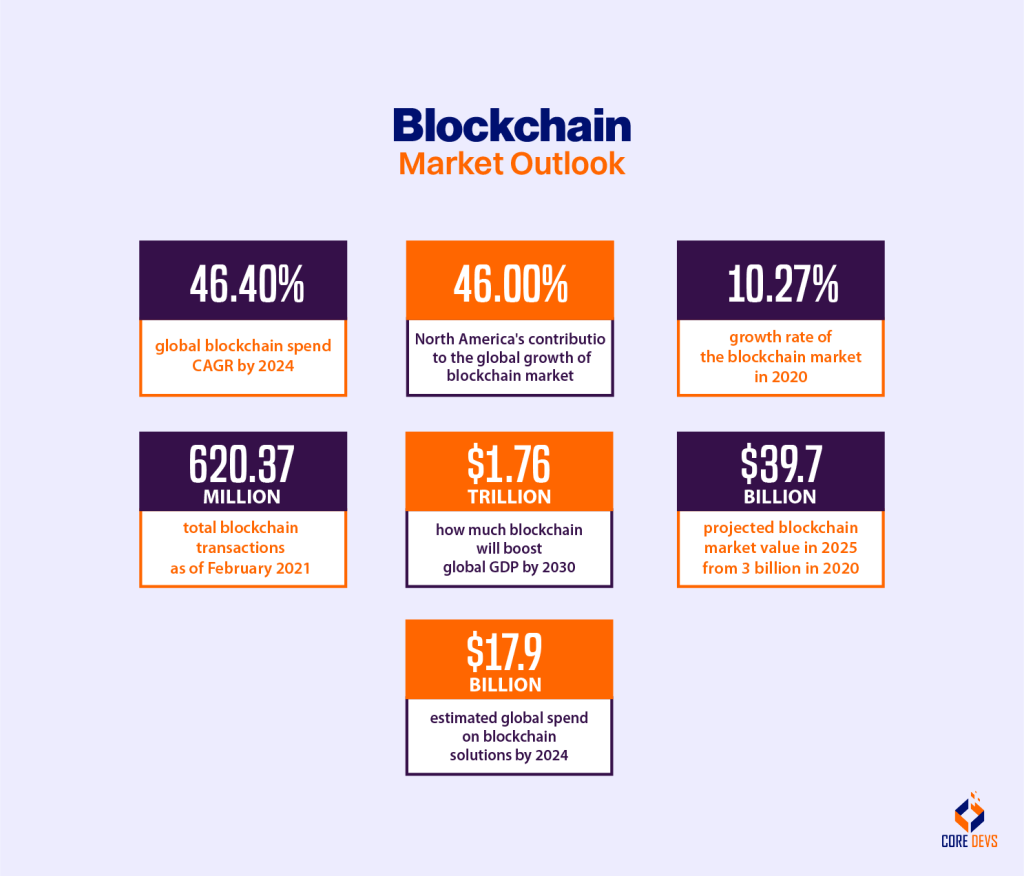

Blockchain Analytics Leader Chainalysis Integrates Ai Via Alterya Acquisition

Apr 27, 2025

Blockchain Analytics Leader Chainalysis Integrates Ai Via Alterya Acquisition

Apr 27, 2025