$440 Million Deal: CMA CGM Acquires Major Stake In Turkish Logistics

Table of Contents

Understanding the CMA CGM Acquisition – A Deep Dive

Who is CMA CGM?

CMA CGM, a global shipping giant, is a leading player in the container shipping industry. Its extensive network spans the globe, making it a key player in maritime transport. With a massive fleet of vessels and a vast reach, CMA CGM handles a significant volume of global trade, solidifying its position as a major force in the international shipping arena. Their expertise extends across all facets of container shipping, including freight forwarding and supply chain management.

The Target Turkish Logistics Company:

While the specific name of the Turkish logistics company remains undisclosed (for now, let's refer to it as "Target Company"), it's understood to be a significant player in Turkish port operations, freight forwarding, and overall supply chain management. The company likely boasts a strong infrastructure network within Turkey, access to key ports, and established relationships with local businesses. This strategic acquisition leverages the Target Company's existing infrastructure and expertise to instantly boost CMA CGM's foothold within the Turkish market.

Deal Details and Financial Implications:

CMA CGM has acquired a substantial equity stake in the Target Turkish logistics company for a reported $440 million. The precise percentage of the acquired stake remains officially unannounced, but it is believed to be a controlling interest, giving CMA CGM significant influence over the company's operations and future strategies.

- Funding Source: The $440 million investment likely came from CMA CGM's internal resources, possibly supplemented by existing credit lines or other financial instruments.

- Key Benefits for CMA CGM:

- Direct access to a crucial Turkish logistics network

- Strengthened presence in a strategically important market

- Enhanced global supply chain capabilities

- Potential for significant return on investment

Strategic Rationale Behind CMA CGM's Turkish Expansion

Accessing the Turkish Market:

Turkey’s geopolitical significance is undeniable. Situated at the crossroads of Europe and Asia, it serves as a crucial bridge for Eurasian trade. The Turkish economy is experiencing continuous growth, making it an increasingly attractive market for international businesses. This acquisition allows CMA CGM to tap into this rapidly expanding market and benefit from its strategic location along major global trade routes.

Strengthening Global Supply Chains:

The acquisition directly strengthens CMA CGM's global supply chain. By integrating the Target Company's operations, CMA CGM gains improved access to infrastructure, enhanced logistical capabilities, and a more resilient network. This strengthens their ability to offer streamlined and efficient supply chain solutions to their clients globally. Supply chain optimization is a key focus for many businesses, and this move positions CMA CGM as a leader in providing reliable and robust global supply chain management.

Competition and Market Share:

This acquisition significantly impacts the competitive landscape in Turkish logistics. By acquiring a major player, CMA CGM gains a considerable market share, enhancing its competitive advantage and putting them in a strong position to attract new clients and outcompete existing players. This strategic move allows them to better serve their existing clients needing Turkish logistics solutions while also aggressively expanding their market presence.

- Advantages for CMA CGM:

- Access to a wider range of resources

- Improved operational efficiency

- Enhanced market dominance

Impact and Future Prospects of the CMA CGM Investment in Turkey

Implications for Turkish Logistics Industry:

The CMA CGM investment has the potential to significantly impact the Turkish logistics industry. It could lead to:

- Increased job creation within the sector.

- Technological advancements in port operations and supply chain management.

- Stimulated competition, potentially leading to improved services and pricing for customers.

- Greater foreign investment into Turkey's logistics infrastructure.

Global Implications for Shipping and Trade:

This acquisition has broader implications for global shipping and international trade. By consolidating its presence in a key geographic location, CMA CGM improves the efficiency and reliability of its global network, ultimately impacting trade flows and the overall stability of international supply chains.

Long-Term Growth Strategy:

This acquisition is likely part of CMA CGM's broader long-term strategy for growth in emerging markets. They may look to further expand their presence in Turkey through strategic partnerships, acquisitions of smaller logistics companies, or development of new infrastructure. This marks a clear investment in their long-term global growth and market expansion plans.

- Potential Future Plans:

- Further investments in Turkish port infrastructure.

- Strategic alliances with Turkish businesses.

- Expansion into related logistics services within Turkey.

Conclusion: The $440 Million CMA CGM Deal: A Game Changer for Turkish Logistics?

The $440 million CMA CGM acquisition represents a significant strategic move, transforming the Turkish logistics landscape. The deal provides CMA CGM with a substantial foothold in a strategically vital market, strengthens their global supply chain, and enhances their competitive advantage. This substantial investment carries implications for global trade and the shipping industry. The long-term impact remains to be seen, but this acquisition undoubtedly sets a precedent for future investments in Turkish logistics.

To stay informed on the evolving impact of this landmark deal and the future trajectory of CMA CGM's investment in Turkish logistics, follow the developments and learn more about CMA CGM's investments in this dynamic and rapidly expanding market. Explore the impact of this $440 million deal and its ripple effects on global supply chains.

Featured Posts

-

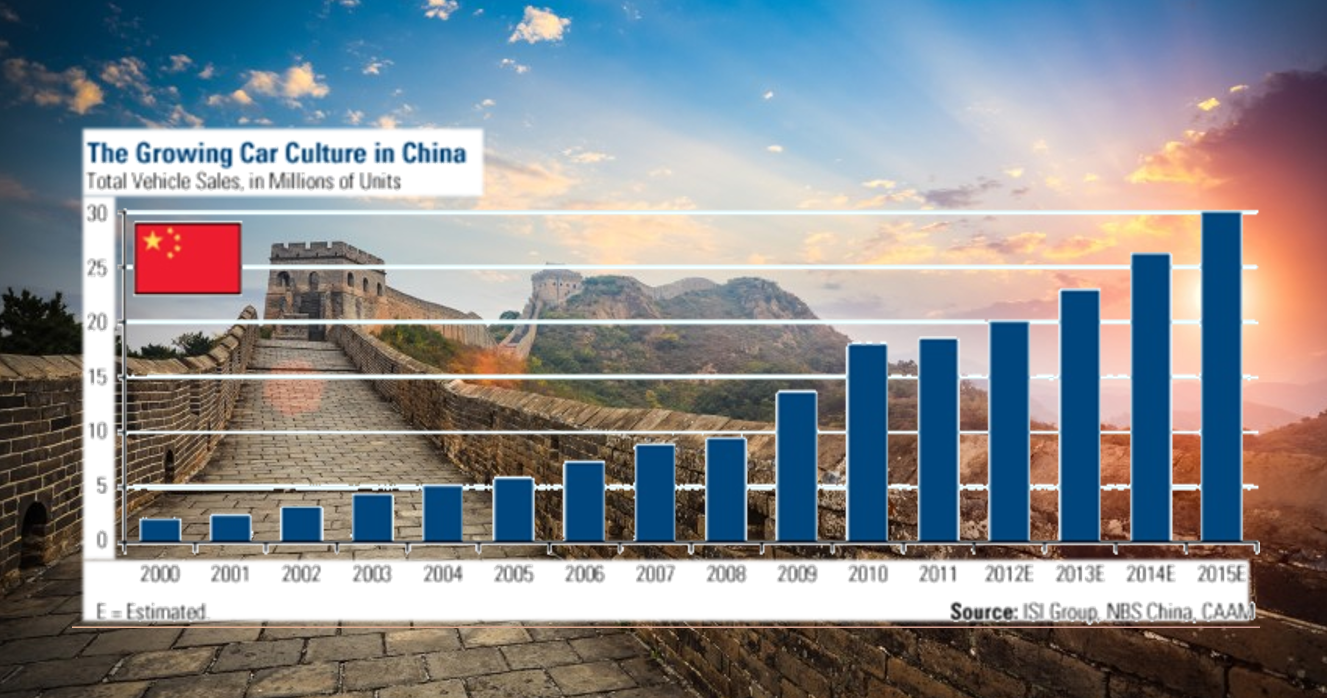

Analyzing The Chinese Auto Market The Experiences Of Bmw And Porsche

Apr 27, 2025

Analyzing The Chinese Auto Market The Experiences Of Bmw And Porsche

Apr 27, 2025 -

Analysis Of Private Credit Failures Credit Weeklys Examination

Apr 27, 2025

Analysis Of Private Credit Failures Credit Weeklys Examination

Apr 27, 2025 -

The Psychology Behind Celebrity Transformations Ariana Grandes Bold Style Choice

Apr 27, 2025

The Psychology Behind Celebrity Transformations Ariana Grandes Bold Style Choice

Apr 27, 2025 -

Wta Lidera Un Ano De Pago Por Licencia De Maternidad Para Tenistas

Apr 27, 2025

Wta Lidera Un Ano De Pago Por Licencia De Maternidad Para Tenistas

Apr 27, 2025 -

The Dax Index How Bundestag Elections And Business Data Shape Market Trends

Apr 27, 2025

The Dax Index How Bundestag Elections And Business Data Shape Market Trends

Apr 27, 2025